Franchise Strategies

Jan 5, 2026

Salad and Go is company-owned only; low menu prices, high costs and supply-chain issues hurt profitability — comparable healthy franchises often need $200K–$596K to start.

Salad and Go doesn’t offer franchising. All locations are company-owned, so purchasing a franchise isn’t an option. While the brand gained attention for its affordable salads priced between $6-$8, its operational model has faced challenges. In late 2024, the company closed 41 Texas locations - over 25% of its footprint - highlighting the difficulties of sustaining profitability in the healthy fast-food space.

Key takeaways:

No franchise opportunities: Salad and Go operates solely as a company-owned chain.

Cost struggles: Low menu prices, high ingredient costs, and supply chain issues make profitability challenging.

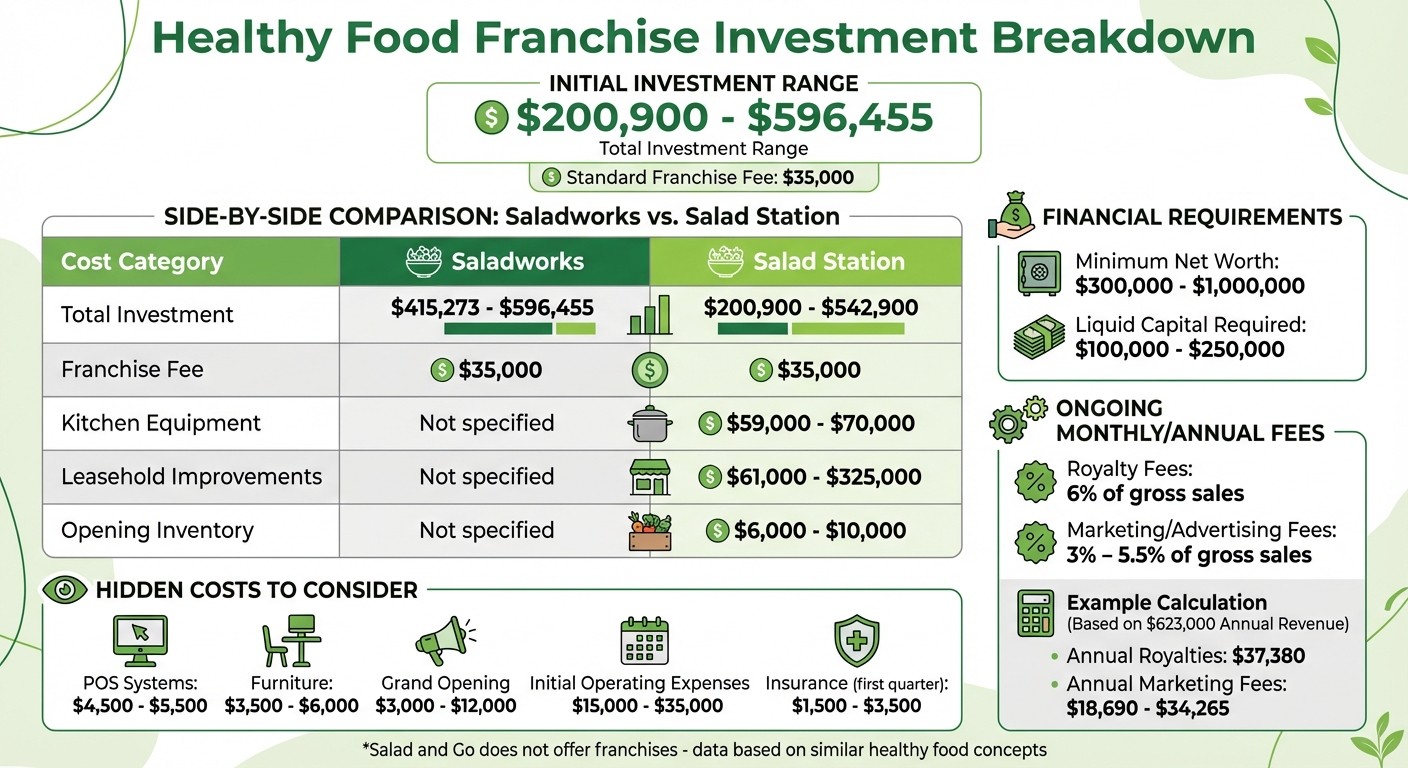

Industry comparison: Similar healthy food franchises require $200,900–$596,455 in startup costs, with ongoing royalty and marketing fees averaging 9-11.5% of gross sales.

For potential investors, this serves as a reminder to carefully evaluate the financial demands and risks associated with healthy food franchises. Always review financial documents like Franchise Disclosure Documents (FDDs) and consult experts before committing.

Clean Eatz: The Most Profitable Healthy Food Franchise? 👀

What Does a Salad and Go Franchise Cost?

Healthy Food Franchise Startup Costs and Fee Comparison

Since Salad and Go doesn’t offer franchises and operates all 100+ locations as company-owned stores, there’s no official Franchise Disclosure Document or published startup costs for the brand. To get a sense of the financial commitment, you’d need to look at similar healthy fast-casual concepts like Saladworks, Salad Station, or Vitality Bowls. These comparisons help paint a clearer picture of the typical investments required in this industry.

Startup Investment Breakdown

For comparable franchises, the initial investment ranges from $200,900 to $596,455. The franchise fee alone is typically $35,000 across similar concepts. Here are some of the key costs you might encounter:

Kitchen equipment: $59,000–$70,000

Leasehold improvements: $61,000–$325,000

Opening inventory: $6,000–$10,000

Most franchisors in this category also require a minimum net worth of $300,000 to $1,000,000 and liquid capital of $100,000 to $250,000.

Expense Category | Saladworks | Salad Station |

|---|---|---|

Total Investment | $415,273 - $596,455 | $200,900 - $542,900 |

Franchise Fee | $35,000 | $35,000 |

Kitchen Equipment | Not specified | $59,000 - $70,000 |

Leasehold Improvements | Not specified | $61,000 - $325,000 |

Monthly and Annual Fees

Once operational, ongoing fees can significantly impact your cash flow. Royalty fees average 6% of gross sales across similar healthy food franchises. On top of that, marketing and advertising fees typically range between 3% and 5.5%. For a franchise generating average annual revenue of $623,000, you’d spend approximately $37,380 on royalties and $18,690 to $34,265 on marketing fees. These fees are non-negotiable and deducted before calculating profits.

Costs That Aren't Always Obvious

Beyond the upfront and recurring fees, there are additional costs to consider. For example:

Point-of-sale systems: $4,500 to $5,500

Furniture: $3,500 to $6,000

Grand opening marketing: $3,000 to $12,000

You’ll also need funds to cover initial operating expenses. This includes $15,000 to $35,000 for wages, rent, and utilities during the first three months. Insurance costs for the first quarter alone can range from $1,500 to $3,500. Additionally, monthly technology fees cover essentials like online ordering, loyalty programs, and PCI compliance.

Why Healthy Food Franchises Can Struggle to Make Money

Low Menu Prices vs. High Operating Costs

Healthy food franchises often face a tough balancing act between affordable menu pricing and hefty operating expenses. With menu items priced around $6–$8, these businesses need to sell a high volume just to break even. On average, similar franchises generate $623,000 in annual revenue, with a profit margin of about 15% before accounting for the owner’s salary. However, labor costs can eat into those already thin margins. For example, paying employees $15 per hour, on top of 6% royalty fees and 5.5% advertising fees, leaves little financial wiggle room. With such tight margins, even minor operational hiccups can have a big impact on profitability.

Supply Chain Issues and Market Competition

Some healthy food franchises, like Salad and Go, rely on centralized kitchens for food prep. These facilities, located in places like Phoenix and Dallas, handle all the preparation before delivering ingredients to individual locations. While this model helps keep menu prices competitive, it also introduces risks. If the franchise expands too quickly, the supply chain may struggle to keep up, driving up costs and increasing operational challenges.

Competition in the healthy food space is another significant hurdle. Jonathan Maze, Editor-in-Chief of Restaurant Business, summed it up:

"Salad on its own is difficult as the centerpiece for a restaurant chain. There are only so many occasions, which is why salad concepts frequently struggle".

High Upfront Investment and Return on Investment

The drive-thru model, while promising convenience, comes with steep upfront costs. For healthy food franchises, this investment can be particularly risky. Unlike coffee or burgers, salads don’t lend themselves well to on-the-go consumption. Jonathan Maze put it plainly:

"Drive-thru-only can work with coffee, because it's easy to sip a latte while on the interstate. It's a lot harder to shove a forkful of greenery into your mouth from a salad bowl secured between your legs".

This challenge limits the customer base to those who plan to eat their meals at home or at work, reducing the frequency of purchases. Without consistent, high-volume sales, it becomes difficult to justify the large capital investment required for a drive-thru setup. The experience in Texas highlights how rapid expansion without strong brand recognition can turn what seems like a promising venture into a financial strain.

How to Decide If This Franchise Is Right for You

Thinking about investing in a healthy food franchise? Before jumping in, it's crucial to evaluate whether your financial situation aligns with the demands of this type of business.

Quick note: While Salad and Go is a popular name in the healthy food space, it remains a privately held, company-owned business and does not currently offer franchise opportunities. That said, the steps below can help you assess any healthy food franchise opportunity.

Step 1: Dive Into Financial Documents and Performance Data

Start by requesting the Franchise Disclosure Document (FDD) at least 14 days before signing any agreements or transferring funds. This document is your key to understanding startup costs, financial performance, and overall stability.

Pay particular attention to these sections:

Item 7: Details startup costs.

Item 19: Offers performance data.

Item 21: Includes audited financial statements.

And here’s an important reminder from the Federal Trade Commission (FTC):

"Purchasing a franchise is like any other investment: there's no guarantee of success."

To get a clearer picture, reach out to franchisees listed in Item 20 of the FDD. They can provide insights into break-even timelines and share whether the franchisor delivered on its promises. If you're unsure about how to interpret the FDD, consulting with an expert can help you avoid costly mistakes.

Step 2: Take Advantage of Free Expert Guidance

Navigating franchise paperwork and financial projections can feel overwhelming, but you don’t have to do it alone. Franchise Ki offers free consulting services to help you review franchise documents and financials. Their team provides personalized franchise matching, funding strategy advice, and support with due diligence - all at no cost to you. Having an expert review your FDD and financials can help you identify potential red flags and make informed decisions.

Step 3: Align the Franchise with Your Financial Situation and Goals

Healthy food franchises often come with steep financial requirements. Typically, you’ll need $125,000–$250,000 in liquid cash and a net worth of $350,000–$750,000. Beyond that, make sure you have enough savings to cover personal living expenses for up to two years while your business gains traction.

Your credit score also plays a role. Since most franchisors don’t offer direct financing, you may need to secure loans from external sources. Additionally, consider whether you’ll be running the business yourself or hiring operators for multiple locations. For instance, franchises like Salata require multi-unit development agreements, which can significantly increase your overall investment.

Finally, think about your income needs and the time you’re willing to commit. The FTC offers this sobering reminder:

"Typically, you must pay royalties for the right to use the franchisor's name, even if you are losing money."

If the idea of adhering to strict operational systems or putting in long hours during the startup phase doesn’t appeal to you, franchise ownership might not be the right fit for your personal or financial goals.

Conclusion

Investing in a healthy food franchise requires a thorough financial and operational evaluation. Salad and Go, with its network of over 130 company-owned locations, has made waves in the industry. However, for those exploring the healthy fast-casual market, it’s worth considering other franchise opportunities, which typically come with an initial investment of around $420,000.

One of the key challenges for healthy food franchises lies in balancing affordable menu prices with the costs of high-quality ingredients and operations. As Salad and Go CEO Charlie Morrison pointed out:

"For those of you who eat salads regularly, you probably know that the price point is somewhere between $14 and $20. It's ridiculous. And it doesn't have to be that way."

Keeping prices low while maintaining quality often hinges on an ultra-efficient supply chain. But this efficiency comes with its own hurdles, such as slim profit margins and ongoing royalty fees, which average around 6%. These factors make a detailed financial review essential.

When evaluating a franchise, carefully examine the Franchise Disclosure Document (FDD), especially Items 7 and 19, to assess your financial preparedness. The industry generally expects liquid capital between $100,000 and $250,000 and a net worth ranging from $300,000 to $1 million. Keep in mind that royalty fees will remain a consistent expense, regardless of the franchise’s short-term profitability.

If the process feels overwhelming, organizations like Franchise Ki provide free consulting services. They can assist with interpreting financial documents, connecting you to pre-vetted franchise options, and even helping you secure funding. Expert advice can be invaluable in avoiding costly mistakes and identifying opportunities that align with your financial and personal goals.

FAQs

Why doesn’t Salad and Go allow franchising?

Salad and Go isn’t available for franchising because it’s a privately-held company. This means every location is company-owned, giving the business complete control over its operations, quality, and overall growth strategy.

If you’re looking to invest in a health-focused food concept, consider exploring other franchise options that fit your financial goals and vision.

What makes it challenging for healthy food franchises like Salad and Go to stay profitable?

Healthy food franchises are undeniably popular, but staying profitable in this competitive market comes with its fair share of challenges. One of the biggest obstacles? High startup costs. Initial investments typically fall between $415,000 and $596,000, and that’s before factoring in franchise fees, which hover around $35,000. Once operational, franchisees also face ongoing expenses like royalties - usually about 6% of gross sales - and marketing fees, often around 3%. These costs quickly eat into profit margins.

Labor expenses pose another significant challenge. Employees at these franchises often earn higher wages, with store staff making $15 per hour or more. Meanwhile, menu prices need to stay competitive, usually under $7 per meal, which leaves little room for profit. To make matters trickier, the business model relies heavily on a tightly controlled supply chain to keep ingredient costs low. Any disruption in that chain - whether due to supplier issues or unexpected price spikes - can quickly chip away at earnings.

Then there’s the issue of rapid expansion. While growth is tempting, opening too many locations too fast can stretch resources thin. Some healthy food chains have learned this the hard way, with overexpansion leading to market oversaturation, workforce reductions, and, in some cases, store closures. To succeed in the long run, these businesses must strike a careful balance between growth and sustainability.

How do startup costs for other healthy food franchises compare to Salad and Go?

Startup costs for healthy food franchises often land in the six-figure range. However, Salad & Go stands apart by not offering a franchise model. Instead, all of its locations are company-owned, so there aren’t any disclosed costs for franchise opportunities.

For comparison, other healthy food franchises provide some insight into typical investment requirements. Salad Station estimates an initial investment between $200,900 and $542,900, covering fees, equipment, and other startup essentials. Meanwhile, Saladworks lists a broader range of $576,557 to $728,457, which includes a franchise fee of $35,000–$36,000. These numbers reflect the substantial upfront costs often needed to launch a healthy food franchise.

Since Salad & Go sticks to corporate ownership, those interested in investing will need to look at other opportunities outside of traditional franchising with this brand.