Franchise Strategies

Jan 9, 2026

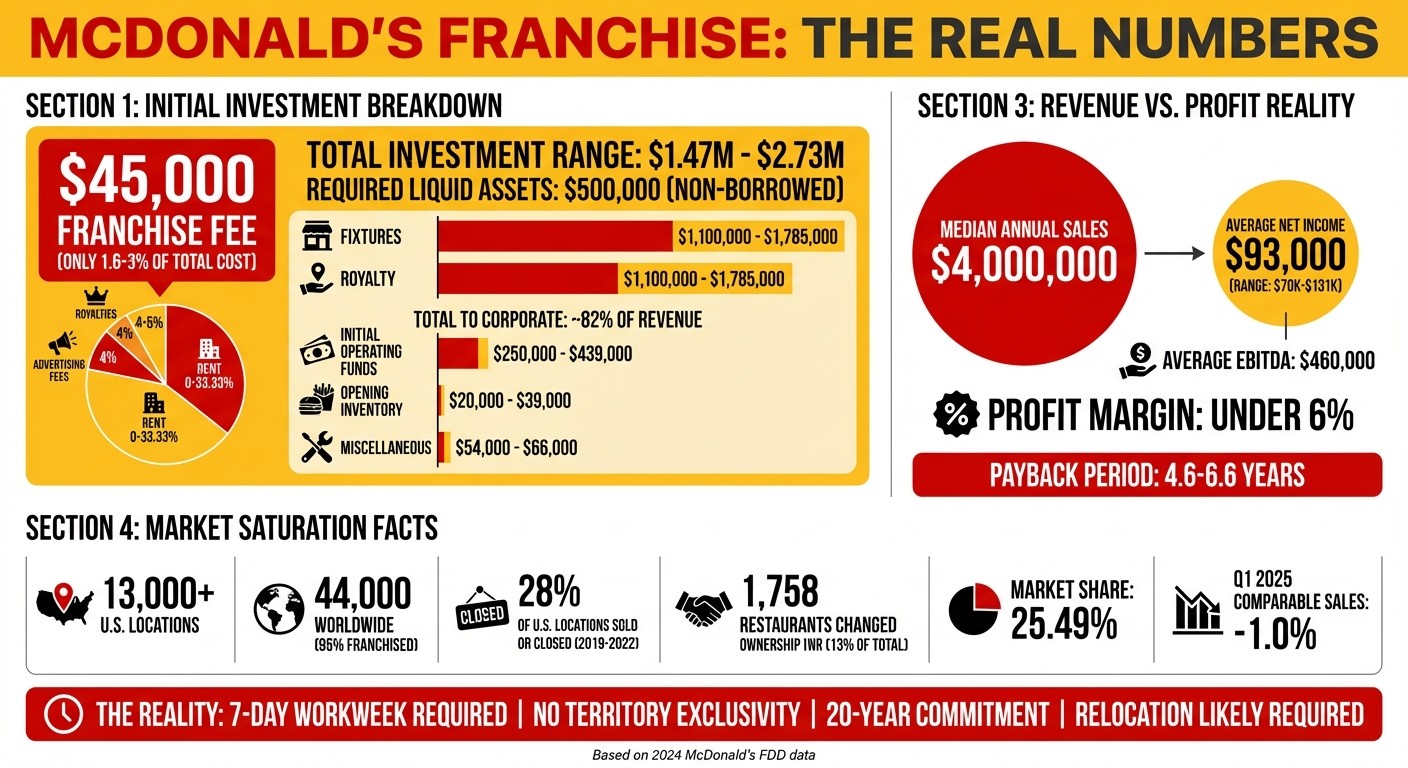

Explains real costs of owning a McDonald's franchise—$1.47–$2.73M startup, $45K fee, heavy ongoing costs, low margins, market saturation, and strict corporate control.

Starting a McDonald's franchise isn't as simple as paying the $45,000 franchise fee. Here's what you need to know:

Total Costs: The initial investment ranges from $1.47M to $2.73M, with a required $500,000 in liquid assets.

Ongoing Fees: Expect royalties (4-5% of sales), advertising fees (4%), and rent that can take up to 33% of gross sales.

Profit Margins: Median annual sales are $4M, but net income averages just $93K annually, with a profit margin under 6%.

Market Saturation: With over 13,000 U.S. locations, growth is challenging. Most new opportunities involve buying existing restaurants.

Corporate Control: McDonald's owns much of the land and dictates operations, leaving franchisees with minimal flexibility.

Time Commitment: Running a McDonald's is hands-on, requiring extensive training and a seven-day workweek.

Investing in a McDonald’s franchise involves high costs, tight margins, and significant personal commitment. Carefully evaluate the financial risks, market conditions, and corporate requirements before proceeding.

McDonald's Franchise Cost Breakdown and Financial Reality

The $45,000 Franchise Fee: What It Covers and What It Doesn't

Franchise Fee vs. Total Investment

Let’s break down what the $45,000 franchise fee actually includes. This fee grants you the right to operate under the McDonald’s brand for a 20-year term. It also covers an extensive training program - lasting anywhere from 6 to 12 months - that you must complete before purchasing a restaurant. On top of that, you’ll receive corporate support, which includes help with site selection and access to national advertising campaigns.

However, the $45,000 fee is just the tip of the iceberg. It only accounts for about 1.6% to 3% of your total investment. Beyond this fee, you’ll need to budget for:

Fixtures: $1,100,000 to $1,785,000

Opening inventory: $20,000 to $39,000

Miscellaneous expenses: $54,000 to $66,000

Initial operating funds: $250,000 to $439,000

To qualify, you’ll need at least $500,000 in non-borrowed liquid assets, proving you have the financial resources to sustain operations. McDonald’s also requires a cash down payment - 40% for new restaurants and 25% for existing ones - and borrowing isn’t allowed for this portion. While McDonald’s doesn’t offer direct financing, they do have relationships with national lenders who can assist with securing funds.

Ongoing Financial Commitments

The financial responsibilities don’t stop once your doors open. Ongoing costs include a service fee (royalty) of 4% to 5% of your monthly gross sales. Advertising and promotion costs will take up at least another 4% of gross sales. Additionally, McDonald’s typically owns or leases the land and building, making them your landlord. Rent includes a monthly base rate plus a percentage of gross sales, which can range from 0% to 33.33%.

"McDonald's franchisees pay about 82% of store revenue to McDonald's each year." – Investopedia

With median annual sales of $3,838,000 in 2024, these percentage-based fees add up quickly. For example, if your location hits the median, you might pay around $153,520 to $191,900 in royalties, another $153,520 for advertising, and potentially hundreds of thousands more in rent. And that’s before you account for labor, utilities, and other operational expenses. These ongoing costs play a significant role in determining profitability and how long it takes to recover your investment.

Profitability and Payback Period

Let’s talk numbers. In 2024, the average annual sales for a domestic, traditional McDonald’s location reached $4,002,000. Franchisees report an estimated EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of about $460,000. But keep in mind, EBITDA isn’t the same as take-home pay. After taxes, debt payments, and reinvestments, the average franchisee ends up with a net income of roughly $93,000 per year, with earnings ranging between $70,000 and $131,000.

Now, consider the initial investment of around $2,000,000. With an EBITDA of $460,000, the simple payback period ranges from 4.6 to 6.6 years. This assumes smooth sailing - no unexpected equipment breakdowns, remodeling needs, or inconsistent sales. In reality, recovering your initial investment could take longer, especially in highly competitive markets where growth is harder to achieve.

Challenges of a Mature, Saturated Market

What Market Maturity and Saturation Mean

The U.S. fast-food industry is fiercely competitive, with McDonald's standing as a prime example of market saturation. With over 44,000 locations worldwide - 95% of which are independently owned franchises - finding opportunities for fresh growth has become a daunting task. In such a crowded market, new franchisees often have no choice but to purchase existing restaurants instead of building new ones. And even those opportunities are typically reserved for seasoned operators with proven success.

Between 2019 and 2022, about 28% of McDonald's U.S. locations were either sold or closed. In one year alone, 1,758 restaurants changed ownership, representing 13% of the 13,000+ franchise-owned locations in the U.S.. While this high turnover may reflect enticing valuations - sometimes reaching 10 times EBITDA - it also underscores the reality that growth for newcomers largely hinges on acquiring existing outlets, often in markets where demand has already peaked.

How Saturation Affects Franchise Performance

In a saturated market, franchisees find themselves vying for a finite pool of customers. As McDonald's CFO Ian Borden put it:

"It's a street fight. Everybody is fighting for fewer consumers. We have to make sure we have that street fighting capability."

To keep foot traffic steady, franchisees often rely on limited-time promotions, steep discounts, and value-driven menu options. While McDonald's held a 25.49% market share in the fast-food sector as of Q2 2023, the challenges of saturation have taken a toll. Global comparable sales dropped by 1.0% in Q1 2025, and net income fell by 12% year-over-year in mid-2024.

Meanwhile, fast-casual competitors are gaining ground, attracting health-conscious customers willing to pay higher prices for perceived quality. McDonald’s, in contrast, caters to a price-sensitive audience increasingly wary of rising menu costs. As Borden acknowledged:

"The consumer is price weary, and we're certainly going to be prudent and thoughtful about any further price increases."

Another challenge is cannibalization. McDonald’s doesn’t assign exclusive territories to franchisees and requires applicants to remain mobile. This means corporate can open new locations near your restaurant, potentially eating into your sales. Additionally, if you take over an existing franchise, you might face a rent increase - from a grandfathered 5% of sales to 13% - which could significantly impact your profit margins.

Real Estate and Site Limitations

McDonald’s handles the entire process of selecting, acquiring, and building restaurant locations before awarding them to franchisees. However, most prime U.S. locations are already taken, leaving new franchisees with less desirable or more expensive options. Adding to the uncertainty, the company cannot guarantee which sites will be available by the time you finish the unpaid 6-to-12-month training program, and there may be a long wait before an opportunity opens up.

Territory exclusivity isn’t part of the deal, so relocation is almost inevitable. McDonald’s advises candidates to budget at least $75,000 for relocation expenses and asks them to rank their top 10 preferred states. If you’re unwilling to move, your chances of securing a franchise drop significantly. This lack of control over location can directly affect foot traffic, operational costs, and long-term profitability, making the journey even more challenging for aspiring franchisees.

Financial and Operational Risks

Financial Risks and Tight Margins

Owning a McDonald's franchise comes with more than just a hefty initial fee and multi-million-dollar investment - it also brings intense financial strains. If you finance the purchase, McDonald's requires that all borrowed funds be repaid within seven years. This short repayment period can put a major squeeze on cash flow.

On top of that, royalties, advertising fees, and rent alone can eat up over 36% of gross sales. Add in food, labor, and technology expenses, which can exceed $11,000 annually, and it becomes clear how profitability is quickly eroded. Even with median annual sales of nearly $4 million, franchisees typically see an average net income of just $150,000 - a profit margin of less than 6%. As one industry analysis from Mashed explains:

"A profit of $150,000 after $2.7 million in sales isn't even 6 percent, but after food cost, supplies, crew payroll, and about a dozen other costs handed down by corporate, that's what franchisees are left with." – Mashed

Adding to the challenge, McDonald's corporate retains about 82% of the revenue generated by franchise locations, compared to only 16% from company-owned stores. Franchisees must also cover mandatory remodeling and repair expenses, which can be particularly burdensome for older locations. These razor-thin margins and high costs make it difficult to thrive in an already saturated market with limited growth opportunities. To make matters worse, franchisees must navigate stringent corporate controls that further complicate operations.

Compliance and Corporate Control

McDonald's exerts tight control over nearly every aspect of its franchise operations. With corporate owning around 57% of the land and 80% of the buildings in its system, franchisees have limited leverage when it comes to decision-making. From equipment and decor to suppliers and technology, everything must align with the "McDonald's Way".

Operational independence is minimal. Corporate dictates which vendors you use, what technology you adopt, and even influences menu pricing. Franchisees are also required to contribute to initiatives like the "Archways to Opportunity" tuition program, which costs about $3,571 per store annually. Over the past decade, technology fees have skyrocketed, increasing tenfold. When McDonald's eliminated subsidies like the Happy Meal toy subsidy, it added over $12,000 in costs per location each year.

This level of control has led to frustration among franchisees. The National Owners Association Board voiced concerns, stating:

"The technology isn't very good, the cost transparency is even worse, and now we have evidence of accounting mistakes." – National Owners Association Board

To ensure compliance, McDonald's conducts frequent audits, and any failure to meet corporate standards can result in penalties or even the loss of the franchise. This rigid oversight leaves franchisees with little room for flexibility, increasing the overall risks of ownership. On top of corporate mandates, the demanding nature of running a franchise adds another layer of difficulty.

Workload and Lifestyle Demands

Owning a McDonald's franchise is not a passive investment - it requires active, hands-on involvement from the owner. The extensive training program highlights the commitment needed, and partnerships are not allowed. This means the entire operational and financial responsibility falls on a single individual.

Geographic flexibility is another requirement. If you're unwilling to relocate, your chances of being approved drop significantly. Even after completing training, there’s no guarantee of an immediate opportunity, and you might wait months - or even years - for a location to become available.

The commitment is long-term, too. Franchise agreements last 20 years, and the daily demands of running the business are relentless. As Investopedia puts it:

"Owning a McDonald's franchise is not for the faint of heart or wallet... the price of admission is steep in dollars and determination." – Investopedia

Between financial pressures, strict corporate controls, and the personal sacrifices required, sustaining a McDonald’s franchise over the long haul is no easy feat. For many, the challenges can feel overwhelming.

How to Evaluate if McDonald's is Right for You

Define Your Goals and Risk Tolerance

Taking on a McDonald's franchise is a big financial step, so it’s crucial to start by outlining your goals and understanding your comfort level with risk. Before diving in, make sure your finances are in order - McDonald's requires $500,000 to $750,000 in liquid, non-borrowed assets just to apply.

It’s also important to set realistic income expectations. While median annual sales for a McDonald's franchise are around $4 million, the average franchisee earns about $93,000 per year, with some estimates ranging from $70,000 to $131,000. If you’re dreaming of a six-figure passive income, McDonald's might not be the right fit. As the company itself points out:

"Profitability depends on many factors, including operating and occupancy costs, financing terms, and (most important) your ability to operate the business effectively." – McDonald's

Think about how long you’re willing to wait to recover your investment. The total cost of opening a McDonald's franchise can range between $1.47 million and $2.64 million, meaning it could take years to break even.

You’ll also need to consider the time commitment. Running a franchise is a hands-on job, often requiring a seven-day-a-week schedule. Tanyel Harrison Bennett, a former lawyer turned McDonald's franchisee in Brenham, Texas, shared her experience with AARP:

"I work seven days a week, but it doesn't feel like the work that I was doing before, because I look at it as 'This is mine.'" – Tanyel Harrison Bennett, McDonald's Franchisee

Additionally, be prepared to relocate if necessary. McDonald's assigns restaurant locations based on availability, so flexibility is key. Once you’ve clarified your goals and assessed your risk tolerance, the next step is to dig into the numbers and local market conditions.

Conduct Market and Financial Analysis

The Franchise Disclosure Document (FDD) will be your best friend here. It includes essential details like financial performance data (Item 19) and a list of current and former franchisees (Item 20). High turnover or frequent closures in a specific area might indicate challenges like market saturation or profitability issues.

Reach out to existing franchisees, especially those who’ve been in the business for at least five years. Ask them how long it took to break even and what their actual income looks like. Use the contact information provided in Item 20 of the FDD to connect directly. These real-world insights can be far more valuable than corporate projections.

When crunching the numbers, take a conservative approach. Account for rent (15-28%), royalties (4-5%), and advertising fees (4%) as percentages of your gross sales. Don’t forget about technology fees, which exceed $11,000 annually, and mandatory contributions like the Archways to Opportunity program, costing about $3,571 per store each year.

It’s also smart to scope out the competition and study local market trends. Between 2016 and 2021, McDonald's reduced its U.S. store count from 14,155 to 13,429, with a slight rebound to 13,666 by late 2022. This reflects a mature market with limited room for growth. Armed with this knowledge, you’ll be better equipped to make informed decisions - or seek expert advice to guide you further.

Get Expert Guidance

Given the size of this investment, it’s wise to bring in professional help. The Federal Trade Commission strongly advises having both an accountant and an attorney review the FDD and financial documents before signing anything.

You might also consider consulting services like Franchise Ki, which provide personalized advice and connect you with vetted opportunities. They offer free consultations covering franchise matching, funding strategies, due diligence support, and ongoing assistance. Unlike traditional brokers, who may push specific franchises for a commission, Franchise Ki focuses on aligning opportunities with your skills, budget, and long-term goals.

Another key step is to verify McDonald's trademark status (Item 13 in the FDD) and review post-termination obligations (Item 17). For example, non-compete clauses can last up to three years, so it’s important to understand these restrictions before committing.

Lastly, prepare for the intensive training program. McDonald's requires new franchisees to complete six to 24 months of training, covering everything from operating the cash register to maintaining equipment. As Eric Stites, CEO of Franchise Business Review, explains:

"It's not an easy business to be in for someone who is 55-plus. Many people may not want to kind of commit to that level of work because they are trying to slow down." – Eric Stites, CEO of Franchise Business Review

How Much Mcdonald's Franchise Owners Really Make Per Year

Conclusion

Investing in a McDonald's franchise isn’t as straightforward as the $45,000 franchise fee might suggest. The total investment ranges from $1.47 million to $2.64 million, with ongoing fees - like royalties and rent - taking a substantial bite out of revenue. In a market where McDonald's is already well-established, opportunities for growth are limited, and competition, even among other franchisees, can be fierce. These realities highlight the importance of conducting thorough research before committing.

The financial picture also presents some hurdles. While median annual sales approach $4 million, net profits for franchisees are relatively modest, often leading to payback periods stretching over a decade. On top of that, owning a McDonald’s franchise demands a full-time, seven-day-a-week commitment, with little flexibility, as the corporation tightly controls key aspects like site location and menu options. Additionally, qualifying requires between $500,000 and $750,000 in liquid, non-borrowed assets.

To navigate these complexities, start by reviewing the Franchise Disclosure Document carefully. Speak with current franchisees to gain insights, and enlist the help of an accountant and attorney to scrutinize all financial details. You might also explore resources like Franchise Ki, which offers free consulting to help match you with franchise opportunities that fit your skills, budget, and long-term aspirations.

FAQs

What are the costs and financial risks of owning a McDonald’s franchise?

Owning a McDonald’s franchise involves more than just the $45,000 franchise fee - it’s a major financial commitment. The total cost to open a location typically falls between $1,000,000 and $2,600,000, with variables like location and whether the site is new or existing playing a big role. Franchisees are also required to make a down payment of 40% for new locations or 25% for existing ones, and this money must come from personal, non-borrowed funds.

Once the restaurant is up and running, there are ongoing expenses to consider. These include royalty fees (4% of gross sales), advertising contributions (4% of gross sales), as well as costs for equipment leasing, real estate leases, inventory, insurance, and technology fees. These recurring expenses can add up quickly, making it critical to maintain strong sales.

The financial risks are substantial. The large upfront investment can be daunting, and the competitive fast-food industry adds pressure to maintain profitability. Many franchisees turn to financing, which can lead to significant debt if sales drop or expenses increase. Fixed lease agreements, rising labor costs, and the requirement to buy supplies from approved vendors can further squeeze profit margins. While the average location generates around $2,700,000 in annual sales, high operating costs often mean net earnings are relatively modest. For anyone considering this path, it’s crucial to thoroughly assess their financial readiness and ability to handle the risks involved.

What challenges does market saturation pose for new McDonald's franchise owners?

Market saturation plays a big role in shaping the success of a new McDonald’s franchise. When too many locations operate close to each other, it reduces the pool of untapped customers and ramps up competition. In well-established U.S. markets, it’s not uncommon to find multiple McDonald’s restaurants within just a few miles. This can lower the sales potential for each location, making it tougher to achieve solid profits.

For new franchisees, the challenge is even greater because domestic market growth has slowed. This makes selecting the right location absolutely critical. To succeed, franchise owners must pinpoint areas where demand still exists, run their operations with top-notch efficiency, and create promotions that can draw customers away from competitors. Without a solid strategy, recovering the initial investment - ranging from a $45,000 franchise fee to a total cost of $1.5–$2.6 million - can become a steep uphill battle in such a crowded market.

What kind of personal commitment and lifestyle changes are needed to own and operate a McDonald's franchise?

Owning a McDonald’s franchise isn’t just a business venture - it’s a full-time commitment that can reshape your daily life. Franchisees often put in 40 or more hours a week, spending significant time on-site to oversee operations. Early mornings, late nights, and bustling weekends are all part of the routine.

The role comes with strict guidelines to uphold the brand’s reputation, which means personal sacrifices are often necessary. Taking extended vacations or traveling frequently might not be realistic, especially in the early stages of running the franchise. Beyond that, owners must be ready to address issues as they arise - whether it’s staffing challenges, equipment malfunctions, or customer concerns - while staying engaged with corporate training and performance evaluations.

Ultimately, running a McDonald’s franchise requires a hands-on approach and the flexibility to align your lifestyle with the fast-paced, round-the-clock demands of the business.