Franchise Strategies

Jan 2, 2026

Company-owned chain uses centralized commissaries to sell low-cost drive‑thru salads, but recent closures highlight scaling risks.

Salad and Go isn’t a franchise, but its company-owned model highlights the challenges and opportunities of the healthy fast-food sector. With over 130 locations and a cost-efficient commissary system, the brand offers $6.99 salads and $3.24 breakfast burritos, making it a low-cost leader in a competitive market. However, the closure of 41 Texas locations in 2025 underscores the risks of rapid expansion and the difficulty of scaling a drive-thru-only salad concept.

Key Takeaways:

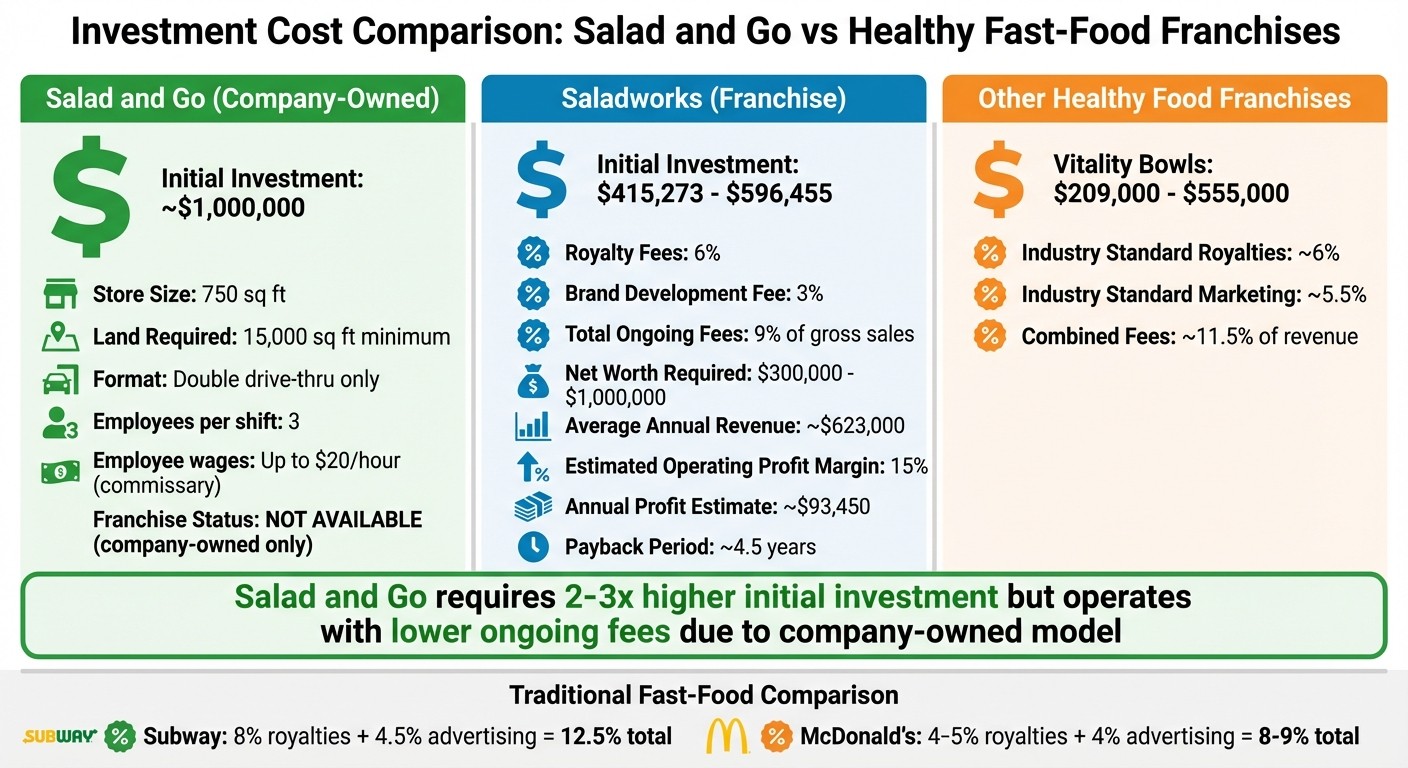

Investment Costs: Building a Salad and Go location costs about $1 million, while similar franchises like Saladworks require $415K–$596K.

Operational Model: Centralized commissaries reduce labor and ingredient costs, supporting competitive pricing.

Challenges: Drive-thru salads are less convenient than typical fast food, and brand recognition remains an obstacle in new markets.

Profitability: Average annual sales per location were $1.1M in 2022, but expansion missteps have impacted growth.

While Salad and Go’s pricing and efficiency are strengths, its recent closures highlight the need for careful market entry strategies and balancing growth with brand awareness.

How Salad and Go's Business Model Works

Centralized Commissary System

At the heart of Salad and Go's operations is its centralized commissary model. Instead of prepping ingredients at individual stores, the company relies on large central kitchens located in Phoenix and Dallas. These facilities handle all the washing, cutting, and preparation of ingredients. By sourcing produce directly from farms and skipping traditional distributors, Salad and Go streamlines its supply chain.

"The way we've built this model at Salad and Go is to have a central kitchen, a large commissary where we actually bring all the produce in direct from the growers... It simplifies the model and allows us to charge that lower price." - Charlie Morrison, CEO, Salad and Go

Each commissary supports more than 400 locations, creating cost efficiencies through scale. Meanwhile, individual stores - compact at just 750 square feet - focus solely on assembling orders and serving customers. With only three employees needed per shift, this setup allows the company to offer central kitchen workers wages of up to $20 per hour while keeping overall labor expenses manageable. This operational efficiency is key to their ability to keep prices competitive.

Low Pricing Strategy and Market Position

Thanks to its commissary model, Salad and Go can offer menu items at prices that are hard to beat. For example, a 48-ounce salad bowl with protein costs $6.99 - significantly less than the $14–$20 price range common elsewhere. Breakfast burritos are priced at $3.24, and drinks like cold brew coffee are just $1.49. A combo meal, such as a breakfast burrito, coffee, and a salad for lunch, totals around $10.

The brand also keeps real estate costs low by operating small, 750-square-foot locations. These stores are often placed on compact parcels of land, sometimes as small as 15,000 square feet, frequently located in the parking lots of major retailers like Home Depot or Lowe's. By focusing exclusively on drive-thru service, Salad and Go avoids the expense of maintaining dine-in spaces.

Streamlined Operations for Expansion

Salad and Go's streamlined menu and efficient operations allow for rapid growth. The menu is intentionally kept simple, featuring around eight core salads (which can also be served as wraps) and a limited selection of breakfast items. This approach helps maintain fast service times, with orders typically completed in under four minutes.

"I'm a big believer in keeping things focused on what you do well... The menu remains focused to preserve operational simplicity." - Charlie Morrison, CEO, Salad and Go

Grown founder Shannon Allen on the franchise model that could scale healthy food

Financial Requirements for Franchisees

Salad and Go Investment Costs vs Competitor Franchises Comparison

Startup Cost Breakdown

Salad and Go operates as a company-owned business and does not offer franchising opportunities. While their efficient model supports their competitive pricing, examining similar ventures provides insight into the financial landscape of healthy fast-food investments.

The company constructs its compact 750-square-foot double drive-thru locations for about $1 million each. This figure includes construction, equipment, and setup costs. These stores are typically built on small parcels, sometimes as little as 15,000 square feet, often located in parking lots of major retailers.

"Stores can be built for about $1 million. They come with one traditional drive-thru lane and one order-ahead lane." - Charlie Morrison, CEO, Salad and Go

For comparison, other healthy food franchises require investments ranging from $209,000 to $596,455, with a typical net worth requirement falling between $300,000 and $1 million.

Recurring Expenses and Profit Margins

Once the initial setup is complete, ongoing costs play a major role in determining profitability. In a franchising scenario, standard industry expenses like royalty fees and marketing contributions would apply. Typically, royalty fees are around 6% of gross sales, while marketing and advertising contributions average 5.5%, collectively accounting for about 11.5% of revenue before operational costs.

For example, Saladworks charges 6% in royalties and 3% for brand development, totaling 9% of gross sales. Traditional fast-food brands vary: Subway requires 8% in royalties and 4.5% for advertising, while McDonald’s charges 4% to 5% in royalties and at least 4% for advertising.

In addition to these fees, franchisees would need to budget for utilities, inventory, maintenance, and labor. Salad and Go’s centralized commissary model significantly reduces labor needs, requiring only three employees per shift. This efficiency allows them to pay employees $15 per hour while keeping menu prices affordable.

Return on Investment and Payback Timeline

Evaluating financial performance is crucial when considering the viability of such investments. Industry benchmarks for similar healthy food franchises suggest average annual revenue of about $623,000 per location. With an estimated operating profit margin of 15%, franchise owners could see annual profits of approximately $93,450. For a $420,000 investment, this translates to a payback period of roughly 4.5 years, excluding financing and owner compensation.

However, profitability varies based on factors like location, local competition, and operational efficiency. Salad and Go's recent moves highlight these challenges. In September 2025, the company closed 41 underperforming locations in Texas and Oklahoma to focus on stronger markets in the Dallas Metro Area. Between 2020 and 2022, the brand expanded rapidly, growing its footprint by 528% - a pace that proved difficult to sustain.

"By owning our own supply chain, we maintain a lot of control, but we also take a lot of costs out of the equation, and we return that back to our customers in the form of a great value." - Charlie Morrison, Former CEO, Salad and Go

Their vertical integration strategy, which includes sourcing directly from growers and processing ingredients in central kitchens, gives Salad and Go a competitive edge that independent operators might struggle to match. Each central kitchen has the capacity to support up to 500 restaurant locations, though this efficiency requires a significant upfront investment.

Competing in a Crowded Market

Market Saturation and Consumer Behavior

The healthy fast-food industry is packed with big names like Sweetgreen, Chopt, and fresh&co, all vying for the same health-conscious customer base. Salad and Go’s recent challenges illustrate just how tough it can be to break into such a crowded space. In late 2025, the company shut down 41 locations across Houston, San Antonio, and Austin - amounting to two-thirds of its Texas operations and over a quarter of its total footprint.

One issue is the drive-thru-only format. While it works well for coffee, it’s a tougher sell for salads. As Jonathan Maze, Editor-in-Chief of Restaurant Business, pointed out:

"Drive-thru-only can work with coffee, because it's easy to sip a latte while on the interstate. It's a lot harder to shove a forkful of greenery into your mouth from a salad bowl secured between your legs".

Brand visibility is another hurdle. Despite having a leadership team with impressive credentials, Salad and Go has kept a relatively low profile, which makes it harder to win over customers who are already loyal to other brands. These challenges set the stage for the company’s bold strategies to stand out in this competitive market.

How to Stand Out from Competitors

Salad and Go’s edge lies in its pricing. The company offers hefty 48-ounce salad bowls for just $6.99, a stark contrast to competitors who charge anywhere from $14 to $20. CEO Charlie Morrison sums it up:

"For those of you who eat salads regularly, you probably know that the price point is somewhere between $14 and $20. It's ridiculous. And it doesn't have to be that way".

Another smart move is the introduction of a breakfast menu. By selling $3 burritos and coffee, the brand not only taps into the morning crowd but also encourages customers to grab lunch for later. This strategy has proven successful, with breakfast items contributing up to 20% of total revenue. For about $10, customers can get a complete meal: a burrito, coffee, and a salad for later. This pricing positions Salad and Go as a cost-effective alternative to traditional fast-food combos.

Keeping operations simple is another pillar of their strategy. The menu features just eight salads, all crafted by a Michelin-star chef. This focus prevents the kind of menu overload that can slow down service and inflate labor costs. Additionally, the company uses a database of over 4 million unique users to target marketing efforts, track customer habits, and re-engage those who haven’t visited in a while. To top it off, they aim to keep drive-thru times under four minutes, ensuring a quick and efficient experience.

Growth and Expansion Potential

While its operational model shows promise, Salad and Go’s next big hurdle is scaling up in a sustainable way. The company’s centralized commissary system, which was discussed earlier, is critical for maintaining efficiency. However, building these facilities demands significant upfront investment, which can slow down rapid expansion.

The drive-thru-only format also presents a challenge. Consumer preferences are shifting, and while drive-thru convenience remains popular, many customers still appreciate having the option of a physical dining area. To grow sustainably, Salad and Go will need to strike a balance between operational efficiency and the time it takes to build strong brand recognition in new markets. Balancing these factors will be key to navigating the evolving landscape of fast-food dining.

Is Salad and Go Worth the Investment?

Main Factors to Evaluate

When considering Salad and Go as an investment, scalability and market reception are crucial factors to assess. The company operates entirely under a company-owned model, with a $300,000+ investment benchmark that aligns with similar healthy fast-food businesses. For comparison, franchises like Saladworks require investments ranging from $415,273 to $596,455, while Vitality Bowls falls between $209,000 and $555,000.

However, scalability concerns have surfaced following the closure of 41 Texas locations in late 2025 - over 25% of the brand's total footprint. While the company's centralized commissary system and $6.99 pricing strategy are innovative, these models hinge on achieving high operating volumes. Each central kitchen can support up to 400 restaurant units, but this efficiency comes with substantial upfront costs.

The drive-thru–only format also presents unique challenges. As Jonathan Maze from Restaurant Business pointed out, eating salads on the go isn’t as convenient as consuming items like coffee or burgers. These operational hurdles highlight the complexities of scaling in the healthy fast-food sector.

Weighing Risks and Opportunities

Balancing the risks of rapid expansion against potential growth opportunities is key for investors. The closures in Texas underscore how operational difficulties can hinder growth, even with innovative cost-control measures. On the other hand, Salad and Go has built a strong foundation, boasting a customer database of over 4 million unique users across approximately 130 locations. While this demonstrates solid engagement in established markets, entering new regions will require significant marketing efforts.

Investors might find better opportunities in less saturated markets, coupled with a focus on pre-opening marketing to establish brand awareness. The breakfast menu, which accounts for about 20% of sales, also underscores the importance of diversifying offerings throughout the day to maximize revenue. Still, one of the biggest challenges for healthy fast-food brands lies in affordability. With competitors often pricing meals between $14 and $20, the target audience may skew toward higher-income customers. Successfully scaling will depend on managing these complexities while meeting the capital demands required for growth.

FAQs

Why did Salad and Go close 41 locations in Texas?

Salad and Go recently shut down 41 locations in Texas, citing difficulties tied to expanding at a fast pace. The aggressive push to open numerous stores resulted in underwhelming performance at several sites. In response, the company has decided to streamline its operations and prioritize a steadier, more manageable growth strategy.

What are the benefits of Salad and Go's centralized commissary system?

Salad and Go operates using a centralized commissary system, where all the ingredient preparation - washing, cutting, and portioning - happens in one large facility. This setup eliminates the need for full-scale kitchen operations at individual locations, saving both time and labor costs.

This efficient process helps the company keep operating expenses low, which translates to affordable menu prices. For example, they offer generous 48-ounce salad bowls for less than $7. Plus, a single commissary can support up to 400 stores, making it easier to open new locations quickly without the need for extensive kitchen installations. This approach not only reduces costs but also supports rapid expansion.

What operational and market challenges does Salad and Go face with its drive-thru-only model?

The drive-thru-only approach gives Salad and Go an edge when it comes to speed, but it also brings some hurdles. To keep service fast, the menu has to stay simple, which limits variety and makes introducing new or seasonal items a bit tricky. The operation also leans heavily on centralized kitchens and smooth supply chains, so any hiccup in these areas can ripple across multiple locations.

On top of that, salads aren’t exactly what people usually think of when they picture a drive-thru. This means the brand has to put extra effort into showing customers how convenient its offerings are. Operating out of compact 750-square-foot spaces adds another layer of complexity. Factors like traffic patterns, weather, and the absence of on-site seating can all influence sales and the overall customer experience.