Franchise Strategies

Dec 22, 2025

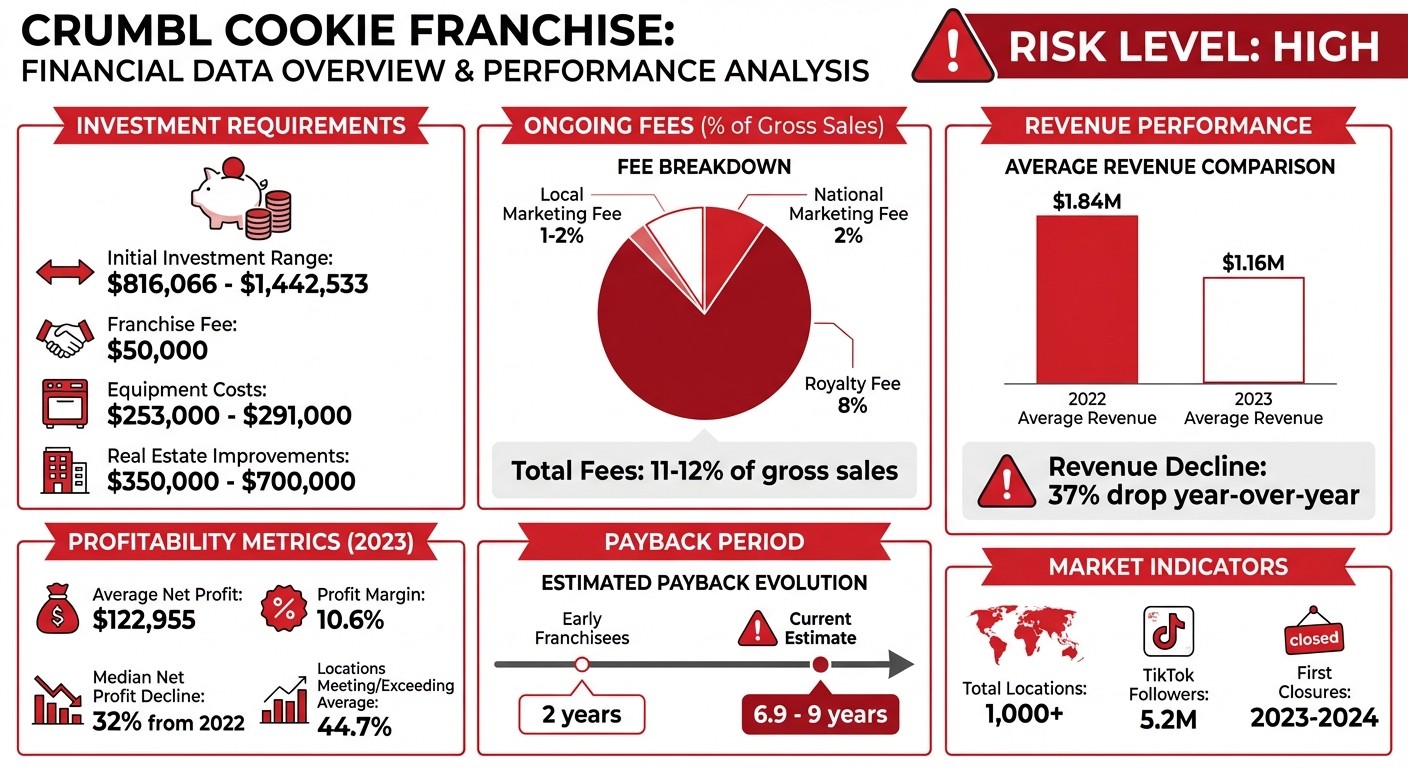

High upfront cost ($816K–$1.44M), heavy fees and falling revenue mean a long payback (7–9 yrs); trend-driven cookie franchising looks risky.

Initial investment: $816K–$1.44M, including a $50K franchise fee.

Ongoing fees: 8% royalty + 2% marketing fee.

Average revenue (2023): $1.16M, down from $1.84M in 2022.

Profit margin: Slim at 10.6%, with net profit averaging $122,955 in 2023.

Crumbl's model relies heavily on social media buzz and weekly menu changes, but declining revenue, market saturation, and rising costs are raising red flags. For franchisees, the payback period has stretched to nearly 7–9 years, making this a risky investment in a cooling market.

Before committing, analyze the latest Franchise Disclosure Document (FDD), evaluate your territory for oversaturation, and consider how a 20–30% sales dip could impact your bottom line.

The key takeaway? This trend-driven business model may not justify the high financial gamble.

Crumbl Cookie Franchise Investment Breakdown and Financial Performance 2022-2023

1. Crumbl Cookie Franchise

Initial Investment and Fees

Opening a Crumbl Cookie franchise requires a hefty financial commitment. Beyond the $50,000 franchise fee, franchisees are expected to invest between $253,000 and $291,000 on specialized equipment like mixers, ovens, and display cases tailored for Crumbl's signature open-kitchen layout. Real estate improvements can add another $350,000 to $700,000, depending on the location and the extent of the buildout required.

On top of these initial costs, ongoing fees can significantly eat into earnings. Franchisees pay an 8% royalty on gross sales, regardless of whether the business is profitable. Additionally, there’s a 2% national marketing fee and a local marketing fee ranging from 1% to 2%, meaning around 11% of gross sales is deducted before covering essential expenses like rent, labor, and ingredients. To put this into perspective, in 2023, the average Crumbl location generated $1,156,838 in revenue but only managed a net profit of $122,955 - a slim margin of 10.6%. This narrow profit cushion leaves little room for setbacks or underperformance.

Such steep costs demand franchisees to maintain constant operational momentum to stay viable.

Business Model Sustainability

Crumbl's business model thrives on its ability to generate buzz, primarily through its weekly flavor drops. Every Sunday night, a new menu is revealed, which not only drives customer traffic but also brings operational challenges. Each week requires new SKUs, fresh ingredient orders, and updated staff training to keep up with the rotating offerings. As Patrick Moradkhani explained, “It takes a lot of control to [rotate the menu]. You have to be committed to the brand to not cheat on it... even if the numbers tell us otherwise”.

However, cracks are beginning to appear in this model. Profitability has been declining, and 2023 and 2024 marked the first permanent closures of Crumbl locations. With over 1,000 stores now competing for attention on social media, market saturation is becoming a real issue, further straining individual franchise performance.

Historical Performance of Similar Trends

The food industry has seen similar patterns before, and history offers a cautionary tale. Frozen yogurt chains, for example, saw massive growth in the 2010s before fading as the novelty wore off. Crumbl's heavy reliance on TikTok trends and Instagram-worthy aesthetics leaves it vulnerable to changes in social media algorithms and shifting consumer preferences. As more people prioritize health and the $5-per-cookie price point shifts purchases from impulsive to planned indulgences, customer visit frequency naturally declines.

In 2023, only 44.7% of Crumbl locations managed to meet or exceed the system’s average revenue of $1.15 million. With prime territories already claimed, new franchisees often face the challenge of buying resales of existing locations or opening in less desirable markets. The real question is not whether Crumbl as a brand will survive, but whether a specific location can generate enough sales to justify the seven-figure investment in an increasingly competitive and cooling market.

2. Other Trend-Driven Food Franchises (Krispy Kreme)

Initial Investment and Fees

Opening a Krispy Kreme franchise requires a much larger financial commitment compared to Crumbl. The initial investment ranges from $622,500 to $4,330,000. However, the franchise fee is significantly lower, between $12,500 and $25,000, while Crumbl’s fee stands at $50,000. Despite the higher upfront costs, Krispy Kreme franchises tend to outperform in revenue, with an average annual income of $3,096,515, compared to Crumbl’s $1,156,838 in 2023. The estimated payback period for a Krispy Kreme franchise is between 6.4 and 8.4 years.

Although the franchise fee is more affordable, the overall investment required for Krispy Kreme is significantly higher. This creates a different level of financial risk for potential franchisees, which should be carefully weighed when considering long-term profitability and sustainability.

Business Model Sustainability

Krispy Kreme’s expansion in the early 2000s serves as a cautionary tale for trend-driven businesses. During that period, rapid growth into grocery and convenience stores sometimes led to issues with product quality, as unsold doughnuts lingered on shelves. While the initial excitement brought in customers, the demand eventually dropped as people became more conscious of consuming high-sugar treats.

To address these challenges, Krispy Kreme evolved into an omnichannel brand, delivering fresh products daily to off-site locations and teaming up with major chains like McDonald’s. This strategic pivot has paid off, contributing to a 32% increase in system sales since 2019. However, the company’s experience highlights the risks of rapid expansion without a sustainable growth plan.

Historical Performance of Similar Trends

The struggles of other trend-driven franchises, like the frozen yogurt craze of the mid-2000s, offer valuable lessons. That boom led to market saturation and widespread closures. Smaller markets, in particular, struggled to sustain multiple dessert shops. As Jennifer Allen of The Associated Press noted:

"Smaller markets could not support multiple high-volume dessert shops. Instead of expanding demand, new stores often divided it".

This underscores a key risk: rapid growth in trend-based businesses can split existing demand rather than creating new markets. While social media buzz can drive an initial surge in traffic, it doesn’t guarantee long-term profitability. As the novelty wears off, maintaining strong unit economics becomes a challenge. The takeaway? Franchises heavily reliant on trends face significant risks if expansion outpaces genuine market demand.

Is Crumbl Cookies a Good Franchise Investment?

Pros and Cons

Crumbl boasts an impressive 5.2 million TikTok followers, surpassing the combined followings of McDonald's (2.1M), Starbucks (1.8M), and Wendy's (1.3M). This massive presence acts as a built-in marketing powerhouse, significantly reducing the need for traditional advertising. On top of that, their weekly rotating menu transforms a simple bakery visit into a social media-worthy event, encouraging repeat customers through the allure of limited-time offerings. Operationally, Crumbl’s focus on cookies simplifies training and inventory management compared to full-service restaurants. But alongside these advantages come notable challenges that can’t be ignored.

One major hurdle is market saturation. Jennifer Allen of The Associated Press highlighted this issue, stating:

"Crumbl's biggest threat came from within. As stores multiplied... foot traffic thinned and spread out".

The numbers back this up. Average unit volumes (AUV) dropped from $1.84 million in 2022 to $1.16 million in 2023, and median net profit took a hit, falling by roughly 32%. Recent store closures further emphasize the risks tied to oversaturation.

Another challenge is the high cost of entry and ongoing fees. Initial investment ranges from $816,066 to $1,442,533, while royalties and marketing fees total 10–12% of gross sales. In 2023, the average net profit was just $122,955, leaving franchisees with a slim 10.6% margin, which offers little room for error if sales dip. Jonathan Maze, Editor-in-Chief of Restaurant Business, summed up the risk:

"The problem, however, is the curiosity customer. A new Crumbl opens, people try it. And then they don't order cookies again for a long time".

To better understand these dynamics, here’s a comparison:

Factor | Crumbl Cookie Franchise | Other Trend-Driven Franchises |

|---|---|---|

Initial Investment | $816K – $1.44M | Varies (often lower for kiosks) |

Average Revenue (2023) | $1,156,838 | Varies |

Net Profit Margin | 10.6% | Varies |

Market Saturation Risk | High (1,000+ locations) | High due to trend reliance |

Business Longevity | Declining AUV trend | Dependent on sustained interest |

This table highlights how Crumbl’s high upfront costs and shrinking margins amplify market challenges. Both Crumbl and similar trend-driven franchises face the same core issue: maintaining momentum after the initial social media buzz fades. For Crumbl, the payback period has ballooned from an estimated 2 years to 6.9 to 8.9 years, as rising costs and declining revenues take their toll. With nearly $1 million required upfront, potential franchisees need to weigh these risks carefully before committing.

Conclusion

Putting over $816,000 into a Crumbl Cookie franchise comes with notable risks for potential franchisees. The financial data reveals some troubling trends: average store revenue fell from $1.84 million in 2022 to $1.16 million in 2023, while the median net profit saw a decline of about 32% in the same timeframe. Jonathan Maze, Editor-in-Chief of Restaurant Business, highlighted the gravity of the situation:

"A per-store net profit of less than $80,000 isn't all that far away from closure."

Crumbl’s heavy dependence on weekly flavor rotations and its 5.2 million TikTok followers creates a business model that’s vulnerable to external factors beyond a franchisee’s control. Adding to this, the 8% royalty fee and 2% marketing fee further chip away at already thin profit margins. These factors, combined with the broader challenges explored earlier, paint a picture of a business model fraught with instability.

Early franchisees may have recouped their investments within two years, but shifting market dynamics have significantly lengthened that timeline. If you're considering investing over $800K in a franchise, it's critical to do your homework. Carefully examine Items 5, 6, 7, and especially Item 19 of the latest Franchise Disclosure Document (FDD) to get a clear understanding of costs and actual performance data. Also, assess whether the territory you’re eyeing is oversaturated and run financial simulations to see how a 20–30% drop in sales could impact your bottom line.

Given the risks, seeking expert advice is essential. Franchise consulting services like Franchise Ki provide professional guidance, free consultations, and access to pre-screened franchise opportunities. With so many uncertainties at play, partnering with experienced consultants can help you determine if this investment aligns with your financial goals. Make sure your decision is grounded in sound financial analysis, not fleeting social media trends.

FAQs

What are the potential risks of investing in a Crumbl Cookie franchise?

Investing in a Crumbl Cookie franchise involves some notable risks, largely tied to the substantial initial costs and the brand's dependence on fleeting trends. Opening a franchise requires a hefty investment ranging from $460,166 to $1,266,333, which includes a $50,000 franchise fee and additional expenses for multi-unit development plans. These upfront costs can leave franchisees exposed if sales begin to drop.

Crumbl’s success leans heavily on its rotating menu and social media buzz - both of which can be unpredictable. Reports have pointed to challenges like falling unit sales, operational hurdles, and tight profit margins, all of which can make it difficult for franchisees to maintain consistent profitability. On top of that, securing a prime location is crucial. A less-than-ideal spot may struggle to draw enough customers to offset the high operating costs.

While Crumbl has certainly captured attention and built a strong following, its reliance on trends and the significant financial commitment required make it a potentially risky venture for new franchisees.

How does Crumbl's focus on social media and weekly flavor changes affect its long-term success?

Crumbl has mastered the art of using social media and weekly menu updates to keep customers engaged. Every Sunday, they reveal six new cookie flavors, sparking excitement on platforms like TikTok and Instagram. This approach not only draws in repeat customers but also gives a noticeable boost to short-term sales. However, this constant rotation of flavors creates unique challenges for franchise owners, including the need for frequent staff training and juggling an ever-changing inventory of ingredients within tight timeframes.

While the weekly buzz helps the brand stay in the spotlight, it comes with risks. The initial excitement can wear off, and any dip in online engagement could hurt sales and strain operations. To keep the momentum going, franchisees have to consistently invest in marketing efforts, staff development, and inventory planning - tasks that can become increasingly demanding over time.

What should you know before investing in a Crumbl Cookie franchise?

Investing in a Crumbl Cookie franchise is no small decision - it comes with a hefty financial commitment. The initial investment ranges from $460,166 to $1,266,333, which includes a franchise fee between $246,000 and $265,000. For those considering a multi-unit development, there’s an extra $50,000 per unit reservation fee, with a minimum of three units required. While the average annual sales hover around $1.15 million, profit margins can be tight, so it’s important to carefully weigh the potential return on investment.

With over 1,000 locations spread across the U.S. and Canada, finding an ideal territory might be tricky. Prime, high-traffic areas are often already taken, and competition among franchisees for the remaining locations can be fierce. Before moving forward, it’s critical to confirm both the availability and the quality of the territory you’re eyeing.

Another factor to think about is the sustainability of Crumbl’s trend-focused business model. While the brand has grown rapidly, expansion has slowed, and some locations have even closed, raising questions about its long-term stability. Before committing, prospective franchisees should thoroughly review the Franchise Disclosure Document, assess local market demand, and prepare for potential ups and downs in sales. This due diligence is key to ensuring the investment aligns with your financial and business objectives.