Franchise Strategies

Dec 27, 2025

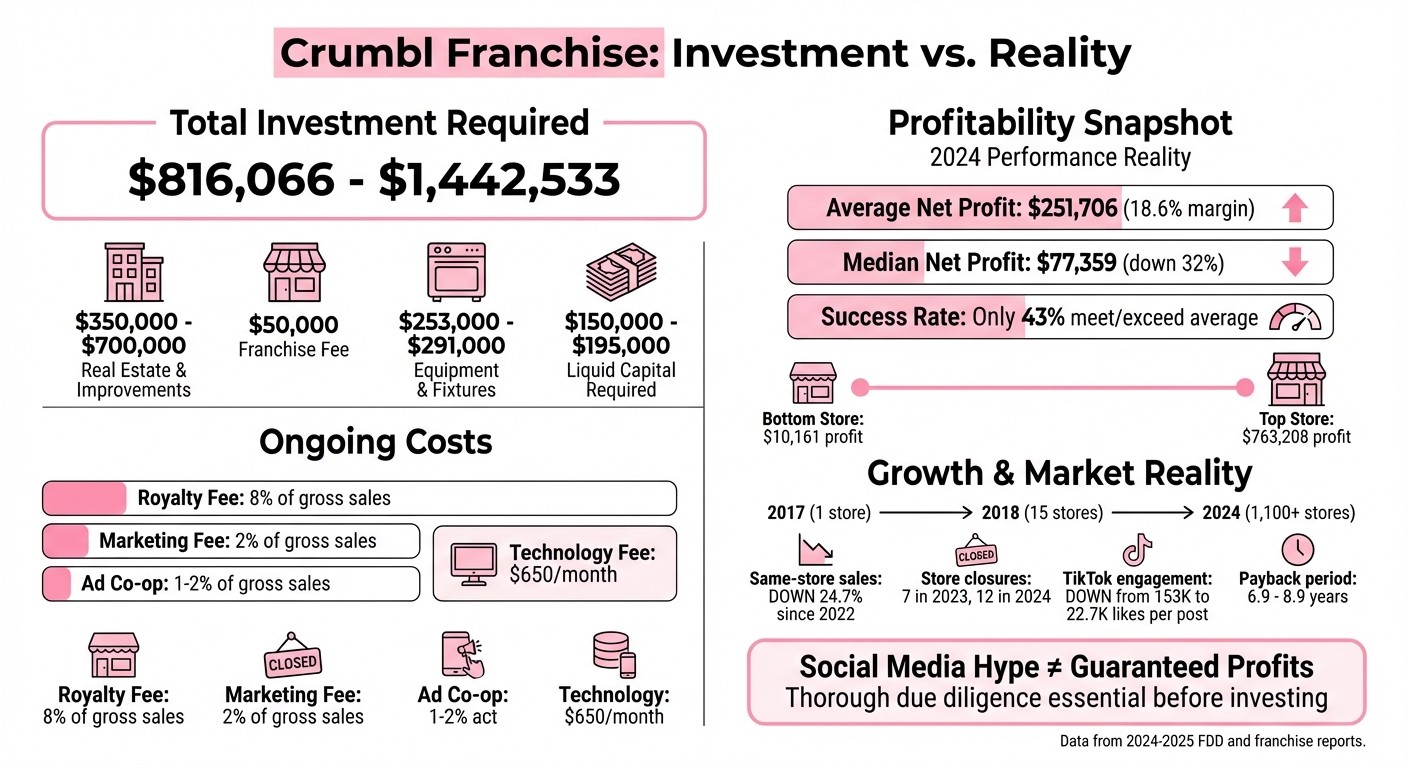

In-depth look at Crumbl franchise costs, recurring fees, and uneven profitability—what social media hype doesn't tell prospective owners.

Crumbl has grown into a social media phenomenon, with over 1,100 locations since its 2017 launch. Known for its weekly rotating menu and signature pink boxes, the franchise has gained millions of followers on TikTok and Instagram. But the numbers reveal a more complicated story for franchisees:

Investment Costs: Opening a Crumbl franchise costs between $816,066 and $1,442,533, including a $50,000 franchise fee and high real estate expenses.

Profitability: In 2024, the average net profit was $251,706, but only 43% of franchisees met or exceeded this figure. The median net profit fell to $77,359.

Challenges: Market saturation, declining social media engagement, and operational demands (like weekly menu changes) have impacted performance. Some stores report losses, while others thrive with strong management and strategic locations.

Fees: Recurring costs include an 8% royalty fee, 2% marketing fee, and other expenses like technology fees and training costs.

While Crumbl's social media buzz drives customer interest, franchisees face real challenges balancing costs, labor, and market conditions. Thorough research and financial planning are essential before investing.

Crumbl Franchise Investment Costs and Profitability Analysis 2024

Crumbl Cookie: A Sweet Investment or Fading Fad?

Crumbl Franchise Overview: From Startup to Sensation

Back in 2017, cousins Sawyer Hemsley and Jason McGowan opened the doors to their first Crumbl store in Logan, Utah. They spent months perfecting their signature cookie recipe through rigorous testing. What began as a single storefront quickly snowballed into a franchise powerhouse, leaping from 15 locations in 2018 to over 1,070 by December 2024. This meteoric rise raises an important question: does Crumbl’s digital buzz reflect a solid business foundation?

By 2022, Crumbl had surpassed $1 billion in annual system-wide sales, climbing to an estimated $1.2 billion by 2024. In 2022 alone, the brand sold over 300 million cookies . This rapid growth attracted major financial backing. In May 2025, Crumbl secured $500 million in loans from Blackstone Inc. and Golub Capital, while TSG Consumer Partners acquired a stake, valuing the company at nearly $2 billion.

"I never imagined in my wildest dreams that we would do over $1 billion in sales."

Jason McGowan, CEO, Crumbl

In 2023, Crumbl hinted at a broader dessert vision by dropping "Cookies" from its logo. This rebranding paved the way for viral hits like the Dubai Chocolate Brownie, a pistachio- and kataifi-stuffed treat that quickly became a fan favorite. The brand also made waves in April 2024 by partnering with the Kardashians for a full menu takeover. This collaboration introduced seven exclusive items, including "Kris' Classic Yellow Layer Cake Cookie" and "Kim's Snickerdoodle Crumb Cake Cookie".

What Makes Crumbl Different

Crumbl’s success rests on three standout features: a weekly rotating menu, an open-kitchen experience, and their iconic pink packaging. The rotating menu, introduced early on, keeps production efficient while creating a sense of urgency for customers. Every Monday, the menu refreshes with new flavors, turning cookie shopping into a highly anticipated event - fans even compare it to "appointment television."

"It creates that hype. It creates that excitement. And it also creates some scarcity, because you can only have that cookie for that week."

Jason McGowan, CEO, Crumbl

The open-kitchen concept invites customers to watch the magic happen - cookies being mixed, shaped, and baked right before their eyes. This transparency not only builds trust but also encourages visitors to share their experiences on social media. Adding to this is the brand’s signature pink box, officially recognized as "Crumbl Pink" by Pantone in 2023. The packaging, paired with minimalist black-and-white interiors, makes every purchase instantly shareable.

"It's like a Tiffany's box. It was those little things they did right... even on the exact hue of pink. It's the perfect pink in a box."

Patrick Moradkhani, Franchisee

Crumbl cookies are priced between $4 and $5 each, with discounts on multi-packs - like a 12-pack for around $50. The brand also taps into customer creativity by crowdsourcing flavor ideas through social media. This approach has led to hits like cornbread and Oreo-inspired cookies. Together, these elements create a unique in-store and online experience that fuels the brand’s growing popularity.

How Social Media Drives Crumbl's Growth

Crumbl’s social media game is second to none. The brand boasts 7.2 million TikTok followers and 6.4 million Instagram followers, while its hashtag #TasteWeekly has racked up over 461.5 million views . At one point, Crumbl’s 5.2 million TikTok followers surpassed the combined following of McDonald's, Starbucks, and Wendy's.

The weekly menu rotation keeps fans hooked, with the Sunday night "flavor reveal" becoming a much-anticipated event. Influencers and everyday customers flood platforms with unboxing videos, reviews, and spoiler alerts, ensuring Crumbl stays in the spotlight.

Strategic collaborations have further amplified the brand’s reach. In 2024, Crumbl teamed up with Warner Bros. to promote Beetlejuice Beetlejuice by creating the "Afterlife Cake" dessert, designed to match the movie’s aesthetic. The brand also partnered with singer Olivia Rodrigo to launch an interactive online game and a special "Guts Cookie", which followed her tour stops on a digital map.

Crumbl’s targeted advertising campaigns also deliver impressive results. By leveraging audience data through Meta campaigns, the company achieved a 6x return on ad spend (ROAS) and grew its weekly customer base from 80,000 to 130,000. The oversized, frosting-heavy cookies in their signature pink boxes make every purchase photo-worthy, effectively turning customers into brand ambassadors.

"Desserts are an international language that everyone understands."

Sawyer Hemsley, CBO, Crumbl

Investment Costs and Financial Commitments

Initial Investment Breakdown

Starting a Crumbl franchise comes with a hefty price tag, ranging from $816,066 to $1,442,533, as outlined in the 2025 Franchise Disclosure Document. This variation largely depends on factors like real estate costs, construction expenses, and lease terms, which differ significantly by location.

The $50,000 franchise fee is due upon signing the agreement. Additionally, you'll need $150,000 to $195,000 in liquid capital to qualify. Real estate and leasehold improvements alone can cost between $350,000 and $700,000, depending on the space and its condition.

Category | Low Estimate | High Estimate |

|---|---|---|

Initial Franchise Fee | $50,000 | $50,000 |

Real Estate and Improvements | $350,000 | $700,000 |

Equipment, Furniture, Fixtures, Décor | $253,000 | $291,000 |

Additional Funds (3 months) | $61,400 | $100,200 |

Rent (3 months) | $16,666 | $83,333 |

Professional Fees | $10,000 | $50,000 |

Initial Training Fees & Travel | $25,000 | $35,000 |

Signs | $12,000 | $32,000 |

Opening Inventory | $10,000 | $20,000 |

Opening Tech Equipment Package | $12,000 | $15,000 |

POS System, Hardware, and Software | $5,500 | $18,000 |

Opening Box and Ingredient Package | $8,000 | $13,000 |

Miscellaneous Opening Costs | $2,500 | $35,000 |

ESTIMATED TOTAL | $816,066 | $1,442,533 |

Equipment expenses alone range from $253,000 to $291,000. Beyond that, you'll need $61,400 to $100,200 to cover the first three months of operating costs, including payroll and unexpected repairs.

"Crumbl is generally not suited to buyers with very limited liquidity or those who would be dangerously stretched at this level of investment."

Ricardo Fontana, Author, Franchise BA

One critical risk to note: Crumbl does not assist with site selection. If you fail to secure an approved location, the company can terminate your agreement and keep your $50,000 franchise fee. This adds a significant level of financial uncertainty before you even open your doors.

While these upfront costs are steep, understanding the recurring fees is just as important for evaluating the financial commitment.

Recurring Costs and Fees

Running a Crumbl franchise comes with ongoing fees that can eat into your profits. Once operational, you'll pay 8% of gross sales as a royalty fee and another 2% for national marketing. On top of that, advertising cooperatives may charge an extra 1% to 2%. These fees are calculated from gross sales, not profit, meaning they apply before you cover basic expenses like rent, payroll, or ingredients.

"Because these fees are based on gross sales, not profit, you'll need a disciplined approach to labor management, food and packaging costs, and rent."

Ricardo Fontana, Author, Franchise BA

Other recurring costs include a $650 monthly technology fee and transaction processing fees ranging from 2.4% to 3%. Training a new manager or owner? That’s an additional $4,000 per person. The franchise agreement lasts 5 years and is renewable, but operational fines - ranging from $250 to $1,000 - can be imposed for issues like cleanliness or dress code violations.

The franchise’s weekly menu rotation adds another layer of complexity, requiring constant management of new ingredients and procedures. Labor costs are also high since all baking and decorating happen in an open kitchen. With tight margins, every dollar counts, and these recurring fees can quickly add up.

Financial Performance Analysis

After diving into the upfront costs and fees, let’s shift focus to how Crumbl has performed financially across its franchise network.

Sales and Profit Numbers

Crumbl’s financial data for 2024 paints a picture of recovery following a tough 2023. Among 858 franchised locations that operated throughout the year, average gross sales climbed to $1,354,688 - a 17% increase from the previous year - with median gross sales at $1,303,412. The average gross profit came in at $653,586, representing a 48.2% margin, while the average net profit hit $251,706, equating to an 18.6% margin. However, only 43% of franchisees managed to meet or exceed this net profit figure.

Performance across locations varied widely. The top-performing store reported $3,479,411 in gross sales and a net profit of $763,208, while the lowest-performing location earned just $383,711 in gross sales, with a modest $10,161 in net profit.

Metric (2024 Data) | Average | Median | High Store | Low Store |

|---|---|---|---|---|

Gross Sales | $1,354,688 | $1,303,412 | $3,479,411 | $383,711 |

Gross Profit | $653,586 (48.2%) | $617,709 | $1,675,228 | $117,565 |

Net Profit | $251,706 (18.6%) | $223,236 | $763,208 | $10,161 |

These numbers highlight the wide range of outcomes for franchise owners, setting the stage to explore what drives such disparities in profitability.

What Affects Profitability

The quality of a store’s location plays a huge role in its financial success. Between 2021 and 2023, Crumbl expanded aggressively, opening nearly one store per day. This rapid growth led to market saturation in certain areas, with stores opening just minutes apart, effectively splitting the same customer base.

Operational efficiency is another key factor. Crumbl’s rotating weekly menu encourages repeat visits but requires constant staff training and precise inventory management. The open kitchen format, where cookies are prepared on-site, adds to labor costs. On top of that, franchisees face an 8% royalty fee and a 2% marketing fee, both calculated from gross sales. This means that controlling expenses is crucial to maintaining profitability.

"The anomaly [in profitability] was explained by... the brand signed on a lot of inexperienced operators early in its history who are not as profitable as they could be, while more experienced franchisees do better."

Jonathan Maze, Editor-in-Chief, Restaurant Business

Declining social media engagement has also impacted the brand. To counter this, Crumbl has diversified its offerings, adding items like pies, cakes, and “dirty sodas,” while also introducing catering services. Celebrity partnerships, such as a February 2024 collaboration with Olivia Rodrigo, aim to keep the brand relevant.

After adding 281 new units in 2023, Crumbl slowed its expansion significantly, opening just 87 locations in 2024. This shift reflects a focus on improving the performance of existing stores rather than rapid growth. While profitability remains uneven across the system, these operational adjustments and a more measured approach to expansion highlight the importance of experienced management in navigating these challenges.

Daily Operations vs. Instagram Hype

After diving into Crumbl's financial performance, let's explore the contrast between the brand's day-to-day operational demands and its glowing digital presence.

What Running a Crumbl Franchise Requires

Owning a Crumbl franchise is no walk in the park - it's a hands-on retail business, not a passive investment. Managing an hourly workforce requires constant training and oversight. The open-kitchen format adds another layer of complexity, as it puts every step of the production process on display, demanding strict cleanliness and consistent brand representation.

One of the biggest challenges? The weekly menu rotation. This system requires franchisees to quickly train staff on new recipes and techniques every single week. As Sawyer Hemsley, Crumbl's COO and Co-founder, explained:

"There are absolutely operational challenges that accompany a weekly rotating menu [like] training, quality assurance [and] sourcing, but we pride ourselves on mastering it for the benefit of our customers." - Sawyer Hemsley, COO and Co-founder, Crumbl

On a daily basis, franchise owners juggle tasks like dough preparation, baking, decorating, boxing orders, and keeping a close eye on food waste to protect thin profit margins. They also manage point-of-sale systems, online orders, and third-party delivery platforms. With high franchise fees, tight cost control becomes critical. As franchise analyst Ricardo Fontana put it:

"Crumbl can be a high-volume, low-margin business if not managed carefully." - Ricardo Fontana, Author, Franchise BA

This operational grind is the reality behind the glitzy social media buzz that draws in customers.

Social Media Benefits vs. Business Challenges

Despite the challenges of running a Crumbl location, the brand's social media presence remains a powerful tool. With nearly 7 million TikTok followers and 4 million on Instagram, Crumbl's online platforms generate massive free publicity. The Sunday evening flavor announcements, for instance, create a "fear of missing out" effect that drives Monday morning traffic spikes. A November 2024 influencer campaign highlighted this impact, generating $1.2 million in earned media value and over 175,000 engagements.

But the Instagram-worthy pink boxes and visually appealing open kitchens come with their own set of challenges. The rotating menu strategy, for instance, means franchisees sometimes have to pull popular flavors - even when they're selling well - to maintain brand consistency. This can affect local profits. Meanwhile, the open-kitchen "stage", designed to look great on social media, adds pressure to maintain high production quality. Franchisees also face logistical headaches, like managing third-party delivery during sudden traffic surges.

The disconnect between social media hype and the business reality becomes clear in the numbers. While Crumbl enjoys massive online engagement - boasting over 107 million TikTok mentions - the median net profit dropped to $77,359 in 2024, with the top-performing locations averaging $251,706. As the initial viral buzz levels off, franchisees are finding that long-term success depends on building strong local connections through catering and community involvement, rather than relying solely on social media stardom.

Franchisee Experiences: Wins and Struggles

Crumbl’s Instagram fame paints a rosy picture, but the reality for franchisees is far more nuanced. While some stores flourish, others face significant hurdles. This contrast raises an important question: does social media buzz translate into lasting profitability?

High-Performing Franchise Examples

In 2024, the top 43% of Crumbl locations reported an average net profit of $251,706, well above the median. These successful stores often share a few key traits: tight cost controls, seasoned management, and a strong commitment to upholding brand standards.

Take Patrick and Katie Moradkhani’s Bakersfield, California store as an example. When they opened the third Crumbl location in August 2020, they encountered early setbacks like supply shortages and technical glitches. Despite these challenges, their store processed an impressive 240 DoorDash orders by 9:00 AM on opening day, thanks in part to support from Crumbl's leadership team. Reflecting on their success, Patrick shared:

"You have to be committed to the brand to not cheat on it. You have to be true to your business commitments and your standards, even if the numbers tell us otherwise." - Patrick Moradkhani, Franchisee, Crumbl

In another standout example, the highest-earning Crumbl location in 2023 posted a net profit of approximately $601,000, proving that the model can excel in the right circumstances. However, not all franchisees share this level of success, and many face steep challenges.

Common Problems Franchisees Face

On the flip side, a significant number of franchisees grapple with tough operational and market-related obstacles. While some stores achieve impressive profits, others fall short, with one franchise reporting a staggering net loss of $242,000 in 2023.

One major issue is market saturation. The brand’s rapid expansion has led to overlapping territories, especially in smaller markets where multiple high-volume locations struggle to coexist. Jennifer Allen, a franchisee, highlighted this concern, noting how oversaturation limits profitability. Evidence of this trend includes seven store closures in 2023 and another 12 shutting down in 2024. Adding to the strain, same-store sales have dropped by 24.7% since 2022.

Inexperience among franchisees compounds these problems. Many new operators, drawn in during Crumbl’s growth surge, find themselves unprepared to manage labor costs or control food expenses effectively. With startup costs ranging from $460,166 to $1,266,333, alongside an 8% royalty fee and 2% marketing fee, there’s little room for error. Some franchisees have even faced legal trouble, such as fines for violating child labor laws.

Adding to the complexity is Crumbl’s weekly menu rotation, which involves over 200 cookie varieties. This constant change requires frequent staff retraining and meticulous inventory management, creating additional operational stress. When social media-driven hype doesn’t convert into consistent foot traffic, these high fixed costs can quickly spiral out of control. For potential franchisees, these mixed experiences highlight the importance of thorough research and preparation before diving in.

How to Make an Informed Decision

Deciding whether to invest in a Crumbl franchise goes far beyond the buzz you might see on social media. With startup costs ranging from $816,066 to $1,442,533 and a payback period of 6.9 to 8.9 years, this is a significant financial commitment that demands careful thought and analysis. To make a well-rounded decision, you need to balance the brand's digital appeal with the operational realities of running a franchise. Here’s a guide to help you evaluate the opportunity thoroughly.

How Franchise Ki Can Help

Franchise Ki provides free consulting services to help you objectively assess franchise opportunities. Founded by Bennett Maxwell and Liam Chase, this service uses their extensive experience to guide potential franchisees through the decision-making process.

One of their standout features is personalized franchise matching. Instead of relying on brand recognition alone, they use tools like the Zorakle Assessment to match your work style and strengths with the demands of specific franchise models. This is especially important for a Crumbl franchise, where hands-on management of a large, young, and hourly workforce is a key part of the job. Not everyone’s skills or lifestyle will align with these operational requirements.

Franchise Ki also conducts territory availability checks, which can save you time and effort. With over 1,000 Crumbl locations already open, many prime markets are no longer available. By knowing this upfront, you can avoid unnecessary research and consider whether a resale opportunity might be a better fit than starting a new location. Additionally, they connect you with funding experts to explore financing options, which can make higher-cost franchises more accessible.

Their support doesn’t stop there. Franchise Ki helps with due diligence by assisting with Franchise Disclosure Document (FDD) reviews, organizing validation calls with current franchisees, and guiding you through financial modeling. This structured approach ensures you understand how Crumbl’s ongoing fees and operational costs could impact your profitability.

Steps to Evaluate the Crumbl Opportunity

If you’re serious about pursuing a Crumbl franchise, here are some steps to guide your evaluation process:

Start by reviewing Item 19 of the FDD, which provides key financial details. For example, in 2024, the average net profit for Crumbl stores was about $251,706 (18% margin), while the median was slightly lower at $223,236 (17% margin). The range of outcomes is significant: the best-performing store brought in around $601,000, while the worst reported a net loss of about $242,000. These figures highlight how factors like location, management experience, and market conditions can dramatically affect results.

Next, speak directly with current franchisees. During these validation calls, ask specific, targeted questions about their experiences. Topics like managing labor, handling the weekly menu rotation, and whether social media-driven traffic has remained steady or declined are important to cover. Ricardo Fontana, an expert on franchise operations, explains:

"Crumbl is not a passive 'mailbox money' investment... you'll likely manage a large team of hourly employees with varying schedules".

Hearing this directly from franchisees can help you gauge whether this level of involvement aligns with your expectations.

Use a franchise calculator to simulate different revenue scenarios. Factor in royalties, marketing fees, and initial reserves like the three-month rent requirement ($16,666–$83,333) and operating funds ($61,400–$100,200). This will give you a clearer picture of the financial commitment and potential returns.

Also, evaluate territory availability and market conditions. With many prime markets already saturated, opening a new location might not be the best option. As Jennifer Allen of The Seattle Times observed:

"instead of expanding demand, new stores often divided it".

If your desired area already has multiple Crumbl locations, consider resale opportunities or explore other dessert franchises that might offer better growth potential. Franchise Ki can help you compare Crumbl with other options to find the best fit for your budget and risk tolerance.

Finally, consult with a franchise attorney and financial advisor to review the agreement and create a realistic financial plan. This step ensures that you’re basing your decision on data, not just social media hype.

Conclusion

Crumbl's Instagram-worthy cookies and viral TikTok presence make it easy to see why the franchise has captured so much attention. But the numbers tell a more complex story. In 2024, the median net profit fell by 32%, landing at $77,359. While top-performing locations averaged $251,706 in profits, others struggled to stay afloat, even as average revenues increased. This stark contrast highlights that social media buzz doesn’t always translate into consistent profitability.

The brand's rapid growth - from just 15 locations in 2018 to over 1,000 by May 2024 - has led to market saturation in several areas. Jennifer Allen, a retired professional chef and writer, put it succinctly:

"The era of effortless growth is over. The next chapter will hinge on discipline rather than hype, with stronger site selection, tighter cost control and a menu that balances indulgence with changing tastes".

Adding to the challenges, Crumbl’s viral momentum has waned. TikTok engagement, once a major driver of its popularity, has dropped from over 153,000 likes per flavor announcement in 2021 to just 22,700 by 2024.

Before committing to an investment of $816,066–$1,442,533 - paired with a payback period of 6.9 to 8.9 years - it’s essential to look beyond the brand’s digital allure. The associated fees and operational demands can be significant, and not everyone’s skills or lifestyle will align with what the franchise requires.

To navigate these complexities, Franchise Ki offers free consulting services designed to help potential investors make informed decisions. Their tools, such as personalized franchise matching, territory availability checks, and a structured due diligence process, ensure you’re relying on hard data rather than just the franchise’s visual or social media appeal. With their support, you can determine if Crumbl aligns with your financial goals, entry budget, and long-term expectations for stability and profitability.

FAQs

What challenges should I expect as a Crumbl franchise owner?

Owning a Crumbl franchise can be a rewarding venture, but it’s not without its challenges. The upfront investment is substantial, ranging from $460,000 to $1.27 million. This includes everything from franchise fees and equipment to the costs of building out the store. While the average annual revenue sits at $1.16 million, profits can vary dramatically. Some franchisees face losses exceeding $240,000, while top-performing locations can bring in as much as $600,000 in net profit. Much of this variability boils down to factors like location and how well the business is managed.

Running a Crumbl franchise also demands a lot operationally. The brand’s weekly rotating cookie menu means constant staff training and tight inventory management. Add to that the challenge of handling sudden spikes in customer traffic, and it’s clear that smooth operations require skill and preparation. Plus, finding the right location is crucial. High-demand areas are becoming more competitive, and without a prime spot, it can be tough to cover fixed costs and turn a profit.

These hurdles - financial, operational, and location-related - underscore the need for thorough planning and preparation for anyone considering a Crumbl franchise.

How does Crumbl’s social media buzz influence franchise profitability?

Crumbl has leveraged social media, particularly Instagram and TikTok, to fuel its rapid expansion. The weekly "flavor reveal" posts have become a viral sensation, sparking excitement and drawing waves of customers to their stores. This strategy has been instrumental in transforming Crumbl from a single bakery in 2017 to a massive network of over 1,100 locations across the U.S. and Canada. Along the way, the company has achieved system-wide sales surpassing $1 billion.

Despite these impressive sales figures, profitability for franchisees can be a mixed bag. On average, Crumbl stores operate with a 17–18% profit margin, translating to median annual net profits of about $223,000. However, individual store performance varies significantly. While some locations rake in over $600,000 in profits, others struggle to break even or report losses. Much of this disparity hinges on the operator’s expertise and their ability to handle the fast-paced demands spurred by Crumbl’s social media-driven popularity. While the online buzz undeniably drives foot traffic, it also brings operational pressures that can make profitability a challenge for some franchisees.

What should you know before investing in a Crumbl franchise?

Before diving into a Crumbl franchise, it’s important to evaluate the financial requirements. The total investment can range from $460,166 to $1,266,333, which includes a franchise fee of $246,000 to $265,000. If you're considering multi-unit development, there’s an additional $50,000 reservation fee per location, with a minimum commitment of three units totaling $150,000.

Profitability and location are also key factors to weigh. On average, Crumbl stores brought in $1.16 million in gross sales last year, with a net profit of $122,955. However, these numbers can vary significantly. Some stores have thrived, while others have reported losses. A prime, high-traffic location can make a big difference, whereas stores in less visible spots may struggle to perform.

Finally, don’t overlook the operational challenges. Thin profit margins, operational hurdles, and the brand’s rapid expansion present potential risks. It’s essential to thoroughly review the Franchise Disclosure Document, assess the franchisor’s support systems, and determine if the brand’s social media-driven popularity aligns with your long-term business plans.