Franchise Strategies

Jan 12, 2026

21,000+ U.S. locations have driven market oversaturation, lower unit sales and thin margins; profitability now depends on careful site selection and operator scale.

Thinking of owning a Subway franchise? Here's the deal: With over 21,000 U.S. locations, Subway's rapid growth strategy has created a problem: too many stores competing for the same customers. This oversaturation has led to declining sales, lower profits, and thousands of store closures since 2015.

Key Takeaways:

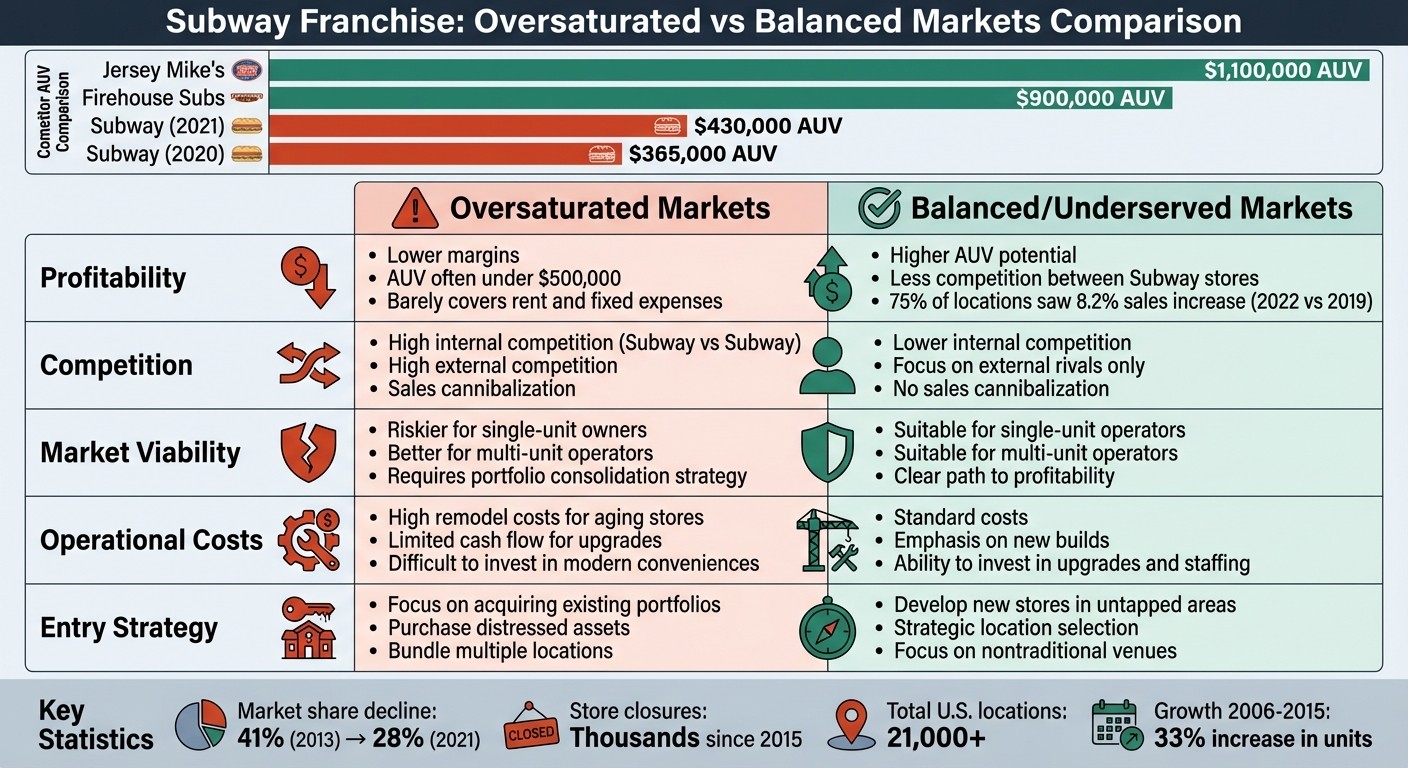

Oversaturation Issues: Subway's aggressive expansion placed stores too close together, cutting into franchisees' profits. Average unit sales ($430,000 in 2021) lag behind competitors like Jersey Mike's ($1.1M).

Balanced Markets: Locations in less crowded areas perform better, with some stores seeing an 8.2% sales increase in 2022.

Challenges for Franchisees: High competition, costly remodels, and slim margins in saturated areas make profitability tough, especially for single-store owners.

Bottom line: Success depends on location. Research your market carefully. Avoid crowded areas and focus on regions with fewer Subway stores for better growth potential.

1. Subway Franchise in Oversaturated Markets

When Subway locations crowd an area, franchisees often end up competing against each other, cutting into their own revenue and threatening long-term viability.

In 2020, Subway's average unit volume (AUV) fell to $365,000, a drop from $420,000 pre-pandemic. Adjusted for inflation, unit volumes saw a 25% decline between 2009 and 2019. To put this in perspective, Jersey Mike's locations average over $1.1 million in AUV. Restaurant consultant John Gordon put it plainly:

"When you are operating at $300,000 to $400,000 AUV, you are barely covering your rent. There's just not enough variable profit to cover the fixed expenses."

This low revenue creates a domino effect. Without enough cash flow, franchisees struggle to invest in upgrades or hire sufficient staff. This limits their ability to offer modern conveniences like curbside pickup or extended hours (e.g., 9 a.m. to 9 p.m.), making it harder to stay competitive.

Subway's rapid expansion often focused on sheer numbers rather than strategic growth. Development agents, incentivized by commissions for signing new franchises, pursued unconventional locations - think gas stations or Walmart stores. Between 2006 and 2015, the number of Subway units grew by over 33%. Former Subway executive Tina Perazzini summed it up:

"We placed them in virtually any available location."

This aggressive approach left many franchisees in overcrowded markets struggling. Subway’s market share dropped from 41% in 2013 to just 28% by 2021. For potential franchisees in these areas, the challenges are clear: low sales, stiff competition from fellow Subway locations, and limited room for growth. This situation highlights how maintaining market balance is crucial for franchise success.

2. Subway Franchise in Balanced or Underserved Markets

Overcrowded markets can weigh down franchise performance, but balanced markets present a strong opportunity for growth. In areas where oversaturation isn’t a concern, franchisees can achieve higher sales volumes and sidestep the pitfalls of sales cannibalization seen in crowded regions. For example, in early 2022, 75% of Subway's 15,000+ locations experienced an 8.2% increase in sales compared to 2019. This highlights how stores in well-chosen, balanced markets can still thrive.

A critical factor here is avoiding encroachment. Properly spaced locations allow franchisees to fully tap into a market's potential. Stronger revenues in these areas also enable franchise owners to invest in important upgrades like modern equipment, mobile ordering systems, and sufficient staffing. David Henkes, Vice President at Technomic, put it succinctly:

"Subway needs to make individual units and franchisees healthy enough that they can grow same-store sales instead of just adding units every year."

Subway has also shifted its focus toward nontraditional locations, such as hospitals, airports, and convenience stores with drive-thru options. Additionally, the brand is moving away from its historical reliance on single-unit operators, instead prioritizing multi-unit franchisees who bring both operational experience and financial resources.

Steve Rafferty, Subway's SVP of Development, explained this new direction:

"Historically, Subway has been a system of primarily single-restaurant operators... to ensure we remain competitive for years to come, we're scaling up with high-caliber multi-unit franchisees who bring operating expertise, development capabilities and capital."

These strategic adjustments aim to pave the way for more consistent earnings. While balanced markets provide a clearer path to profitability, achieving success still requires careful market analysis to avoid oversaturation as Subway continues refining its approach.

Pros and Cons

Subway vs Competitors: Average Unit Volume Comparison and Market Performance

Investing in a Subway franchise comes with a mix of challenges and opportunities, heavily influenced by whether the market is oversaturated or balanced. Each scenario impacts profitability and growth potential in distinct ways.

In oversaturated markets, there’s an opportunity to acquire established portfolios, often from franchisees looking to retire or exit. Multi-unit investors, in particular, can benefit by purchasing restaurant portfolios in bundles. This approach allows operators to consolidate profits across multiple locations. As Jonathan Maze, Editor-in-Chief at Restaurant Business, explains:

"A multi-store operator can keep that restaurant going and potentially fix it before closing."

However, oversaturation has its downsides. Profit margins are often slim, with average unit volumes (AUV) hovering around $430,000 in 2021. This figure pales in comparison to competitors like Jersey Mike's ($1.1 million) and Firehouse Subs ($900,000). Additionally, Subway locations in close proximity compete for the same customer base, and older stores often require costly remodels to remain competitive.

On the flip side, balanced markets offer a different set of advantages. These markets typically deliver higher revenue potential per location, allowing franchisees to focus on competing with external brands rather than neighboring Subway stores. Instead of dealing with expensive remodels, operators in balanced markets can invest in new builds, which often come with more manageable costs. Early 2022 data showed that 75% of Subway’s system experienced an 8.2% sales increase over 2019 levels, highlighting the growth potential in these markets.

Here’s a quick comparison of the two market types:

Feature | Oversaturated Markets | Balanced/Underserved Markets |

|---|---|---|

Profitability | Lower margins; AUV often under $500,000 | Higher AUV potential; less competition between Subway stores |

Competition | High internal and external competition | Lower internal competition; focus on external rivals |

Market Viability | Riskier for single-unit owners; better for multi-unit operators | Suitable for both single and multi-unit operators |

Operational Costs | High remodel costs for aging stores | Standard costs; emphasis on new builds |

Entry Strategy | Focus on acquiring existing portfolios or distressed assets | Develop new stores in untapped areas |

Ultimately, your decision will depend on your budget and appetite for risk. Multi-unit operators with substantial capital might find opportunities in oversaturated markets by turning around underperforming locations. Meanwhile, those looking for a simpler path to profitability may prefer balanced markets, where growth doesn’t come at the expense of nearby Subway franchises.

Conclusion

Subway's nearly 22,000 U.S. locations highlight the challenges that can come with rapid growth, particularly when profitability takes a backseat. With average unit sales significantly trailing behind top competitors, many markets struggle to sustain individual stores. The brand's long-standing practice of clustering locations has only intensified competition among its own franchisees.

Whether or not a Subway franchise is a smart investment depends entirely on the specifics of your local market. Before committing, take the time to map out all existing Subway locations within a 3-to-5-mile radius to assess market saturation. Investigate the reputation of your regional Development Agent, as some have faced accusations of using aggressive tactics, such as strict inspections, to terminate agreements. Connecting with current franchisees can also provide valuable insight into the viability of adding another store in the area. This kind of thorough market research directly aligns with the type of franchisee Subway now prioritizes.

Today, Subway leans toward multi-unit operators who have the resources to meet the brand's high capital requirements. This shift places greater risk on first-time or single-unit operators. As Darren Tristano, Executive Vice President at Technomic, pointed out:

"Subway's business has been selling franchises. If your goal is to have the most versus the best, you'll eventually run into trouble."

In less saturated or underserved markets, Subway can still present a solid opportunity - especially for those with the capital to invest in multiple locations. But in oversaturated regions, even seasoned operators may face an uphill battle. With 22,000 stores already in operation, this imbalance underscores the importance of evaluating local conditions carefully.

Take a hard look at the numbers and assess whether your market can realistically support another Subway location. Pragmatic, data-driven decisions are essential for navigating these challenges.

FAQs

What challenges come with investing in a Subway franchise in an oversaturated market?

Opening a Subway franchise might seem like a solid business move at first glance, but it comes with its fair share of risks. One of the biggest hurdles is market oversaturation. With more than 21,000 locations across the U.S., franchisees often find themselves competing not only with other fast-food chains but also with nearby Subway outlets. This intense competition can shrink customer traffic and reduce sales per store. In fact, oversaturation has been a key factor behind the closure of thousands of Subway locations in recent years, highlighting the difficulty of maintaining steady profits.

Another challenge is navigating thin profit margins. Franchisees frequently face rising costs for mandatory store renovations, which can eat into earnings. On top of that, fixed royalties and advertising fees - paid to the franchisor regardless of how well the store performs - further squeeze profits. Adding to the complexity, Subway’s franchise model grants the franchisor substantial control over daily operations. Repeated compliance issues could even lead to losing the franchise entirely.

Given these challenges, anyone considering a Subway franchise should take a hard look at the numbers and assess whether this opportunity matches their financial goals and appetite for risk.

How can I find a good location for a Subway franchise in a less saturated market?

To find the right spot for a Subway franchise, start by checking how many Subway stores are already in the area you're considering. With over 21,000 locations across the U.S., some regions are packed with outlets. Tools like store locators and demographic data can help you identify neighborhoods where Subway stores are fewer compared to the population size. Focus on high-traffic areas like malls, colleges, or hospitals for better visibility and foot traffic.

You should also investigate areas where Subway stores have closed recently. Since about 5,000 locations have shut down since 2015, closures within the past 12 to 18 months might reveal untapped potential. Look for places where there's still a strong appetite for affordable, customizable meals. These areas could be great for launching a new store with updated designs and features.

Lastly, make sure your location choice aligns with Subway’s newer strategy. They’re focusing on flexible formats like drive-thrus, kiosks, and standalone units in busy, high-visibility spots. Conduct a thorough analysis of local demographics and traffic patterns to confirm that your chosen site can thrive without competing too closely with existing stores.

What changes is Subway making to help franchisees succeed?

Subway is adjusting its U.S. franchising approach to focus on multi-unit operators who can oversee multiple stores. By targeting franchisees with extensive experience and solid financial backing, the company plans to simplify operations, support restaurant upgrades, and expand into new spaces like drive-thrus.

As part of its brand modernization efforts, Subway is also requiring existing franchisees to update their restaurants. So far, about half of its U.S. locations have been remodeled. To help franchisees meet these requirements, the company offers design templates and peer support. These updates aim to tackle market oversaturation, boost profitability, and establish a more sustainable business framework for franchise owners.