Franchise Strategies

Dec 29, 2025

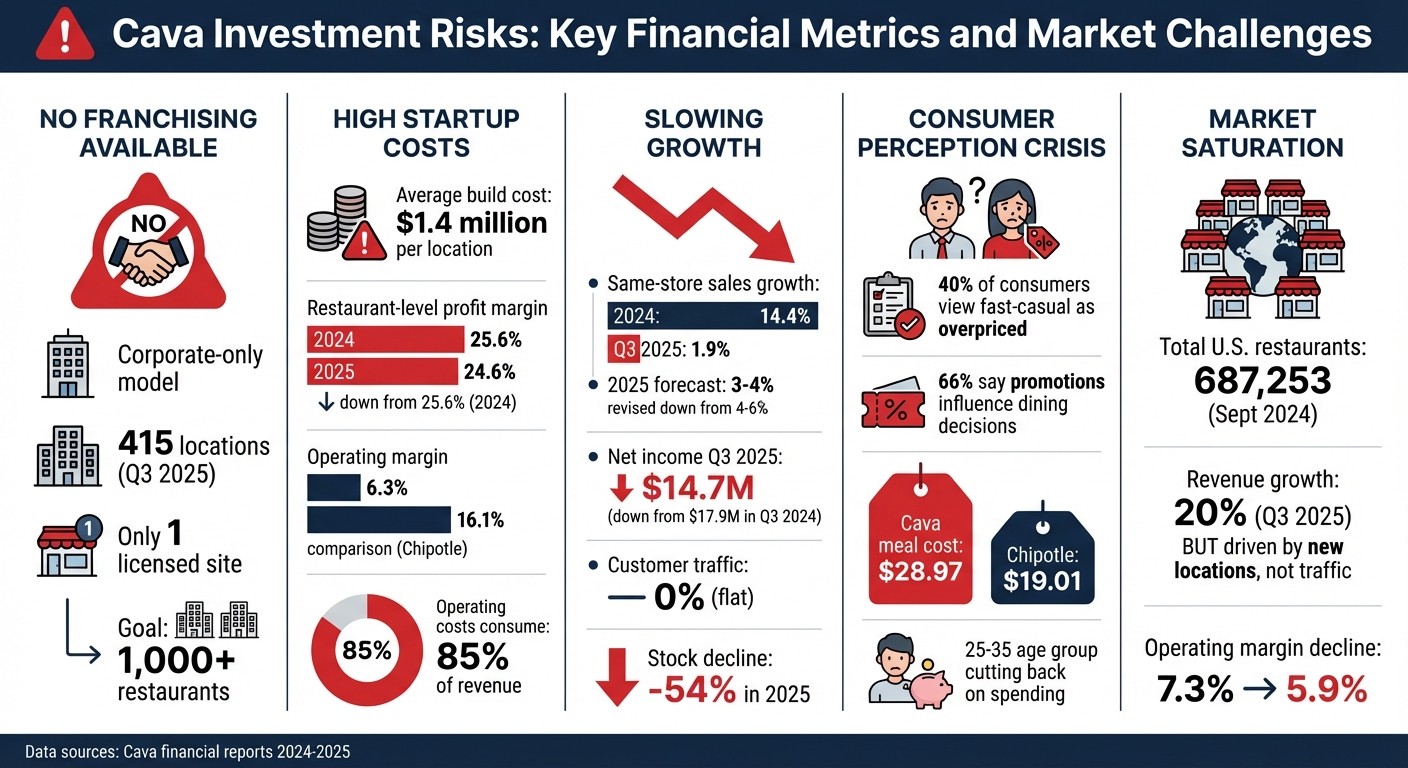

Cava’s corporate-only model, high startup costs, slowing same-store sales and thin margins make investing in the brand risky for potential owners.

Cava’s Mediterranean bowls might be popular, but investing in the brand presents serious challenges. Here’s why:

No Franchising Model: Cava operates all locations corporately, meaning you can’t buy a franchise.

High Startup Costs: Opening a new location costs approximately $1.4 million, with slim profit margins (24.6% in 2025).

Slowing Growth: Same-store sales growth dropped from 14.4% in 2024 to just 1.9% in Q3 2025.

Industry Pressure: Nearly 40% of consumers perceive fast-casual dining as overpriced, with younger diners cutting back due to economic pressures.

Stagnant Traffic: Customer traffic has remained flat, and competition from casual dining and grocery options is growing.

Cava’s aggressive expansion strategy and reliance on new locations for revenue growth raise concerns about market saturation and long-term profitability. While the brand has seen revenue increases, operational costs and declining margins make it a risky investment in an already struggling fast-casual dining sector.

Cava Investment Risks: Key Financial Metrics and Market Challenges

Cava Doesn't Offer Franchises

Corporate-Only Ownership Model

Cava runs all its restaurants under a corporate ownership structure. Every location - except for one licensed site - is owned and managed directly by the company itself. In other words, buying a Cava franchise simply isn’t an option.

The company makes this stance clear on its website, which explicitly states that franchising is not part of its business model. CEO Brett Schulman has explained this decision, noting that Cava aims to "establish this category" while maintaining strict control over its operations.

This approach mirrors the corporate model used by brands like Chipotle. It allows Cava to focus on operational consistency and strategic growth. A prime example of this strategy was the $300 million acquisition of Zoe’s Kitchen in 2018, which added 145 locations that could be converted into Cava restaurants. However, despite this clear corporate model, some investors remain confused, believing franchising might still be on the table. This disconnect highlights broader financial and market risks already noted.

Why Investors Think Franchises Are Available

Cava’s rapid expansion plan - aiming for 68–70 new locations in 2025 - resembles the kind of growth often seen in franchised brands. With new units generating over $3 million in annual sales and recouping their average $1.4 million build costs in about two years, it’s easy to see why some might assume franchising is involved.

Adding to the confusion, Cava has been dubbed the "Next Chipotle", a label that places it alongside franchised competitors in the fast-casual dining space. This positioning, coupled with its remarkable 99% stock price surge on its first trading day in June 2023 - opening at $22 and closing near $44 - has sparked interest from entrepreneurs eager to invest. Unfortunately, these factors contribute to a misunderstanding: while Cava’s growth story is impressive, franchising is not part of the equation.

High Costs and Profit Concerns

Startup Costs for Fast-Casual Restaurants

Launching a fast-casual restaurant requires a hefty financial commitment. Depending on factors like location and whether you're building from the ground up or renovating an existing space, the total startup costs can range from $95,000 to over $2 million. These costs typically include:

Construction: Averaging $450 per square foot, with a range of $100 to $800.

Interior finishes and equipment: Anywhere from $20,000 to $400,000.

Pre-opening expenses: $20,000 to $120,000.

Licenses and permits: $2,500 to $200,000.

Initial food inventory: $5,000 to $25,000.

Monthly rent: $2,000 to $12,000.

Contingency fund: $20,000 to $250,000, which is crucial to cover at least six months of potential slow sales or unexpected expenses.

For those considering established franchises, the financial barriers are even steeper. For example, opening a KFC requires an investment of $1,852,825 to $3,771,550, along with $750,000 in liquid cash. Taco Bell, on the other hand, demands $934,750 to $4,310,200 in investment and $2 million in liquid assets.

Once the doors are open, the financial challenges only grow.

Hidden Operating Expenses

The real financial strain begins post-launch, as operating costs consume a staggering 85% of a restaurant's revenue. That leaves only 15% - or less - for profit, taxes, and reinvestment. Matt Bruenderman, a restaurant operations consultant, puts it this way:

"You're not going to find $1,000 you can grab in your P&L (profit and loss statement), but you can find 1,000 ways to save money. Most restaurants are bleeding from 1,000 individual cuts."

One of those "cuts" is food waste. Commercial kitchens typically waste between 4% and 10% of their purchased food, which can translate to losses of $40,000 to $100,000 annually for a restaurant with a $1 million food budget. Then there are utilities: full-service restaurants spend about $2,300 a month on electricity and $8,000 annually on water, while fast-food locations may see electricity bills closer to $2,800 monthly.

Cava's financials illustrate these struggles. The company recently revised its 2025 restaurant-level profit margin projections downward to 24.4%–24.8% from an earlier estimate of 24.8%–25.2%. Additionally, its same-store sales growth slowed to 1.9% in Q3 2025, falling short of analyst expectations of 2.8%.

Revenue Doesn't Cover Costs

Even with strong sales figures, operational expenses often outweigh profits. For instance, Cava reported an operating loss of $2.3 million during the first 16 months of 2023. By Q3 2025, the company's net income had dropped to $14.7 million, down from $17.9 million during the same period the previous year.

A key challenge is the perception among consumers that fast-casual dining is overpriced. Nearly 40% of diners believe these restaurants charge too much, and two-thirds say promotions heavily influence where they eat. To put things into perspective, a typical meal at Cava - consisting of a bowl, chips, drink, and dessert - costs approximately $28.97, compared to a similar meal at Chipotle priced at $19.01.

Cava's CEO, Brett Schulman, acknowledges this delicate balancing act:

"You can't discount your way to prosperity. We want to invest in our guests for the long term and continue to provide stronger everyday value."

Even with menu prices now 17% higher than in 2019 - still below the industry's average increase of 34% - Cava is grappling with declining net income and tighter margins. With operating costs consuming 85% of revenue and customer traffic remaining flat, profitability remains an uphill battle.

Market Saturation and Slowing Growth

Cava's Expansion Creates Market Risks

Cava's growth journey has been impressive - it reached 415 locations by the end of Q3 2025 and aims to eventually surpass 1,000 restaurants. But here's the catch: much of its revenue growth is tied to opening new locations rather than driving more foot traffic to its existing ones.

Take Q3 2025, for example. Total revenue climbed by 20%, but same-restaurant sales only edged up by 1.9%, a steep drop from the 14.4% growth seen in 2024. Stock strategist Tracey Ryniec from Zacks Investment Research summed it up:

"Cava isn't so special after all. After blowing out same store sales in Q1 of 10.8%, it fell in line with the industry at 2.1% in Q2."

This trend poses a real challenge. As the company grows, its operating margins are taking a hit - falling from 7.3% to 5.9% in Q3 2025. On top of that, Cava lowered its full-year 2025 same-store sales forecast to 3% to 4%, down from an earlier projection of 4% to 6%. These issues are compounded by broader industry struggles with declining customer traffic.

Declining Customer Traffic Across the Industry

The fast-casual dining sector as a whole is grappling with falling foot traffic. In a recent quarter, Cava reported flat (0%) customer traffic, while Chipotle saw a 5% decline, and Shake Shack experienced a 0.7% dip. Financial analyst Vince Martin captured the sentiment well:

"The stampede away from fast-casual names strongly implies that [investors] learned something new about the industry – and didn't like it."

One major factor is "menu fatigue." Consumers are growing weary of the endless customizable bowl options, and many balk at paying $20 for lunch. Nearly 40% of consumers now see fast-casual dining as too pricey, and two-thirds say promotions heavily influence their dining decisions. Younger diners, especially those aged 25 to 35, are cutting back on discretionary spending.

Competition is also heating up. As of September 2024, there were 687,253 restaurant locations in the U.S., up from 681,764 in 2019. With so many choices, customers are spreading their dollars thin. When Cava's stock dropped 17% after a Q2 earnings miss, it raised serious questions about whether the Mediterranean bowl concept can thrive in an increasingly crowded and challenging market.

Why a Popular Menu Isn't Enough

Menu Success Doesn't Guarantee Profits

Cava's Mediterranean bowls might pack restaurants during lunch hours, but popularity alone doesn't cover the bills. In Q3 2025, the company saw a revenue increase of 19.9%, yet its net income took a hit, dropping by 17.9%. The problem? Shrinking margins. Cava's restaurant-level profit margins fell to 24.6% in 2025, down from 25.6% the year before. Rising expenses for food, beverages, packaging, and labor are eating into profits. To make matters worse, Cava's operating margin is just 6.3%, a stark contrast to Chipotle's 16.1%. When you add economic challenges and fierce competition to the mix, the pressure on margins becomes even more intense.

Economic Pressures and Competition

Cava’s challenges go beyond internal costs - external economic factors are also at play. The fast-casual dining sector is grappling with a growing perception problem: nearly 40% of consumers now believe these restaurants are overpriced. As prices climb, diners are increasingly opting for casual dining chains that offer table service and multi-item meals at comparable or lower price points.

Younger customers, a key demographic for bowl-based concepts, are feeling the pinch of economic pressures. In November 2025, Sweetgreen's CFO Jamie McConnell highlighted a 15% spending drop among their 25-to-35-year-old customers, who make up 30% of their base. Cava's CFO Tricia Tolivar echoed similar concerns:

"The 25 to 34-year-old consumer seems to be impacted a bit more than others, and fast casual tends to have a higher concentration of those consumers".

But the competition isn't limited to other fast-casual chains. Chipotle CEO Scott Boatwright pointed out a broader issue:

"We're not losing them to the competition; we're losing them to grocery and food at home".

With Gen Z unemployment running at double the national average, even a $20 lunch feels like a luxury many can’t afford. This shift forces restaurants into discount wars, further squeezing already narrow profit margins.

Should Investors Buy CAVA Stock? | CAVA Stock Analysis

Evaluate Your Investment Options Carefully

When considering investments in the fast-casual restaurant sector, it's crucial to weigh your options with a sharp eye on potential risks. This industry comes with its share of financial challenges. For instance, Cava's stock saw a steep 54% drop in 2025, and its same-store sales growth slowed to just 1.9% in Q3 of the same year . With high startup costs and slim operating margins, careful analysis is essential before committing your capital.

History shows that restaurant IPOs often struggle to deliver long-term gains. While Chipotle's stock skyrocketed by 4,563% after its IPO, other brands like Noodles & Co and Potbelly faced stark declines of 91% and 73%, respectively. As analyst Reuben Gregg Brewer aptly stated:

"The landscape is littered with once-hot restaurants that have flamed out".

Even when a brand garners initial excitement, factors such as market saturation, competition between locations, and changing consumer tastes can quickly erode profitability.

Another critical factor to consider is the ownership structure of the brand. For example, Cava operates solely through corporate-owned locations and does not offer individual franchise opportunities . Understanding such details can significantly impact your investment strategy.

Given the complexities of this market, seeking expert advice can make a world of difference. Franchise Ki, for instance, offers free consulting services to align your financial goals with well-researched franchise opportunities. Their team conducts thorough due diligence on key factors like unit-level economics, payback periods, and market trends, helping you navigate the volatile restaurant industry and avoid costly missteps.

FAQs

Why doesn’t Cava allow franchising?

Cava operates exclusively through corporate-owned restaurants, opting not to offer franchising opportunities. The company has made it clear that it has no intention of adopting a franchise model in the future.

By keeping all locations under corporate control, Cava ensures a consistent brand identity, streamlined operations, and a uniform customer experience across its restaurants. While this decision might be disheartening for those interested in franchise opportunities, it aligns with Cava's strategic vision for growth and brand integrity.

What financial risks should I consider before investing in a Cava franchise?

Investing in a Cava franchise carries several financial risks that potential franchisees need to weigh carefully. Since Cava went public in mid-2023, there isn’t enough historical financial data to confidently evaluate its profitability or track long-term cost trends. On top of that, operating as a public company comes with added expenses, such as regulatory compliance and IPO-related costs, which can obscure a clear picture of its cash flow.

Another issue is Cava's lofty valuation. Following its IPO, the company’s price-to-earnings ratio has spiked, which means even minor earnings shortfalls could result in steep drops in stock value. This, coupled with slowing consumer demand in the broader fast-casual dining market, could strain revenue growth and make it more challenging for franchisees to see a quick return on their investment.

Before diving into a Cava franchise, it’s crucial to thoroughly assess these risks and determine whether they align with your financial objectives.

How does Cava’s rapid expansion affect its profitability?

Cava’s growth plan centers on opening new corporate-owned locations at a rapid pace to seize market share and drive sales. This strategy has fueled strong revenue projections, with average locations expected to bring in over $3 million annually by 2025. However, this approach isn’t without its hurdles.

Expanding quickly means dealing with rising operating costs, such as increased overhead and continuous spending on new store openings. On top of that, slowing growth in same-store sales has raised red flags about long-term profitability. For instance, in late 2025, weaker sales at existing locations caused Cava to fall short of earnings expectations, forcing the company to lower its financial forecast. This situation underscores the risks tied to market saturation and economic pressures that could weigh on profits.

While Cava’s rapid expansion might boost revenue, it also puts pressure on profitability when sales momentum slows or fixed costs climb.