Franchise Strategies

Jan 6, 2026

Detailed breakdown of McDonald's $1.47M–$2.73M startup costs, 4–5% royalties, steep rents, ~$93K average owner earnings, and long ROI versus rivals.

Initial Investment: $1.47M–$2.73M, with setup costs alone reaching up to $1.79M.

Liquid Assets Required: $500K–$1M (non-borrowed).

Ongoing Fees: 4%-5% royalties, up to 29% of gross sales as rent, and at least 4% for marketing.

Average Earnings: Franchisees typically earn around $93K/year, despite median annual sales of $4M.

Profit Challenges: High fees and declining U.S. sales (-3.6% in Q1 2025) make profitability harder to achieve.

Comparison:Chick-fil-A's $10K franchise fee and $8M+ average sales highlight lower-cost alternatives with higher potential returns.

While McDonald's offers global brand recognition and a proven system, the steep costs, long ROI timeline (15–20 years), and shrinking returns may prompt you to consider other fast-food franchise options like Chick-fil-A, Subway, or Taco Bell.

1. McDonald's Franchise

Initial Investment Costs

Opening a McDonald's franchise requires a hefty financial commitment. The initial investment ranges from $1,471,000 to $2,728,000, which covers essentials like signage, seating, equipment, and decor (costing anywhere between $375,000 and $1,785,000). You'll also need to budget for opening inventory, which can cost $14,000 to $45,000, and working capital for the first three months, estimated at $80,000 to $439,000.

Before you even apply, McDonald's asks for proof of $500,000 in non-borrowed liquid assets. Additionally, you'll need a down payment of 40% for new locations or 25% for existing ones, all sourced from personal funds. The rest can be financed, with repayment terms of up to seven years. While McDonald's retains ownership or leasing rights to the property, you'll be responsible for the interior build-out and equipment costs, leaving the company in control of the real estate. Beyond these initial costs, you’ll also need to factor in ongoing fees that can impact your bottom line.

Ongoing Fees and Operating Costs

Running a McDonald's franchise comes with recurring monthly expenses. Franchisees pay a royalty fee of 4% to 5% on gross sales and must contribute at least 4% of sales toward advertising and marketing. Rent is another significant cost, often calculated as a percentage of sales, ranging from 0% to 29%, though in some cases, effective rates can climb as high as 33.33%.

Other operating costs include product expenses, which take up about 28% of revenue, and additional overhead such as labor, utilities, insurance, and maintenance, which account for another 46% to 47%. For a McDonald's franchise generating $3.4 million in annual sales, this leaves an operating income before occupancy costs of roughly $879,000.

Profitability and Revenue Trends

While median annual sales for a McDonald's franchise sit around $3,838,000, the net income for franchise owners paints a less rosy picture. After accounting for all fees and costs, the average franchise owner earns about $93,000 per year, with most falling in the range of $70,000 to $131,000. McDonald's claims about 82% of revenue through royalties, rent, and service fees.

For comparison, while McDonald's restaurants average around $4 million in annual sales, Chick-fil-A non-mall locations boast averages exceeding $8 million. This highlights a key point: high gross revenue doesn’t always translate to high net profits.

Risk Factors

Even after navigating the upfront and operational costs, franchisees face several risks that can impact profitability. One major concern is the lack of territorial protection. McDonald's grants rights to a specific location but doesn’t prevent another franchise from opening nearby. Additionally, McDonald's owns 57% of the land and 80% of the buildings used for its restaurants, giving the corporation significant control over your operations.

Training for new franchisees lasts 6 to 18 months before they can begin operations. Franchise agreements also impose limits on partnerships, and financing comes with a strict seven-year repayment schedule. Adding to the financial strain are rising technology fees, which now exceed $11,000 annually for software and kiosk maintenance.

2. Other Fast-Food Franchise Options

Initial Investment Costs

When comparing fast-food franchises, it's clear why McDonald's steep initial investment might not always translate into proportional returns.

Franchise startup costs vary widely. For instance, starting a Subway franchise requires an investment between $222,050 and $506,900, with a franchise fee of about $22,300. Five Guys falls in a similar range, costing between $256,000 and $591,000. On the higher end, Burger King requires an investment anywhere from $230,000 to $4,200,000, while Jollibee's costs range from $1,635,000 to $4,888,000.

Chick-fil-A stands out with its comparatively low franchise fee of just $10,000, especially when compared to McDonald's $45,000 fee. Business Insider reporters Hayley Peterson and Nancy Luna explain:

"Launching a McDonald's restaurant requires an investment between $1.4 million and $2.5 million... Owning a McDonald's might seem lucrative for a potential franchisee, but it does require a lot of upfront cash compared to fast-food rivals like Chick-fil-A and Subway".

This stark difference in upfront costs highlights the varying financial commitments required by different franchises.

Ongoing Fees and Operating Costs

McDonald's ongoing fees are another factor to consider. Franchisees typically pay 4%-5% royalties and around 4% in advertising fees, along with high percentage rent due to McDonald's landlord-tenant model. Many competitors, by contrast, offer more flexibility, as they don't follow this model, allowing franchisees to have greater control over real estate expenses.

Profitability and Revenue Trends

Revenue trends further set these franchises apart. For example, Chick-fil-A's non-mall locations average over $8 million annually in sales - nearly twice as much as McDonald's stores, despite operating only six days a week. While detailed profitability figures for franchisees are often unavailable, McDonald's fee structure results in franchisees paying approximately 82% of store revenue back to the corporation each year.

Risk Factors

Franchises with lower initial costs, like Subway and Five Guys, present a reduced financial risk but may also yield lower sales volumes. On the other hand, high-cost franchises such as Burger King (up to $4,200,000) and Jollibee (up to $4,888,000) demand significant upfront investment, requiring potential franchisees to carefully weigh the risks against possible returns.

Is McDonalds Franchise Cost Worth The Profit Potential?

Pros and Cons

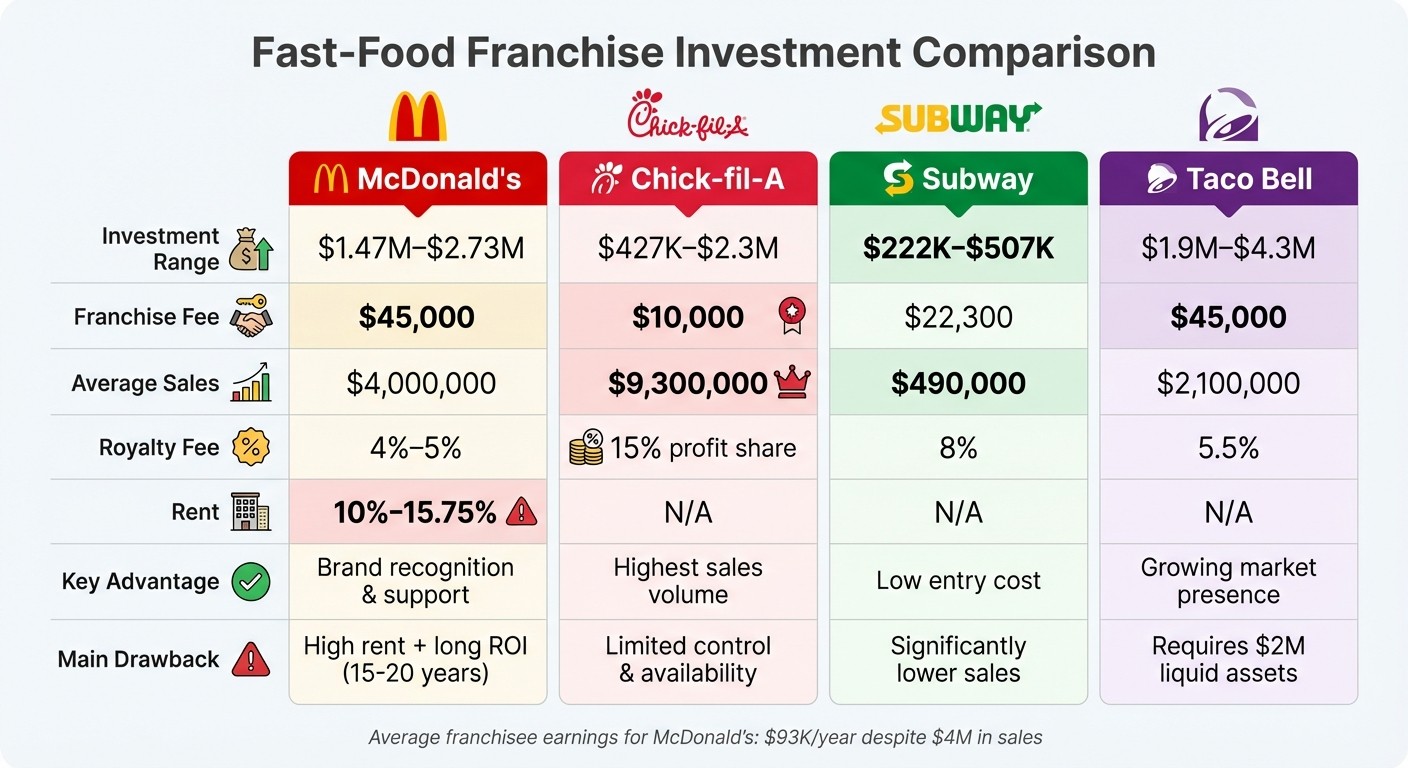

McDonald's vs Top Fast-Food Franchise Costs and Returns Comparison

When comparing McDonald's brand power to its financial demands, it's clear the company offers unmatched global recognition. With over 44,000 locations across more than 100 countries and 79% of its U.S. restaurants generating at least $3 million annually, McDonald's dominance is undeniable. This success is built on a proven business model and strong customer loyalty, which help reduce the typical risks associated with starting a new business. However, these strengths come with a hefty price tag, making a cost-benefit analysis essential.

For example, while McDonald's franchisees take home an average of $93,000 annually, the initial investment of over $2 million means a long return-on-investment (ROI) period. Comparatively, Chick-fil-A's $10,000 franchise fee offers access to average per-unit sales of $9.3 million, while Subway's startup costs range from $222,050 to $506,900.

Here’s a breakdown of key costs and benefits for some popular franchise options:

Franchise | Investment Range | Franchise Fee | Avg. Sales | Royalty Fee | Key Advantage | Main Drawback |

|---|---|---|---|---|---|---|

McDonald's | $1.47M–$2.73M | $45,000 | $4,000,000 | 4%–5% | Brand recognition & support | High rent (10%–15.75%) + long ROI |

Chick-fil-A | $427K–$2.3M | $10,000 | $9,300,000 | 15% profit share | Highest sales volume | Limited control & availability |

Subway | $222K–$507K | $22,300 | $490,000 | 8% | Low entry cost | Significantly lower sales |

Taco Bell | $1.9M–$4.3M | $45,000 | $2,100,000 | 5.5% | Growing market presence | Requires $2M liquid assets |

McDonald's also offers world-class training through Hamburger University and provides assistance with site selection. However, its real estate model lacks exclusive territory protection, meaning the company can open new locations near existing ones. For franchisees who value creative freedom or faster returns, these operational controls may feel restrictive.

Lower-cost franchises like Subway minimize financial risk but also deliver much lower sales volumes. On the other hand, high-investment franchises such as Burger King (up to $4.7 million) and Taco Bell (ranging from $1.9 million to $4.3 million) demand significant liquid capital - Taco Bell, for instance, requires $2 million in liquid assets. The trade-off is clear: McDonald's offers unmatched stability and scale but demands patience and significant financial resources to achieve meaningful returns.

Conclusion

Owning a McDonald's franchise demands a hefty financial commitment, with the average investment topping $2 million. Despite the brand's global appeal, franchisees often face modest annual returns of about $93,000, which translates to a lengthy return on investment (ROI) timeline - typically 15 to 20 years. This extended payback period is largely due to significant fees that funnel a substantial portion of store revenue back to McDonald's corporate. Prospective franchisees must weigh these financial realities against the draw of operating under one of the world's most recognized brands.

Deciding whether to invest in a McDonald's franchise comes down to your personal financial goals and tolerance for risk. If you have the necessary capital and are prepared for a long-term commitment, McDonald's provides unparalleled brand recognition and a well-established system. With plans to expand to 50,000 locations by 2027, the company continues to demonstrate growth potential. However, franchisees must operate within strict corporate guidelines and forgo territorial exclusivity. These factors demand careful consideration of the risks and benefits, as well as a willingness to be actively involved in the business.

If you’re seeking quicker returns or a lower-cost entry point, other franchise options like Subway or Chick-fil-A might better align with your financial goals. Ultimately, the best choice depends on matching the franchise model to your available resources, desired level of involvement, and realistic expectations for ROI.

FAQs

What are the financial risks of owning a McDonald's franchise?

Opening a McDonald's franchise comes with a hefty price tag, and the financial payoff might not always meet expectations. The initial investment hovers around $2.5 million, yet franchise owners often report annual net earnings of just $150,000. When you crunch the numbers, the return on investment (ROI) might feel underwhelming, especially considering the size of the initial outlay.

On top of that, there's the question of opportunity cost. That same $2.5 million could be directed toward safer, lower-risk options, like investments yielding a steady 5% annual return. For many, this could mean similar - or even better - earnings without the stress and demands of running a franchise. It's crucial for anyone considering this path to weigh these factors against their financial goals and appetite for risk before diving in.

What is the initial investment for a McDonald’s franchise, and how does it compare to its potential earnings?

Opening a McDonald’s franchise is a major financial commitment, with initial investments typically surpassing $2 million. This amount covers everything from franchise fees and real estate to equipment and other startup expenses. McDonald’s franchises benefit from a well-established brand and high sales volumes, but profitability isn't guaranteed - it depends heavily on factors like location, operational efficiency, and local market conditions.

Franchise owners generally earn between $150,000 and $300,000 annually. However, rising costs and increasing competition have started to squeeze those returns. For anyone considering this venture, it’s crucial to thoroughly analyze these numbers to determine if the investment aligns with their financial objectives and appetite for risk.

Why does it take so long to see a return on investment for a McDonald’s franchise?

The extended timeline for seeing a return on investment (ROI) with a McDonald’s franchise stems from the hefty upfront costs and ongoing fees. To open a franchise, you’re looking at an initial investment often topping $2 million. This covers everything from the franchise fee and property expenses to construction and equipment. With such a significant financial commitment, it can take years for a franchise to generate enough income to break even.

On top of that, franchisees are required to pay royalty fees (roughly 4% of gross sales) and a national advertising fee (around 4%), both of which are based on revenue, not profit. These fees can cut into the funds available for reinvestment and overall profitability. Add in operational expenses like wages, food costs, and utilities, and the challenge grows even more - especially in areas where market saturation limits revenue potential. Because of these factors, it’s not unusual for franchise owners to wait 7–10 years or longer to fully recover their initial investment.