Franchise Strategies

Dec 26, 2025

Viral cookie trends don't equal profits: high startup costs, steep royalties and market saturation make Crumbl franchises risky—review the FDD and local demand.

Crumbl Cookies has grown fast, with over 1,000 locations and $1 billion in sales by 2023. But viral success doesn't guarantee strong profits. Average store revenue dropped 37% from 2022 to 2023, and net profits fell 59%. High startup costs ($816K–$1.44M) and ongoing fees (10% of gross sales) make profitability challenging. Market saturation and operational hurdles, like high turnover and complex menus, add to the risks. While some stores thrive, others struggle, with profits ranging from $601K to losses of $242K. Careful research and realistic expectations are key before investing.

How Crumbl Became a Cookie Phenomenon

Social Media and Rotating Flavors Drive Growth

Crumbl’s success can be traced back to a simple yet highly effective idea: making cookies an event to look forward to every week. Each Sunday night, the company unveils six fresh flavors, available for just seven days. This limited-time approach creates a sense of urgency that keeps customers coming back for more.

From the start, the founders recognized the power of social media in building their brand. CEO Jason McGowan explained, "We realized very early on that social media is a huge part of the brand". The oversized cookies, paired with their signature "Tiffany-pink" boxes, made for highly shareable content that thrived on platforms like Instagram and TikTok. As Jennifer Allen from The Seattle Times put it, "Eating a Crumbl cookie became only half the experience; posting about it was the rest".

This strategy paid off in a big way. For years, Crumbl relied almost entirely on organic social media buzz rather than traditional advertising. They even invited followers to contribute recipe ideas, making customers feel personally connected to the brand’s growth.

This unique approach to marketing laid the groundwork for Crumbl’s explosive expansion.

Growth Numbers: From Startup to 1,000+ Locations

Fueled by its viral popularity, Crumbl quickly grew from a small startup to a massive franchise. After opening its first store in 2017, the company expanded to 15 locations by 2018. By the end of 2024, Crumbl had skyrocketed to 1,059 stores across the U.S. and Canada. Between 2021 and 2023 alone, the brand opened an average of 276 stores per year, sold 863 franchise agreements, and generated over $43 million in franchise fees.

The financial growth has been equally impressive. From 2019 to 2022, system-wide sales surged by 463%, culminating in $1 billion in revenue in 2023. At its peak, the average Crumbl store earned $1.7 million annually, putting it on par with well-known chains like Denny’s. While this rapid expansion attracted many eager franchisees, it also brought challenges, including financial unpredictability.

The Real Costs and Challenges of Crumbl Franchises

Initial Investment and Ongoing Fees

Opening a Crumbl franchise comes with a hefty price tag, requiring an initial investment ranging from $816,066 to $1,442,533. This includes a $50,000 franchise fee, $350,000–$700,000 for real estate and improvements, and $253,000–$291,000 for equipment.

On top of that, ongoing fees can take a big bite out of profits. Crumbl charges an 8% royalty on gross sales - a figure notably higher than the industry average of 4–6%. There’s also a 2% fee for the national marketing fund, plus an additional 1–2% for local advertising cooperatives. These fees are calculated based on gross revenue, meaning they’re owed even during slower sales periods.

"Crumbl can be a high-volume, low-margin business if not managed carefully." - Ricardo Fontana, Franchise Analyst

Because of these high fixed costs, the business model relies heavily on maintaining high sales volumes. When sales falter, these costs can quickly eat into profit margins. This issue becomes even more pronounced when factoring in market saturation and competition.

Territory Availability and Market Saturation

With over 1,000 locations already established, finding a prime territory for a new Crumbl franchise is becoming increasingly difficult. Many of the most desirable suburban and urban areas are either already developed or reserved, leaving potential franchisees with limited options. In some cases, new investors may need to consider purchasing existing franchises rather than starting fresh.

Rapid expansion has also led to internal competition between Crumbl locations. This clustering has contributed to a sharp 37% drop in average unit volumes - from $1.8 million in 2022 to $1.2 million in 2023. Although volumes rebounded somewhat to $1.36 million in 2024, Crumbl significantly slowed its growth, opening just 81–87 new locations that year compared to its earlier pace of nearly one new store per day.

"By growing units so quickly, however, the brand has spread demand for cookies among a larger number of locations. And it has opened the door to troubled locations." - Jonathan Maze, Editor-in-Chief, Restaurant Business

This rapid expansion has created a challenging environment for franchisees, especially in markets where oversaturation limits customer demand.

Daily Operations and Management Requirements

Running a Crumbl franchise involves more than just managing finances - it also comes with operational hurdles that can complicate profitability. The brand’s weekly rotating menu requires constant staff training, frequent adjustments to inventory, and meticulous production scheduling to ensure quality standards are met.

High employee turnover adds another layer of difficulty. Many Crumbl locations rely on a student workforce, which can result in turnover rates as high as 75% annually. Connor Tews, a multi-unit operator with over 225 employees, tackled this issue by partnering with BBSI and restructuring "Shift Lead" roles into better-trained "Shift Manager" positions. This strategy led to 100% retention in management by October 2022.

However, staffing challenges go beyond retention. In 2022, eleven Crumbl franchises faced fines for child labor violations, underscoring the compliance risks tied to employing younger workers. Rapid expansion can also strain resources, as seen in the case of franchisee Shideler Bennett. Between 2021 and 2022, Bennett opened seven locations across three states in just 12 months. This aggressive growth left him with over $2 million in debt and forced him to personally handle construction tasks, such as tiling and electrical work, to meet deadlines.

"Running a business to pay debt, no one wants to do that." - Shideler Bennett, Multi-unit Franchisee

Bennett’s experience highlights the dangers of expanding too quickly without sufficient operational support, which can jeopardize both financial stability and long-term success.

Is Crumbl Cookies a Good Franchise Investment?

What Crumbl Franchises Actually Earn

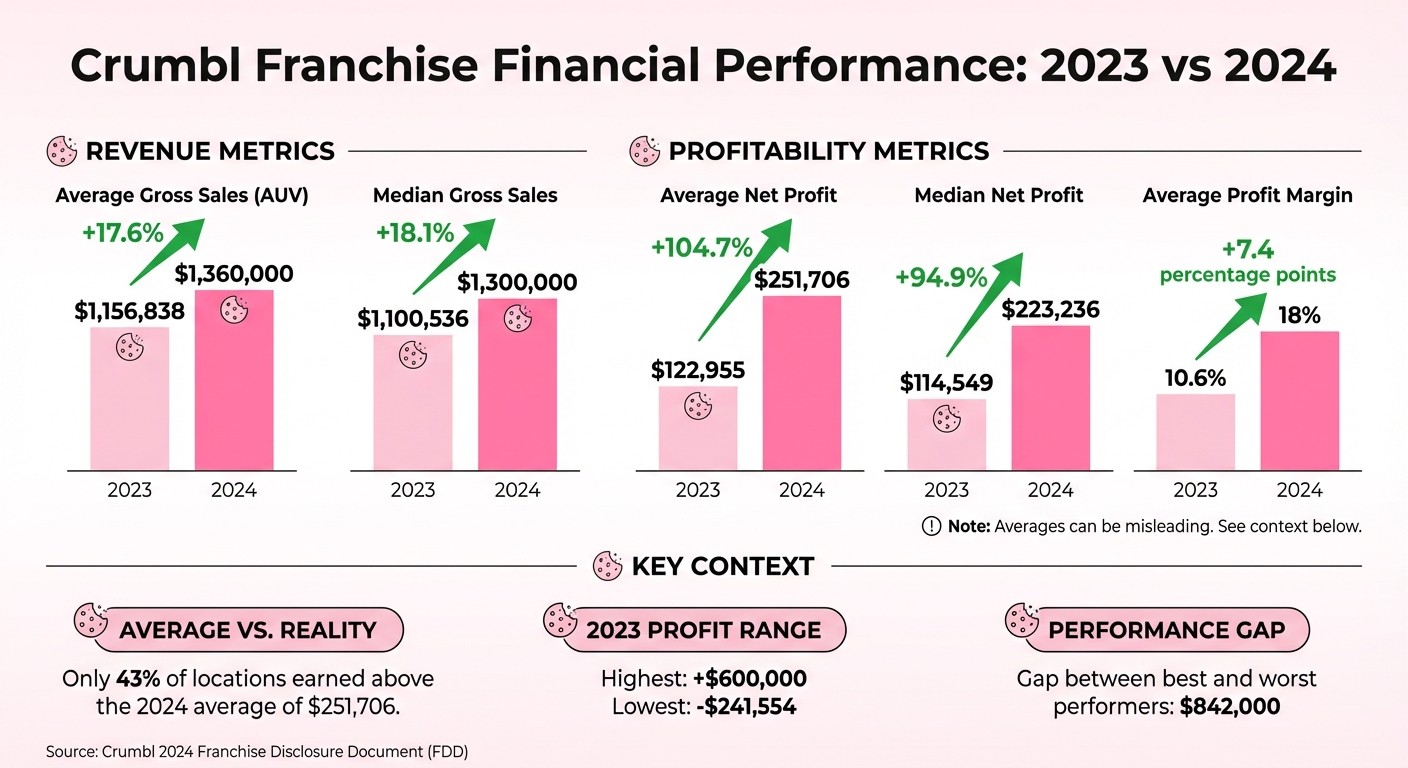

Crumbl Cookie Franchise Financial Performance 2023-2024 Comparison

Average vs. Median Profit Figures

When looking at the earnings of Crumbl franchises, it's important to dig deeper than the surface numbers. In 2024, the average net profit per location rose from $122,955 in 2023 to $251,706 in 2024. However, the median net profit of $223,236 tells a slightly different story, showing that a few top-performing stores push the average higher. This difference highlights how operational challenges and market saturation play a big role in profitability.

The numbers show that only 43% of Crumbl locations earned more than the $251,706 average in 2024. This means many franchisees are making less than what’s often portrayed as "typical" earnings - a crucial point, especially given the hefty initial investment, which ranges from $816,066 to $1,442,533.

The gap between the best and worst performers is stark: $842,000. In 2023, the highest-earning store reported over $600,000 in net profit, while the lowest saw a net loss of $241,554.

"A per-store net profit of less than $80,000 isn't all that far away from closure."

– Jonathan Maze, Editor-in-Chief, Restaurant Business

Next, let’s explore the factors that influence these wide-ranging outcomes.

Factors That Reduce Profitability

Even when gross sales look strong, several factors can quickly eat into profits. For instance, the 8% royalty fee and 2% marketing fee are based on gross sales, meaning they remain fixed no matter how well - or poorly - a store performs. Add in high labor costs and fluctuating prices for ingredients, and profit margins can shrink fast.

Another issue is market saturation. As Crumbl expanded to over 1,000 locations, many markets became crowded with multiple stores competing for the same customers. This "cannibalization" effect contributed to a sharp 37% drop in average unit volumes - from $1.8 million in 2022 to $1.2 million in 2023. While volumes bounced back to $1.36 million in 2024, the company significantly slowed its expansion, opening just 81–87 new locations compared to the nearly one-per-day pace of earlier years.

Experience also matters. New franchisees often face higher labor and food costs compared to seasoned operators who have fine-tuned their processes. On top of that, Crumbl’s weekly rotating menu adds an extra layer of complexity to operations.

2024 Financial Performance Data

Despite these hurdles, recent financial data shows some improvement. The table below highlights key metrics from 2023 and 2024:

Metric | 2023 Performance | 2024 Performance |

|---|---|---|

Average Gross Sales (AUV) | $1,156,838 | ~$1,360,000 |

Median Gross Sales | $1,100,536 | ~$1,300,000 |

Average Net Profit | $122,955 | $251,706 |

Median Net Profit | $114,549 | $223,236 |

Average Profit Margin | 10.6% | ~18% |

While these numbers indicate progress, the 2024 results are still below the peak years of 2021–2022, when average net profits reached $357,512. The company’s shift from rapid expansion to focusing on individual store profitability has helped stabilize performance, but it also suggests that the era of explosive growth may be over.

"The company's decline in unit volumes in 2023 intensified concern that the brand was a flash in the pan, a fad chain that got too big too quick."

– Jonathan Maze, Editor-in-Chief, Restaurant Business

For prospective investors, the key is to focus on median figures rather than averages. Success will largely depend on factors like the quality of the territory, operational know-how, and local market dynamics.

How to Evaluate Franchise Opportunities

Review Financial Documents and Projected Returns

Start by diving into the Franchise Disclosure Document (FDD) to analyze costs, obligations, and potential earnings. Pay particular attention to Item 19, which outlines financial performance data. For instance, Crumbl's 2024 FDD reveals that 858 franchised locations reported an average revenue of $1,354,688 and an average net profit of $251,706. However, only 43% of these locations met or exceeded the average, making it crucial to also consider the median net profit of $223,236, which better reflects typical outcomes since extreme top performers can skew averages.

It's also important to note that 201 locations were excluded from the 2024 data due to being too new or failing to report their earnings on time. For a clearer picture of upfront costs, review Item 7, which details the total investment range of $816,066 to $1,442,533. This includes a $50,000 franchise fee, $253,000–$291,000 for equipment, and $350,000–$700,000 for real estate and improvements. Additionally, franchisees must account for ongoing fees like an 8% royalty fee and a 2% national marketing fee, both based on gross sales.

To understand how these fees and other variables (like labor or ingredient costs) affect profitability, use a franchise financial calculator. Crumbl's estimated payback period ranges from 6.9 to 8.9 years, but this can vary depending on your local market and operational costs.

Once you've reviewed the numbers, consider how your specific market conditions might influence these projections.

Research Local Market Conditions

After assessing the financial side, it's time to evaluate your local market to ensure the franchise can thrive in your area. Crumbl's rapid expansion has, in some cases, led to stores opening very close to one another, which can dilute the customer base. Typically, Crumbl designs territories for populations between 40,000 and 150,000, though adjustments may be made for areas exceeding 100,000 residents.

Start by mapping out existing Crumbl locations and investigating nearby competitors, especially those offering rotating dessert menus. Since a single Crumbl cookie costs around $4, your market should have enough disposable income to sustain demand for what is essentially a premium treat.

Social media engagement can also provide clues about brand popularity. For example, TikTok likes on Crumbl's weekly flavor announcements dropped significantly, from 153,000 in June 2021 to 22,700 by June 2024. Visiting local stores during peak hours can give you a better sense of actual foot traffic and customer enthusiasm.

"All restaurants have to survive the ever-changing whims of consumers, but it becomes much more difficult when you essentially only sell one thing."

– Kevin Schimpf, Director of Industry Research, Technomic

Another factor to consider is compliance with local labor laws. In 2022, 11 Crumbl operators were fined for child labor violations. Make sure you're familiar with your state's regulations and prepared to invest in proper staff training to avoid similar issues.

Balancing financial insights with operational realities and local competition is key to making an informed decision.

Get Free Expert Guidance from Franchise Ki

Navigating franchise opportunities can be overwhelming, but Franchise Ki offers free consulting services to help you make sense of FDD details and secure funding. Founded by Bennett Maxwell, who successfully sold over 300 units of Dirty Dough Cookies in just two years, the Franchise Ki team brings valuable experience from both franchisor and franchisee perspectives [franchiseki.com].

Their services go beyond typical marketing materials, offering personalized franchise matching based on your goals, skills, and investment capacity. You'll gain access to pre-vetted opportunities and expert analysis of key FDD elements, such as the differences between average and median profit figures, territory saturation, and Crumbl's 10% fee structure.

Franchise Ki also provides guidance on funding strategies to help structure your investment effectively. They assist with due diligence, including verifying territory availability and negotiating terms. And because consultations are free, you can get professional insights without adding to your upfront costs.

Co-founder Liam Chase has helped clients grow from 13 units sold to nearly 70 units in just one quarter, demonstrating the impact of experienced guidance on franchise success [franchiseki.com]. Whether you're exploring a Crumbl franchise or considering other options, expert advice can help you avoid costly mistakes and align your choices with your financial goals. Making well-informed, data-driven decisions is essential to minimizing risks and maximizing potential in the competitive world of franchising.

Conclusion

Crumbl’s rapid rise and social media buzz drew plenty of attention, but recent dips in same-store sales and engagement highlight the unpredictable nature of market trends. What initially seemed like unstoppable momentum now reveals the challenges of sustaining consumer interest over time.

With hefty upfront costs and ongoing fees, investing in a Crumbl franchise requires a close look at the financials. Median profits can be misleading, as they often mask significant differences between locations. Add in territory saturation, waning social media traction, and the complexities of managing a workforce, and the risks become even clearer. This is not a business for the faint of heart - or for those who skip thorough research.

Before jumping in, take the time to carefully review the Franchise Disclosure Document (FDD) with expert guidance. Pay close attention to critical details like territory viability, local competition, and whether your market can realistically support a $4 cookie. Also, consider the operational realities of running a food service business, which can be far more demanding than the glossy marketing might suggest.

The bottom line? Let data guide your decision, not hype. Franchise Ki offers free consulting services to help you navigate the complexities of franchise investments. With insights from experienced founders - like Bennett Maxwell, who successfully sold over 300 Dirty Dough Cookies franchises in just two years - you’ll gain valuable advice on avoiding common pitfalls. By combining careful analysis with practical guidance, you can make smarter, more informed choices and avoid being swept up by fleeting trends.

FAQs

What financial risks should I consider before investing in a Crumbl franchise?

Investing in a Crumbl franchise involves significant financial risks, starting with the hefty upfront costs. You'll need between $300,000 and $500,000 to cover everything from franchise fees to store construction, equipment, and initial inventory. On top of that, Crumbl takes a 6% royalty on gross sales and a 2% marketing fee, which can cut into your profits. Since the business model relies heavily on selling large volumes of cookies, you'll also need enough working capital to cover operating expenses like labor, utilities, and ingredients - especially during the early months when sales may fall short of expectations.

Another issue is the uncertainty of earnings and market saturation. While Crumbl's popularity can attract customers, some franchisees report sales that don't meet projections, leaving them with slim profit margins after paying for expenses such as rent and payroll. The rapid rollout of new locations can also lead to competition between nearby stores, further affecting performance.

Franchisees may also encounter challenges tied to corporate policies and financial strain. Rising fees and strict operational requirements have left some franchisees feeling overwhelmed, increasing the likelihood of financial troubles. It's important to carefully weigh these risks and ensure you're fully prepared before committing to this investment.

How does market saturation affect the profitability of Crumbl franchises?

Market saturation is proving to be a major hurdle for Crumbl franchises, directly impacting their profitability. With the chain expanding at breakneck speed to over 1,100 locations across the U.S. and Canada, many stores have been set up uncomfortably close to one another. This has sparked competition among franchisees for the same pool of customers, leading to a noticeable drop in average store sales. To put it into perspective, the average revenue per store sank from $1.84 million in 2022 to $1.16 million in 2023, with some locations even reporting net losses exceeding $200,000.

Experts in the industry caution that such rapid growth and dense store placement make it increasingly difficult for individual franchises to maintain steady profits. Franchisees are not only grappling with startup costs that range between $816,000 and $1.44 million, but also dealing with tighter profit margins and heightened competition. If you're considering investing in a Crumbl franchise, it's crucial to weigh how market saturation might affect your ability to achieve consistent and sustainable earnings.

What challenges should I consider before investing in a Crumbl franchise?

Investing in a Crumbl franchise comes with its fair share of hurdles, and potential owners need to weigh these carefully before diving in.

From an operational standpoint, running a Crumbl location is no small feat. You’ll need to assemble and manage a team of skilled employees capable of handling the rotating menu and maintaining the fresh, high-quality experience that customers expect. This often translates into higher payroll expenses and juggling complex schedules, especially during peak times like evenings and weekends. On top of that, managing inventory for the weekly flavor changes requires accurate forecasting to minimize waste and keep food costs in check.

Financial challenges are another key consideration. The upfront investment ranges from $300,000 to $400,000, and there are ongoing royalty and advertising fees to account for. Profitability isn’t a given, and many franchisees struggle to break even if sales don’t meet expectations. Rapid expansion has also created issues in some areas, where market saturation has led to declining sales and higher lease costs. Additionally, Crumbl’s strict brand standards leave little room for tailoring the business to meet local market demands, which can further impact the bottom line.

Before committing, it’s essential to do your homework. Conduct thorough market research, create conservative cash flow models, and plan for potential challenges with staffing and supply chain disruptions. Careful preparation can make all the difference in navigating these obstacles.