Franchise Strategies

Jan 3, 2026

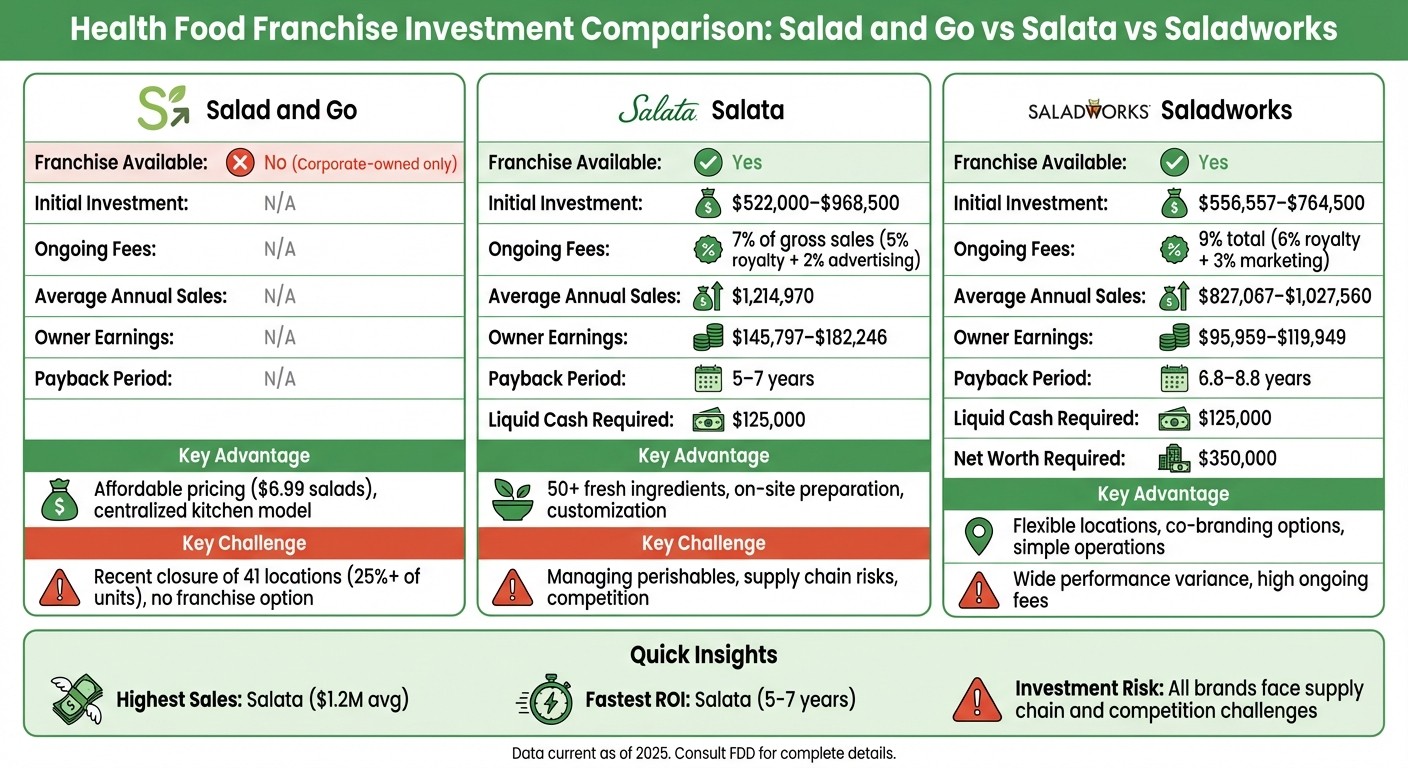

Explains why Salad and Go isn't franchisable and compares Salata and Saladworks—costs, fees, sales, and operational risks for franchise investors.

If you're considering investing in the health food sector, here's what you need to know about Salad and Go and its competitors, Salata and Saladworks:

Salad and Go is a corporate-owned chain, not a franchise. You can't buy into it as an independent operator. Its affordable pricing ($6.99 salads) is possible due to a centralized kitchen model, but recent closures of 41 locations in Texas highlight challenges with rapid expansion and sustainability.

Salata operates as a franchise, with an initial investment of $522,000–$968,500 and ongoing fees (7% of gross sales). Franchisees can expect annual earnings of $145,797–$182,246, but managing perishable ingredients and stiff competition are key challenges.

Saladworks also offers franchising, requiring $556,557–$764,500 upfront. It charges 9% in ongoing fees and has average annual sales of $827,067–$1,027,560, depending on location. Its simpler operations are appealing, but performance varies widely by unit.

Quick Comparison

Brand | Franchise Option | Initial Investment | Ongoing Fees | Average Annual Sales | Key Challenges |

|---|---|---|---|---|---|

Salad and Go | No | N/A | N/A | N/A | Recent closures, no franchise model |

Salata | Yes | $522,000–$968,500 | 7% of gross sales | $1,214,970 | Managing perishables, competition |

Saladworks | Yes | $556,557–$764,500 | 9% of net sales | $827,067–$1,027,560 | Unit performance varies, competition |

Investing in the health food space requires careful consideration of market positioning, financial commitment, and operational hurdles. While Salad and Go's model is intriguing, it's not open to franchising, leaving Salata and Saladworks as more traditional options for franchise-seekers.

Salad and Go vs Salata vs Saladworks Franchise Comparison

1. Salad and Go

Financial Requirements

Salad and Go operates exclusively as a company-owned chain. CEO Charlie Morrison has been clear about this approach, explaining:

All of it will be corporately owned, partly because of the supply chain setup.

This means there’s no option to franchise - no franchise fees, no royalties, and no way to buy into the brand as an independent operator.

Still, understanding the financial side of their business sheds light on the economics of the health food sector. Each Salad and Go location costs about $1 million to build. The brand uses a compact 750-square-foot double drive-thru format, which fits on plots as small as 15,000 square feet, keeping real estate and construction costs in check. Morrison highlighted the advantage of this model:

This approach affords us the opportunity to find unique pockets of real estate that others can't get into.

This efficient setup plays a big role in shaping their operations.

Operational Demands

Salad and Go runs on a centralized commissary kitchen model, which supports all its locations. A single commissary can handle up to 400 individual restaurants. This eliminates the need for extensive food prep at each store, significantly reducing labor hours. Employees at the stores earn a minimum of $15 per hour, while workers at the central kitchen can earn up to $20 per hour.

The drive-thru-only format also helps streamline operations. Salads are assembled in under 15 seconds, and customers can typically get through the drive-thru in under four minutes. About 20% of sales come from mobile orders and order-ahead lanes. While this setup is efficient, it also comes with unique service challenges tied to the fast-paced drive-thru environment.

This operational efficiency supports the brand’s overall strategy.

Market Positioning

Rather than competing with premium salad chains, Salad and Go focuses on the fast-food market. Morrison explained the company’s strategy:

Our concept is not tailored to compete against [other salad chains]. It's tailored to compete against eating occasions that are unhealthy for you, but otherwise you couldn't afford to eat well.

A 48-ounce salad bowl with protein costs $6.99, and customers can get a breakfast burrito, coffee, and a salad for lunch for around $10. For comparison, Sweetgreen charges about $12 for similar salads, while other brands range between $14 and $20.

Morrison attributes this affordability to the brand’s supply chain efficiencies. By keeping prices low, Salad and Go aims to appeal to a broad audience, prioritizing accessibility over premium pricing.

Growth Challenges

Despite its cost-effective model, Salad and Go has faced hurdles in its expansion. In September 2025, new CEO Mike Tattersfield made the tough decision to close 41 locations in Houston, San Antonio, and Austin - over a quarter of the chain’s total footprint. These closures allowed the company to focus on its core market in the Dallas Metro Area, where its Garland central kitchen is located. Tattersfield explained:

The closures will allow Salad and Go to concentrate its efforts on remaining units and 'strengthen the brand and invest more in improving quality'.

Some industry experts point to rapid expansion as a key factor in these struggles. Between 2020 and 2022, the chain grew by an astounding 528%, jumping from 14 to 88 locations. However, this rapid growth outpaced the brand’s ability to build awareness and sustain operations, leading to a strategic shift toward more measured expansion.

These challenges highlight the risks of scaling too quickly, especially in the competitive health food space.

2. Salata

Financial Requirements

Salata operates as a franchise model, setting it apart from Salad and Go. To get started, franchisees need to invest between $522,000 and $968,500, which includes a $40,000 franchise fee. Additionally, prospective owners must have $125,000 in liquid cash. Beyond the initial investment, franchisees are responsible for ongoing fees: a 5.0% royalty on gross sales and an additional 2.0% for advertising. The franchise agreement spans 10 years, with an option to renew for another decade.

On average, Salata locations generate $1,214,970 in yearly gross sales, and owner-operators typically earn between $145,797 and $182,246 annually. The estimated payback period for franchisees ranges from 5 to 7 years. Next, let’s explore the operational demands franchisees face daily.

Operational Demands

Running a Salata franchise comes with its own set of challenges. The restaurant’s build-your-own model features an extensive menu of over 50 fresh ingredients, 10 lean proteins, and 12 house-made dressings. Managing this variety requires strict inventory control and waste reduction strategies to maintain profitability.

Franchisees undergo three to four weeks of training at the Salata Support Center in Houston, Texas, to prepare for these operational demands. However, reliance on high-quality produce suppliers introduces a layer of unpredictability - any disruption in the supply chain can directly affect the business. As President Michelle Bythewood explains:

This brand is based on health, not a trend.

These operational practices underscore Salata’s commitment to standing out in a competitive market.

Market Positioning

Salata takes a different approach compared to competitors like Salad and Go, which rely on centralized kitchens. Instead, Salata focuses on on-site preparation and customized meal options, appealing to consumers prioritizing wellness. Julie Davis, VP of Franchise Development, highlighted this strategy:

If my job is to deliver the best unit economics for our franchisees, I can't do that if someone else is controlling the process.

To adapt to changing customer behavior, Salata has reduced its restaurant footprint by 25%, cutting buildout costs to $500,000–$600,000. This shift reflects that 70% of orders are off-premises. The company aims for an Average Unit Volume (AUV) of $1.5 million, with current locations averaging around $1.3 million.

Growth Challenges

As of 2021, Salata operated 73 franchised locations, with 68 concentrated in the Southern United States. The brand faces stiff competition from local eateries and other fast-casual chains. Additionally, handling perishable ingredients presents ongoing risks, particularly during supply chain disruptions.

To address these challenges, Salata has brought its development services in-house and now directly manages its vendors. The company is also focusing on attracting multi-unit operators to drive national expansion. President Michelle Bythewood emphasized what makes Salata stand out:

We're very different in that we have over 50 fresh ingredients cut fresh every day... The amount of people who come in is shocking. It separates us from the pack.

SALAD AND GO FRANCHISE? - 3 Alternatives That Are Way Cooler 🥗

3. Saladworks

Saladworks, like Salata, brings its own unique franchise model to the bustling health food industry.

Financial Requirements

Known as America's original fast-casual salad concept, Saladworks has been serving up fresh options since 1986. Opening a franchise requires a total investment ranging from $556,557 to $764,500, depending on factors like construction and location. The initial franchise fee is $35,000.

Prospective franchisees need to meet specific financial criteria, including $125,000 in liquid assets and a net worth of at least $350,000. Ongoing costs include a 6% royalty fee on net sales, a 3% Brand Development/Marketing Fund fee, and a 2% Local Advertising and Promotion fee. In 2022, average net sales were $827,067 for strip mall locations and $1,027,560 for pad sites. Franchise owners typically earn between $95,959 and $119,949 annually, with a payback period estimated at 6.8 to 8.8 years.

These financial details set the stage, but the day-to-day operations of a Saladworks franchise are equally important in understanding its appeal.

Operational Demands

Saladworks centers its operations around a straightforward "chop, slice, and dice" preparation method. This simplicity reduces overhead costs - there’s no need for fryers or exhaust hoods - making it easier to manage. Multi-unit operator Vince Rosetti highlights the brand's customer loyalty:

We don't have a customer base like most restaurants. We have a fan base. I see customers 3 or 4 times a week!

Franchisees undergo a two-week training program at the corporate headquarters to learn the ins and outs of the business. Managing fresh produce and proteins is critical, as supply chain disruptions can directly affect daily operations. The menu focuses on signature salads, many of which are under 300 calories, and offers soups and sandwiches to broaden its appeal.

Market Positioning

Saladworks targets Millennials and Gen Z consumers, with nearly half of them purchasing three or more entrée salads off-premises. The brand operates over 100 locations across 13 states and two countries, with more than 50 additional stores in development. Top-performing locations in the highest quartile achieve median net sales of $1,117,884.

Multi-unit operator Curtis High shares his optimism about the brand’s growth:

With people's increased awareness of the food they're consuming and our commitment to serving only the best and freshest ingredients, we're in a perfect position for expansion.

While Saladworks has carved out a strong niche, it still faces challenges that come with operating in a competitive market.

Growth Challenges

The fast-casual sector is crowded with burger, pizza, and Mexican food brands all vying for consumer attention. Saladworks must navigate these competitive pressures while maintaining consistent quality across its locations. The reliance on fresh ingredients adds another layer of complexity, as supply chain disruptions can quickly impact profitability. Owner-operators Lee and Tara Smith appreciate the support system in place:

The Home Office team really gives us the opportunity to be heard. They value our insights as owner-operators who are in stores every day.

Despite these hurdles, Saladworks continues to build on its reputation for fresh, healthy options and strong customer loyalty. Its ability to adapt to market demands and maintain quality will be key to its future success.

Advantages and Disadvantages

Before considering an investment, it’s crucial to weigh the strengths and potential challenges.

Salad and Go operates entirely under corporate ownership, meaning franchising is not an option. While this limits opportunities for franchise investors, the brand’s operational approach offers valuable lessons. By using a centralized kitchen system, Salad and Go cuts down on in-store labor, allowing it to sell 48-ounce salad bowls for just $6.99 - far below the $14–$20 industry standard. However, recent store closures have raised questions about the company’s stability. Jonathan Maze, Editor-in-Chief of Restaurant Business, commented:

Shuttering stores so soon into a lease is brutal, suggesting the company would be better off paying rent on a bunch of empty locations, rather than operating them as restaurants.

Another drawback is its drive-thru-only model, which can limit its appeal to a broader consumer base.

For those interested in franchising, Salata and Saladworks are alternative options. Saladworks, for instance, requires a significant upfront investment and has strict financial qualifications. On the plus side, it offers flexibility in trade channels, such as malls, strip malls, and pad sites, and even allows co-branding opportunities. But performance can vary widely - top-quartile units earn over $1.23 million annually, while bottom-quartile units bring in just $401,690. This disparity highlights how critical location and execution are to success. These findings echo broader concerns about operational challenges and market unpredictability.

To better understand the pros and cons, here’s a side-by-side comparison:

Brand | Key Advantages | Key Drawbacks |

|---|---|---|

Salad and Go | Affordable pricing and reduced labor via central kitchen | No franchise option, recent closures, and drive-thru-only model limits |

Saladworks | Flexible trade channels and co-branding opportunities | High upfront costs and inconsistent unit performance |

Saladworks also charges 9% in ongoing fees, which can significantly impact profit margins for underperforming units. The payback period for an investment typically falls between 6.8 and 8.8 years. Additionally, managing fresh ingredients adds another layer of complexity, as supply chain disruptions can directly affect daily operations.

Conclusion

Stepping into the health food franchise market requires a careful look at both opportunities and challenges. Salad and Go has shown that affordable, healthy food is achievable with its central kitchen model and $6.99 price point. However, the brand isn’t open to franchising, and its recent closure of 41 locations in Texas - over a quarter of its total units - illustrates that even well-thought-out concepts can face significant hurdles. These factors set the stage for evaluating other franchising options in this space.

For those considering a franchise investment, Saladworks offers an alternative. However, it requires a substantial financial commitment, including ongoing fees of approximately 9% (6% royalty and 3% marketing). It’s crucial to ensure this aligns with your financial goals and strategy.

The operational challenges of health food franchises highlight the importance of thorough research. Managing fresh ingredient supply chains, catering to evolving consumer preferences, and addressing the complexities of drive-thru-only models for salads are just a few of the hurdles. Success in this sector hinges on selecting the right location, executing effectively, and confirming that your target market has a steady demand for healthy fast-casual dining.

To make an informed decision, it’s important to review franchise documentation and connect with experienced franchisees. Confirm that the brand is franchisable, and focus on key sections of the Franchise Disclosure Document, such as Item 19 and Item 20. Speaking with franchisees who have been in business for at least five years can provide valuable insights. Understanding the financial commitment - including how much risk you can tolerate and whether you have enough savings to sustain yourself during the initial ramp-up - is essential.

Franchise Ki offers free consulting services to help match you with opportunities tailored to your financial and operational needs. Their team, led by Bennett Maxwell (founder of Dirty Dough Cookies, who sold over 300 units in two years) and Liam Chase (who helped a client grow from 13 to nearly 70 units in a quarter), provides personalized support, due diligence guidance, and expert advice throughout your franchising journey.

FAQs

Why doesn’t Salad and Go offer franchise opportunities?

Salad and Go runs on a company-owned, centrally-managed model, meaning they don’t offer franchise opportunities. By keeping everything in-house, the company retains full control over its operations, including a centralized supply chain and its signature double-drive-thru design.

This setup allows Salad and Go to directly oversee every part of the business from its headquarters, ensuring everything runs smoothly and consistently. Because of this, they don’t provide Franchise Disclosure Documents (FDDs) or collect franchise fees, making franchise investment off the table for now.

What are the financial requirements to open a Salata franchise?

Opening a Salata franchise comes with a notable financial commitment. The franchise fee alone can go up to $40,000, while the total investment needed to get a location up and running typically falls between $646,000 and $889,000. These figures account for construction, equipment, and all the essentials for opening day.

On top of that, you'll need to set aside $20,000 to $30,000 in working capital to handle initial operating expenses. Franchisees are also obligated to pay a 5% royalty fee on gross sales to the franchisor. Taking the time to thoroughly assess these costs is crucial to ensure they fit within your financial plans and objectives.

How does Saladworks address supply chain challenges?

Unfortunately, there isn't specific information available about how Saladworks addresses supply chain challenges in the provided resources. For the most accurate and current details, it's best to reach out to Saladworks directly or review their official franchise documentation.