Franchise Strategies

Jan 10, 2026

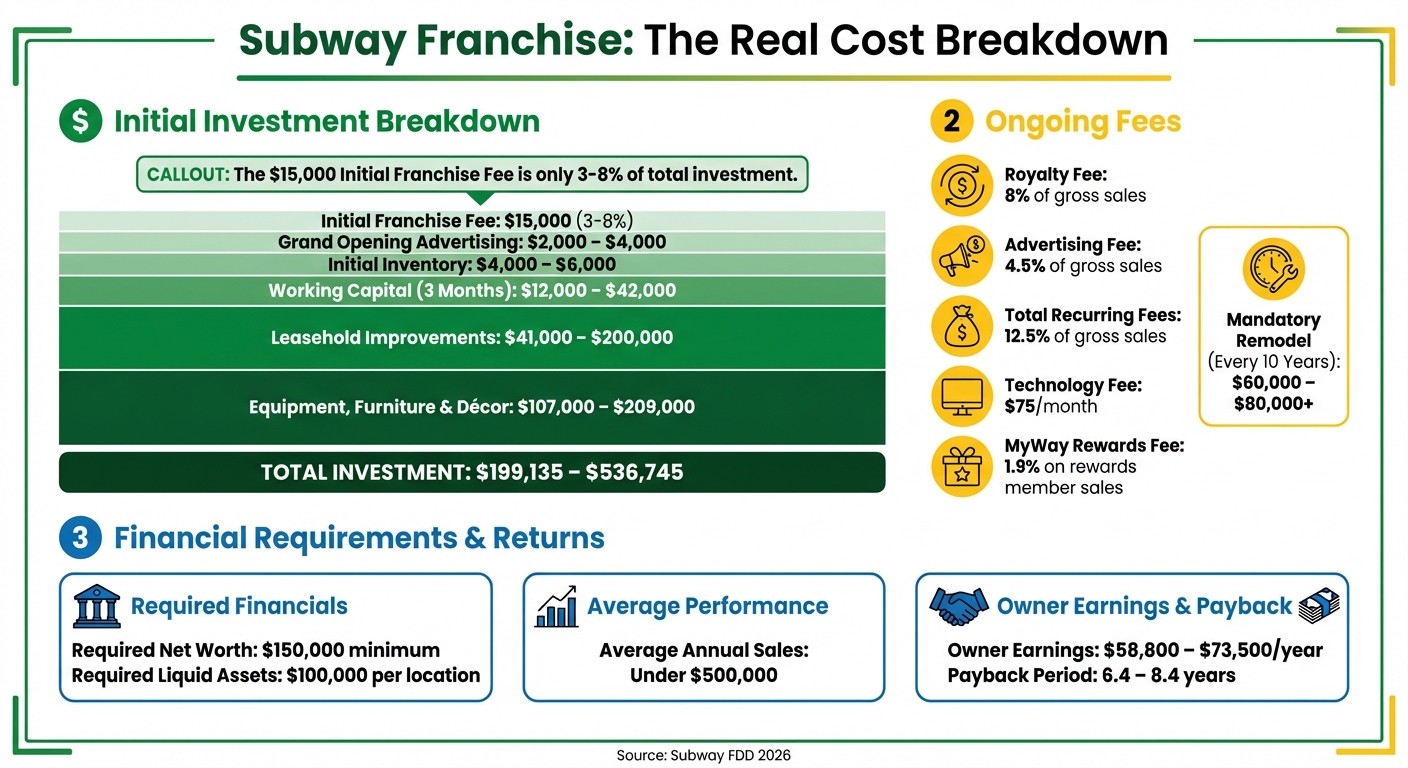

Don't be misled by a $15K franchise fee—total Subway startup costs run $199K–$537K, plus 12.5% recurring fees, remodels and tight profit margins.

Thinking about starting a Subway franchise because of its $15,000 franchise fee? Here's the reality: that fee is just the beginning. Opening a Subway restaurant in 2026 requires a total investment of $199,135 to $536,745, factoring in construction, equipment, inventory, and more. On top of that, ongoing fees like an 8% royalty, 4.5% advertising fee, and mandatory remodels every 10 years add to the financial burden.

With average annual sales under $500,000 and narrow profit margins, many franchisees face challenges breaking even. Labor shortages, rising costs, and competition from nearby Subway locations make it even tougher. Before diving in, it's essential to analyze the full financial picture, review the Franchise Disclosure Document (FDD), and assess local market conditions.

Key Costs to Consider:

Initial Investment: $199,135–$536,745

Ongoing Fees: 12.5% of gross sales (royalties + advertising)

Remodel Costs (Every 10 Years): $60,000–$80,000+

Average Annual Sales: Under $500,000

Owner Earnings: $58,800–$73,500/year

Starting a Subway franchise may seem affordable upfront, but the deeper costs and challenges require thorough planning and research to determine if it’s a viable investment.

Consider THIS Before Investing in a Subway Franchise! [The Reality of Food Franchises]

The Real Cost of Opening a Subway Franchise

Complete Subway Franchise Cost Breakdown 2026: Initial Investment and Ongoing Fees

Total Startup Investment Breakdown

The $15,000 franchise fee is just the tip of the iceberg. By 2026, the total investment required to open a Subway franchise ranges from $199,135 to $536,745, depending on factors like location, building condition, and real estate expenses. While the franchise fee might seem manageable, it's a small piece of the overall startup puzzle. Here's a closer look at where the money goes:

Leasehold Improvements (space buildout): Between $41,000 and $200,000, covering construction, renovations, and modifications to align with Subway's design standards.

Equipment, Furniture & Décor: Costs range from $107,000 to $209,000, including ovens, refrigeration units, prep tables, seating, and point-of-sale (POS) systems.

Initial Inventory: Expect to spend $4,000 to $6,000 on essentials like bread, meats, vegetables, and other supplies needed to get started.

Grand Opening Advertising: Allocating $2,000 to $4,000 helps attract customers during the critical launch phase.

Working Capital (first three months): Budget $12,000 to $42,000 to cover payroll, rent, utilities, and other operating costs as your business gains traction.

Investment Category | Cost Range |

|---|---|

Initial Franchise Fee | $15,000 |

Leasehold Improvements | $41,000 – $200,000 |

Equipment, Furniture & Décor | $107,000 – $209,000 |

Initial Inventory | $4,000 – $6,000 |

Grand Opening Advertising | $2,000 – $4,000 |

Working Capital (3 Months) | $12,000 – $42,000 |

Total Estimated Investment | $199,135 – $536,745 |

This breakdown makes it clear how a seemingly affordable franchise fee can balloon into a much larger commitment. Knowing these costs upfront is crucial for crafting a strong financial plan and ensuring you have the resources to handle the early months of operation.

Unexpected Costs and Operating Challenges

A low franchise fee can mask a slew of hidden costs that add up over time. Beyond the initial investment, ongoing expenses and unforeseen challenges can take a toll on profitability, making financial planning more complicated than it might initially seem.

Location and Real Estate Expenses

When it comes to real estate, rent is just the beginning. While monthly rent typically ranges from $1,000 to $6,000, franchisees face additional financial obligations. Subway mandates that locations undergo remodeling every 10 years to meet brand standards, a requirement that can cost anywhere from $60,000 to $80,000 or more. Bill Mathis, Chairman of the North American Association of Subway Franchisees, explained the importance of this:

"You can't continue in this restaurant world and have stores look like they're 20 years old. People will stop coming."

Adding to the challenge, Subway does not offer territorial protection. This means another franchise could open nearby, potentially splitting your customer base. Before committing to a lease, it’s essential to investigate whether additional Subway locations are planned in your area. These real estate hurdles are just one piece of the larger puzzle of operational expenses.

Labor and Food Cost Fluctuations

Rising wages and fluctuating food prices have reshaped the financial landscape for Subway franchisees. The once-popular $5 Footlong promotion is no longer viable due to increased costs. Jonathan Maze, Editor-in-Chief of Restaurant Business, commented on this shift:

"The $5 Footlong was a remarkable promotion for some time but ultimately became obsolete given rising costs."

Labor shortages compound the issue, forcing many franchisees to work long hours themselves, as low sales volumes make it challenging to offer competitive wages. Extended operating hours, often required by the franchise, add further strain to staffing. To make matters worse, average unit volumes have dropped - from approximately $420,000 before the pandemic to $365,000 in 2020 - making it even harder to absorb rising expenses.

Technology, Maintenance, and Compliance Costs

Even after opening, the costs don’t stop. Maintaining technology and equipment can be a significant ongoing expense. For example, monthly fees for POS systems ($57) and digital menu boards ($155) add up to more than $2,500 annually per location. Security systems require an upfront investment of $2,450 to $3,550, plus additional monitoring fees. Legal and accounting services for tax and regulatory compliance can cost another $1,000 to $3,500 annually.

On top of that, franchisees are required to participate in all digital offers and discounts through the Subway app. This includes a MyWay Rewards fee of 1.9% on gross sales made to rewards members. Altogether, these technology and compliance-related expenses can exceed $5,000 annually, further squeezing already tight profit margins.

Why a Low Franchise Fee Doesn't Equal Success

Paying $15,000 to start a Subway franchise might sound appealing, but it’s just the beginning of a much bigger - and riskier - financial journey. That initial fee doesn’t capture the full cost of running a quick-service restaurant in today’s market.

Narrow Profit Margins and the Break-Even Challenge

Subway’s business model depends on high sales volumes to make up for its steep recurring fees and slim profit margins. But here’s the catch: with average annual unit sales under $500,000, many Subway locations earn far less than their competitors. That’s a tough spot when franchisees have to pay 12.5% of their gross sales in royalties and advertising fees.

For owner-operators, typical yearly earnings fall between $58,800 and $73,500, with a payback period ranging from 6.4 to 8.4 years. Restaurant consultant John Gordon summed it up well:

"The operator ultimately declined because the profit was slim and he would have had to fix up the stores, many of which are outdated."

When margins are this tight, even small changes in sales or expenses can flip profits into losses. This financial pressure creates a challenging environment for franchisees trying to stay afloat.

Daily Operations and Added Risks

The financial strain is only part of the story. Running a Subway franchise comes with daily operational hurdles that can eat into those already narrow margins. Franchisees juggle staffing, inventory, and quality control, all while trying to keep costs in check. Historically, Subway has leaned on small, family-operated franchises, but as Reuters reported:

"Subway, which has closed thousands of U.S. locations since 2016, said a year ago that it wants to shift away from its current base of small franchisees that own just one or two shops, which tend to be family-run and sometimes barely scrape by."

Labor shortages make things even harder. When sales are too low to afford competitive wages, franchisees often end up working extra hours themselves. On top of that, they’re required to buy supplies exclusively through the Independent Purchasing Co-op (IPC), which limits their ability to shop around for better deals. These challenges have pushed some multi-unit operators to step back entirely. As Hilary Russ from Reuters observed:

"Several multi-unit operators walked away after seeing how little money they made."

For many, the combination of financial strain and operational risks makes the low franchise fee far from a guarantee of success.

How to Evaluate a Subway Franchise Investment

Before diving into a Subway franchise, it’s crucial to look beyond the initial $15,000 franchise fee and take a hard look at the bigger picture. The difference between making a solid investment or a costly mistake hinges on how thoroughly you assess the opportunity.

Creating a Complete Financial Plan

Start by building a detailed pro forma that outlines all potential costs and revenues. You’ll need to account for the total investment range, which runs from $238,625 to $536,745 - not just the franchise fee. Don’t forget to include the 8% royalty fee and the 4.5% advertising fee, both calculated on gross sales.

When estimating sales, stay realistic. Subway’s average unit volume is under $500,000, so it’s better to use conservative figures. Additionally, plan for Subway’s recommended "Additional Funds" buffer of $12,000 to $43,000 to cover the first three months, as early losses are common. Be sure to factor in the costs for mandatory 10-year remodels, as outlined in the Franchise Disclosure Document (FDD).

Other ongoing expenses to include in your plan are the $75 monthly technology fee, $2,500–$5,000 for training, and the minimum financial requirements - $150,000 in net worth and $100,000 in liquid assets per location.

Performing Due Diligence

Numbers alone aren’t enough; you need to back up your assumptions with careful research. Start by thoroughly reviewing Subway’s Franchise Disclosure Document (FDD). Pay close attention to Item 7, which breaks down the full investment, and Item 20, which details store closure trends. Since 2016, Subway has shuttered thousands of U.S. locations, a trend worth investigating.

Subway doesn’t offer exclusive territories, so it’s essential to ensure your target area isn’t oversaturated. Research how many Subway locations are already within a few miles of your proposed site. Too many nearby stores could lead to sales cannibalization, leaving you competing with other franchisees for the same customers.

Take the time to interview current and former franchisees using contact information provided in the FDD. This can help you verify profit margins and operational challenges. A report from Reuters highlighted a concerning trend:

"Several multi-unit operators... examined the possibility of entering the chain's system by buying swaths of restaurants but walked away after seeing how little money they made".

If experienced operators are opting out, that’s a red flag you can’t ignore.

Additionally, if you’re considering an existing location, check whether it has already been upgraded to the "Fresh Forward" design. If not, you’ll need to cover the renovation costs yourself.

Using Franchise Ki's Free Consulting Services

With so many variables at play, getting expert guidance can make all the difference. Franchise Ki offers free consulting services to help you determine whether a Subway franchise - or any franchise opportunity - aligns with your financial goals and risk tolerance.

Led by Bennett Maxwell, who sold over 300 Dirty Dough Cookies franchise units in just two years, Franchise Ki provides personalized services like franchise matching, investment analysis, and funding strategy support. Their team can help you dig into the FDD, assess trade area demographics, and validate projections. Co-founder Liam Chase has a proven track record, helping clients grow from 13 units sold to nearly 70 units in just one quarter.

Whether you’re considering Subway or exploring other opportunities, Franchise Ki’s experts are there to guide you every step of the way - from initial research to negotiation and beyond. Best of all, their services are completely free, so you can get professional advice without adding to your upfront costs.

Conclusion

Paying the $15,000 franchise fee for Subway is just the tip of the iceberg. The total startup costs actually fall between $199,135 and $536,745, which includes major expenses like leasehold improvements that can hit $200,000 and a requirement to have at least $100,000 in liquid assets. While the low franchise fee might seem appealing, it’s important to focus on the bigger financial picture.

Beyond the upfront costs, running a Subway franchise means preparing for ongoing expenses and financial commitments. From cautious revenue expectations to required remodels, the investment goes far beyond the initial fee. To make an informed decision, it's crucial to review the Franchise Disclosure Document, speak with current franchisees, and evaluate your local market thoroughly - especially since Subway doesn’t guarantee exclusive territories. These steps can help you assess whether your chosen location has the potential to succeed.

To help you navigate these challenges, Franchise Ki offers free consulting services. Their personalized guidance includes everything from investment analysis to FDD reviews, giving you the tools to make smarter, more financially sound decisions - all without adding to your upfront costs.

FAQs

What unexpected costs should I consider when opening a Subway franchise?

While the $15,000 franchise fee for a Subway might seem like a bargain, it’s just the tip of the iceberg. There are plenty of other costs you’ll need to factor in. For starters, leasehold improvements can range from $75,000 to $200,000. Then there’s equipment, which can set you back another $7,500 to $15,500, and exterior signage, costing between $2,000 and $8,000. Don’t forget about opening inventory, which typically runs from $4,400 to $6,050. On top of that, you’ll need to account for insurance, training, legal fees, and a cash reserve to cover at least three months of operating expenses. Altogether, these upfront investments can easily climb into the hundreds of thousands of dollars.

But the expenses don’t stop there. Once your Subway is up and running, you’ll face ongoing fees that chip away at your profits. Subway takes an 8% royalty on gross sales, plus a 4.5% advertising contribution, adding up to 12.5% of your weekly revenue. When you combine these recurring fees with the hefty startup costs, it’s clear that the $15,000 franchise fee is only a small piece of the financial puzzle required to operate a Subway franchise.

What challenges do Subway franchisees face without territorial protection?

Subway doesn’t provide territorial protection, meaning there’s no promise that another franchise won’t pop up nearby. This lack of exclusivity can create competition between franchisees, which might impact customer traffic and sales for individual stores. In areas with overlapping locations, franchisees may need to put extra effort into standing out and building a loyal customer base.

For anyone considering a Subway franchise, it’s crucial to thoroughly assess the local market. Think about how existing locations - or the possibility of new ones - might influence your business before committing to the investment.

Why should I review the Franchise Disclosure Document before investing in a Subway franchise?

Reviewing the Franchise Disclosure Document (FDD) is a critical step because it lays out all the legal, financial, and operational responsibilities you'll take on as a Subway franchisee. The document includes essential details like the initial franchise fee of $15,000, ongoing costs such as royalties (8% of gross sales) and advertising fees (4.5% of gross sales), as well as start-up expenses, lease terms, and the 20-year franchise agreement. It also helps you determine if you meet the financial requirements, including a net worth of $150,000 and liquid assets of $100,000.

The FDD goes beyond just costs. It provides transparency by outlining the franchisor’s performance history, litigation records, and any franchisee disputes. This information helps you assess risks, plan for unexpected expenses, and ensure the investment aligns with your financial goals. Skipping this review could lead to unforeseen problems, while taking the time to thoroughly analyze the FDD sets you up to make informed decisions and better prepares you for success as a franchise owner.