Franchise Strategies

Jan 7, 2026

High startup costs, rising royalties and rent, market saturation and strict corporate rules are squeezing franchisee profits—what to consider before investing.

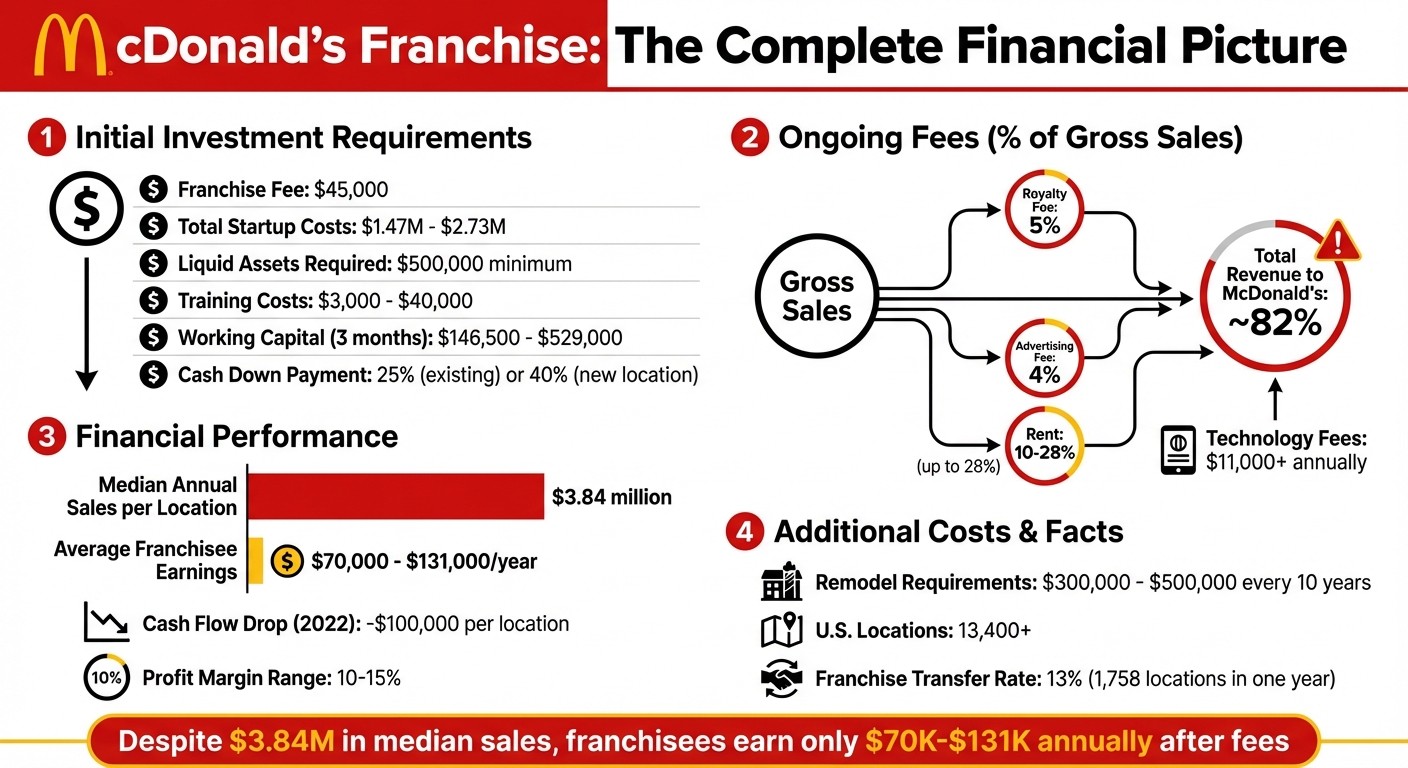

Owning a McDonald’s franchise might seem like a lucrative opportunity, but the reality is far more challenging. While the brand boasts global recognition and impressive sales figures (median annual sales of $3.84 million per location), franchisees face steep costs, shrinking profit margins, and increasing corporate demands. Key points to consider:

High Costs: Startup costs range from $1.47M to $2.73M, with a minimum of $500K in liquid assets required. Ongoing fees, including royalties (5% of sales), rent (up to 28% of sales), and advertising (4% of sales), consume about 82% of revenue.

Falling Profit Margins: Despite sales growth, franchisee cash flow dropped by $100K per location in 2022, and average earnings are now between $70K and $131K annually.

Market Saturation: With 13,400 U.S. locations, franchisees often compete with nearby McDonald’s stores, limiting growth opportunities.

Rising Costs: Labor, food, and real estate expenses are climbing, further squeezing profits. California’s $20/hour minimum wage adds to the strain.

Corporate Control: Strict policies, frequent remodel requirements ($300K–$500K every 10 years), and limited flexibility for local adjustments create additional hurdles.

While McDonald’s offers a proven business model and extensive support, the financial and operational demands make it a tough road for franchisees. If you’re considering this path, weigh the risks carefully and ensure it aligns with your financial goals and risk tolerance.

McDonald's Franchise Costs and Financial Breakdown 2024

High Entry Costs and Recurring Financial Obligations

Initial Investment Requirements

Becoming a McDonald's franchisee is no small feat - it requires a hefty financial commitment right from the start. The initial franchise fee alone is $45,000. While McDonald's takes care of owning or leasing the property, franchisees are responsible for the interior setup, which adds to the financial load.

The cash requirements are daunting. To even qualify, you need at least $500,000 in liquid assets. If you're purchasing an existing restaurant, you'll need to pay 25% of the purchase price in cash. For new locations, the bar is even higher, requiring 40% in non-borrowed funds. As Investopedia puts it:

"Owning a McDonald's franchise is not for the faint of heart or wallet... the financial and personal commitment required is substantial".

Training costs can range from $3,000 to $40,000, and you'll need working capital for the first three months, which includes opening inventory and other miscellaneous expenses. This can add up to anywhere between $146,500 and $529,000.

Once you've cleared these initial hurdles, the financial demands don't stop - they evolve into ongoing commitments that can significantly impact profitability.

Recurring Fees and Royalties

After the initial investment, franchisees face a slew of recurring expenses that continue to squeeze profit margins. Starting in 2024, McDonald's increased its royalty fee from 4% to 5% of gross sales for new franchisees, marking the first hike in nearly three decades. On top of that, franchisees are required to allocate around 4% of their gross sales to advertising and marketing efforts.

Rent is another major expense. For restaurants opened since January 2020, rent typically falls between 10% and 15.75% of gross sales, but in some cases, it can climb as high as 28%. Since McDonald's owns a significant portion of the land and buildings - 57% of the land and 80% of the buildings - these rent payments funnel directly back to the corporation.

Technology fees also pile on. Annual fees exceed $11,000, with additional digital costs ranging from $73.80 to $2,956. Industry experts estimate that franchisees end up returning about 82% of their store revenue to McDonald's through these various fees and rent.

The National Owners Association (NOA) has voiced concerns about this fee structure. In one of their memos, they noted:

"In spite of the incredible sales growth the restaurants are driving, franchisees are making less money per restaurant today than they did in 2010".

Even with median annual sales close to $4 million per location, the average franchisee earns only about $93,000 a year. To make matters worse, franchisee cash flow dropped by an average of $100,000 per location in 2022, underscoring the mounting financial pressures.

These ongoing financial challenges create a tough environment for franchisees, setting the stage for additional hurdles like market saturation and rising operational costs, which we'll explore next.

How Much Does it Cost to Open a McDonald’s? (Costs, Sales, & Fees)

Market Saturation Problems

With more than 13,400 locations scattered across the United States, McDonald’s has reached a point where market saturation is a real hurdle for new franchisees. The sheer number of stores means that franchisees aren’t just competing with other fast-food brands - they’re often going head-to-head with nearby McDonald’s locations for the same pool of customers. This internal competition has been so intense that the company refrained from opening new U.S. units for eight years, focusing instead on remodeling existing restaurants until 2022.

For franchisees, this saturation adds another layer of difficulty to an already expensive business. While average unit volumes climbed from $2.6 million to $3.4 million over five years, this growth came primarily from price increases rather than more foot traffic. Meanwhile, visits from lower-income customers - traditionally McDonald’s core audience - dropped by nearly double digits over a 24-month span leading into 2025. As CEO Chris Kempczinski bluntly stated:

"This is an environment where you've just got to grind it out".

Adding to the pressure, McDonald’s maintains tight control over franchise expansion. The company often uses its "right of first refusal" to purchase stores that go up for sale, limiting opportunities for existing franchisees to grow while handpicking new operators. When these transfers occur, the rent can jump from a grandfathered rate of 5% to as high as 13% of sales. Former franchisee Michael Anton described the situation vividly:

"They took my stores and gave them to who they wanted to give them to".

In one recent year alone, a record 1,758 franchise-owned locations - about 13% - changed hands. Since early 2019, 28% of McDonald’s locations have either been sold or shut down. Many veteran operators are selling their stores for up to 10 times EBITDA, highlighting just how hard it has become to secure and maintain profitable territories.

Increasing Operating Costs

On top of the hefty initial investment and a saturated market, McDonald's franchisees are grappling with soaring operating costs that are eating into their profit margins. Expenses like labor, food, and real estate have all surged, creating what's often referred to as a "margin squeeze." This is especially noticeable in labor costs, where franchisees are feeling the pinch as they juggle higher wages while still offering value meals to customers.

The labor issue reached a boiling point in April 2024, when over 500,000 fast-food workers in California saw substantial wage increases due to new state laws. These rising wages, a major challenge across the industry, come on top of escalating food and real estate costs, creating a perfect storm of financial pressure for franchise operators. As Sarah Bregel from Fast Company put it:

"It's unmistakably a tough time for restaurant franchisees, between rising food costs, as well as higher labor costs and slower foot traffic".

The pressure has become so intense that some franchisors are pushing value deals, even if it means temporarily operating at a loss, just to claw back market share. In more severe cases, these rising costs have driven large multi-unit franchisees into Chapter 11 bankruptcy.

McDonald’s real estate model adds yet another financial strain. Unlike many franchisors, McDonald’s owns the land and buildings for its locations, leasing them back to franchisees at marked-up rates. Rent for newer restaurants typically falls between 10% and 15.75% of total gross sales. Additionally, franchisees face extra costs, such as an estimated $12,000 annually for new technology fees and contributions to tuition reimbursement programs. With profit margins hovering around 10% to 15%, these added expenses leave franchisees with little room for missteps.

Training and Time Requirements

The challenges don’t stop at financial hurdles. New franchisees must also invest a significant amount of time before they can even open their doors. McDonald’s requires 500 hours of on-the-job training and 72 hours of classroom instruction. This extensive training process can stretch over months, during which franchisees earn no revenue, adding another layer of difficulty to the already steep entry costs. While this rigorous training ensures that the brand maintains consistent operations across its locations, many prospective franchisees underestimate the time and effort required to meet these demands. It’s a non-financial cost that’s just as critical to consider as the monetary investment.

Changing Consumer Preferences

The fast-food industry is undergoing a shift as customers increasingly prioritize healthier options, challenging franchisees to balance nutritious menu offerings with affordable pricing.

As operational expenses climb, evolving consumer demands are putting additional pressure on franchise profitability. McDonald's now faces fierce competition from fast-casual chains like Chipotle, Five Guys, and Smashburger, which appeal to customers seeking higher-quality meals. At the same time, grocery stores such as Whole Foods and Trader Joe's are luring health-conscious diners with their ready-to-eat, wholesome meal selections. In response, McDonald's has broadened its menu to include items like salads, fruit, oatmeal, and grilled chicken.

Price perception has become a key challenge. CEO Chris Kempczinski highlighted the issue, stating:

"Today too often if you're that consumer, you're driving up to the restaurant and you're seeing combo meals, could be priced over $10, and that absolutely is shaping value perceptions... in a negative way".

In some areas, the price of a Big Mac meal approached $20 before McDonald's reverted to more affordable pricing. This pricing disconnect played a role in a 3.6% drop in U.S. same-store sales during Q1 2025 - the steepest decline since 2020. Additionally, there was a nearly double-digit decrease in visits from lower-income customers during the same period.

To address these shifting preferences, McDonald's has leaned on value-driven promotions like the $5 Meal Deal and brought back popular items such as $2.99 Snack Wraps to attract budget-conscious diners. While the company reported a strong 47% operating margin in Q2 2025, individual franchise owners often face tighter profit margins due to rising costs. As The Economist aptly observed:

"McDonald's risks ending up too pricey for the poor and not posh enough for the less so".

For franchisees, the challenge lies in navigating the delicate balance between corporate pricing strategies and the mounting costs of running their businesses - a balance that is becoming harder to sustain.

McDonald's Franchising: Pros and Cons

Diving into McDonald's franchising reveals a mix of opportunities and challenges. On the plus side, franchisees gain access to a globally recognized brand, a tested business model with median annual sales hitting around $3.84 million per location, exceptional training through Hamburger University, and extensive national advertising support.

But these advantages come with hefty financial requirements. Prospective franchisees must have at least $500,000 in liquid assets, while startup costs range from $1.47 million to $2.64 million. Additionally, McDonald's takes a significant share of revenue - about 82% - through royalties (set at 5% starting January 1, 2024), rent (up to 28% of gross sales), and advertising fees. Despite the impressive sales figures, the average franchisee earns between $70,000 and $131,000 annually.

The operational side also brings its own hurdles. McDonald's enforces strict corporate policies - the "McDonald's Way" - leaving little room for local menu or pricing adjustments. Beginning January 1, 2026, new global standards will further evaluate pricing value, and franchisees must commit to dining room remodels every 10 years, costing between $300,000 and $500,000.

Tensions between franchisees and corporate leadership add another layer of complexity. The National Owners Association has voiced concerns, stating, "we are disposable and easily replaced. If you do not accept our agreement, someone else will." Recent surveys reflect this discontent, with operator satisfaction scoring a low 1.71 out of 5.

Comparison Table: Pros vs. Cons

Factor | Advantages | Drawbacks |

|---|---|---|

Brand & Recognition | Access to one of the world's most recognized brands with strong customer loyalty | Market saturation in many U.S. regions limits growth opportunities |

Financial Performance | Median annual sales of approximately $3.84 million per location | High entry costs ($1.47M–$2.64M) and a $500K liquid asset requirement |

Support System | Comprehensive training, established supply chains, and national marketing | Ongoing fees consume about 82% of revenue; remodels cost $300K–$500K |

Business Model | Proven system with lower risk compared to independent startups | Strict corporate guidelines and new 2026 value standards limit pricing flexibility |

Ownership | Ownership of a high-value business asset with an established customer base | Requires active involvement; not a passive investment |

Navigating these complexities requires careful planning and expertise. Franchise Ki can provide the guidance you need to make informed decisions.

Franchise Ki: Your Free Consulting Partner

Navigating the complexities of owning a McDonald's franchise can be daunting. Between financial hurdles and operational demands, expert guidance can make all the difference. That’s where Franchise Ki steps in, offering free consulting services to help entrepreneurs make well-informed decisions.

Tailored Franchise Guidance

Franchise Ki customizes its recommendations based on your financial resources, professional experience, and lifestyle aspirations. When it comes to McDonald's, consultants assess whether you meet critical qualifications, such as having at least $750,000 in non-borrowed liquid assets, an additional $100,000 in working capital per unit, and the ability to commit to a full-time training program lasting 6–12 months. This training also requires you to step away from any other business ventures.

But it’s not just about meeting the baseline requirements. Franchise Ki dives deeper, helping you understand potential risks. For instance, McDonald's saw a 13% transfer rate in one year, with around 400 franchisees selling their stores. Rising costs are another concern, including royalty fees increasing from 4% to 5% for new or acquired locations and an average cash flow reduction of $100,000 in 2022. By providing this detailed analysis, Franchise Ki ensures you’re equipped with the knowledge you need to explore franchise opportunities with confidence.

Explore Without Commitment

Franchise Ki’s services go beyond analysis by offering a no-strings-attached way to explore your options. You’ll gain access to a wide range of vetted franchise opportunities across various industries, helping you determine if McDonald's aligns with your investment goals. This is particularly useful when considering challenges like reports that up to 30% of McDonald's operators may face insolvency, or that franchisee morale was rated as low as 1.19 out of 5 in 2025.

The service also includes support with funding, due diligence, and relocation planning. For example, consultants can help you rank your top 10 states for operating a franchise and prepare for relocation costs, which may require a budget of $75,000.

With Franchise Ki, you’ll have the tools and insights to evaluate if McDonald's - and its iconic Golden Arches - align with your financial goals and risk tolerance.

Conclusion: Is a McDonald's Franchise Right for You?

The Golden Arches might still shine brightly, but running a McDonald's franchise today comes with its fair share of hurdles. Franchisees are grappling with rising fees, higher rents, and shrinking profit margins - all of which have made the road to success more challenging than ever.

Operational struggles add another layer of complexity. Many franchisees feel the traditional partnership model has shifted, with increased corporate oversight and reduced support from headquarters. In states like California, the mandated $20 per hour minimum wage puts additional strain on profitability, while nationwide value promotions continue to chip away at margins. To top it off, franchisee morale is alarmingly low, with an average score of just 1.19 out of 5 - highlighting widespread dissatisfaction.

Given these challenges, it’s more important than ever to evaluate the risks carefully. Franchise Ki offers free consulting services to help you navigate the franchise landscape. With personalized advice and thorough analysis, they can guide you toward opportunities that align with your financial goals. Instead of relying solely on the allure of a well-known brand, working with experts can help you focus on profitability and a true sense of partnership.

FAQs

What financial challenges should I consider before investing in a McDonald's franchise?

Investing in a McDonald’s franchise comes with some hefty financial considerations that potential franchisees need to weigh carefully.

Starting January 1, 2024, McDonald’s increased its royalty rate for new U.S. locations from 4% to 5% of gross sales. On top of that, franchisees face additional costs, such as a $12,000 one-time technology fee per restaurant and training expenses. To add to the pressure, McDonald’s has eliminated long-standing perks like the Happy Meal subsidy, which further tightens profit margins.

Rising operational costs are another big hurdle. For instance, in states like California, where the minimum wage has reached $20 per hour, payroll expenses can take a significant bite out of profits. Even though average sales have grown over the past decade, franchisees have only seen modest improvements in cash flow, underscoring how much these rising costs impact the bottom line.

And then there’s the expense of mandatory remodels and upgrades, which can run into the hundreds of thousands of dollars. If these updates don’t deliver the expected boost in sales, franchisees may struggle to meet lease-renewal requirements, putting the long-term viability of their business at risk.

With higher fees, increasing operational expenses, and costly remodel obligations, it’s essential to take a hard look at whether a McDonald’s franchise fits your financial goals before diving in.

How does market saturation impact the profitability of owning a McDonald’s franchise?

Market saturation plays a big role in the profitability of a McDonald’s franchise. While average annual store sales have climbed by about $770,000 over the past decade, this increase hasn’t translated into a comparable boost in cash flow, which has only grown by around 9%. With more locations competing for the same pool of customers, individual stores often face shrinking profit margins, making it tougher for franchisees to hit strong profit targets.

This crowded market has also led to a surge in franchise sales, with roughly 1,700 locations recently changing hands. Many franchise owners point to rising operational costs - like higher wages and food prices - and the need for frequent discounts to draw in customers as major hurdles. These challenges tighten profit margins, making it crucial for anyone considering a McDonald’s franchise to carefully weigh whether it aligns with their financial and business goals.

What challenges do McDonald’s franchisees face due to corporate policies?

Franchisees of McDonald’s face a growing list of corporate requirements, which include rising fees and tighter operational standards. For instance, a recent change introduced a $12,000 annual fee per restaurant for technology and training, while discontinuing perks like the Happy Meal discount. These adjustments often leave franchise owners shouldering the burden of increased expenses.

On top of that, franchisees are mandated to roll out frequent menu updates and complete required remodels, both of which add to operational challenges and demand significant capital investment. Stricter inspections and heightened performance standards have intensified the pressure on staff, leading to higher turnover and dips in morale. Corporate decisions, such as removing self-serve soda fountains, have also complicated operations by requiring layout changes and driving up labor costs. Additionally, updated pricing and promotional rules designed to preserve customer value place further strain on profitability.