Franchise Strategies

Dec 30, 2025

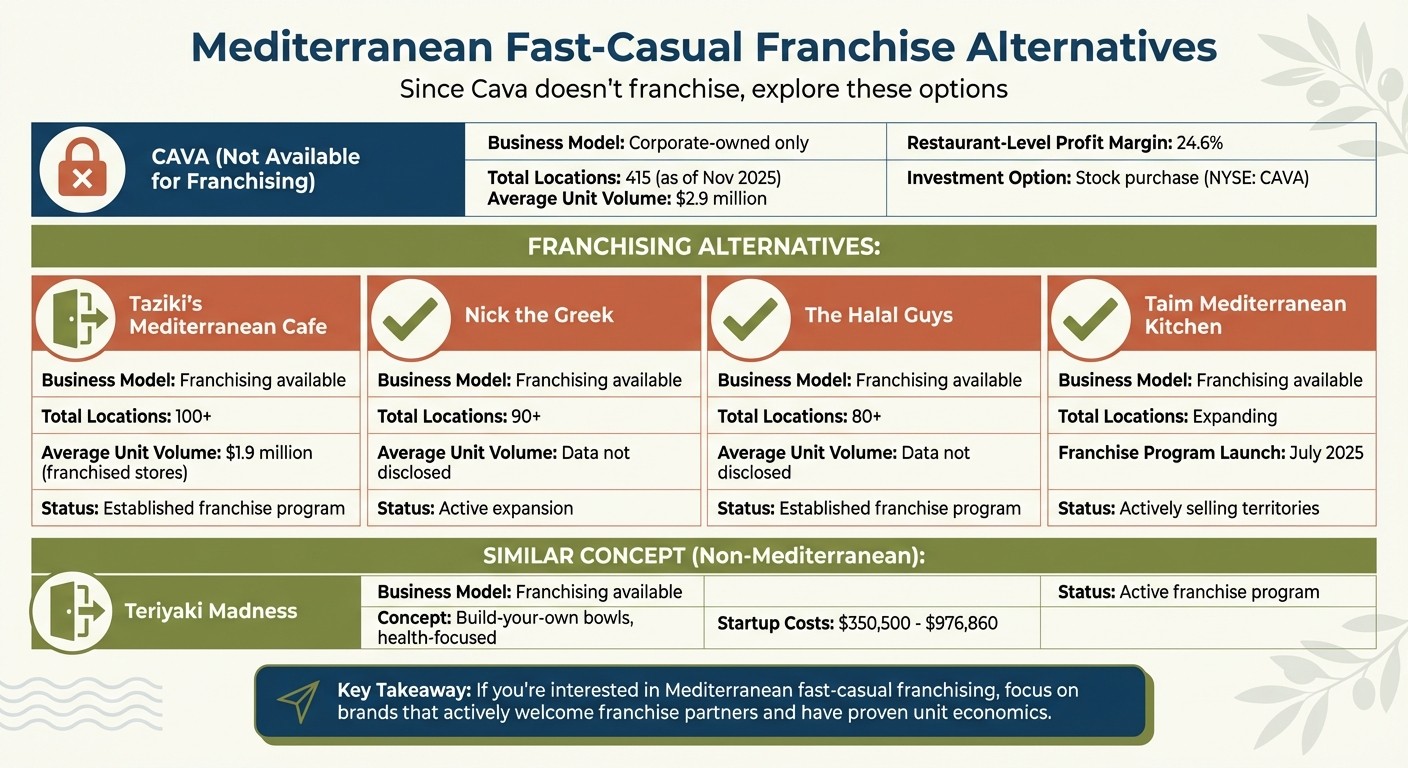

Cava is corporate-owned and doesn't franchise. Learn how fast-casual saturation affects investors and which Mediterranean brands offer franchise alternatives.

Cava is a fast-casual Mediterranean dining brand known for its customizable bowls and rapid growth, but it does not offer franchise opportunities. Instead, the company operates all 415 locations under corporate ownership and plans to expand to 1,200 by 2033. While its success is evident with an average unit volume (AUV) of $2.9 million in 2024, the broader fast-casual market is facing challenges like saturation, slower traffic, and intense competition.

Key takeaways:

Cava's business model: Fully corporate-owned, no franchising available.

Market challenges: Saturation, flat traffic, and reliance on loyalty programs and discounts.

Alternatives for franchise investors: Brands like Taziki's, Nick the Greek, and Taim offer Mediterranean franchise opportunities.

For aspiring franchisees, evaluating local competition and market conditions is essential, especially as the fast-casual segment faces slowing growth and tighter consumer spending.

Why Fast-Casual Just Collapsed

Cava's Business Model: No Franchising Available

Mediterranean Fast-Casual Franchise Alternatives to Cava: Comparison Chart

Cava's Company-Owned Location Strategy

Cava has made it clear that franchising isn't part of their business plan and has no intentions of offering franchise opportunities. Instead, the company operates entirely with corporate-owned locations, a strategy they’ve embraced as a core principle.

As of November 2025, Cava runs 415 restaurants across the United States, marking a 17.9% year-over-year growth. Looking ahead, the company aims to reach 1,000 locations by 2032, all of which will remain under corporate ownership. This approach is similar to brands like Chipotle and In-N-Out Burger, which maintain tight control over their operations to ensure consistency and quality.

This corporate model allows Cava to enforce high standards across all locations and quickly implement changes system-wide. For example, Cava manages its own production facilities to ensure that its signature sauces and spreads are made with fresh ingredients. Additionally, the company is introducing "Project Soul" store redesigns, which feature warmer colors and more comfortable seating, to all new locations by the end of 2026.

The financial numbers back up this strategy. Cava boasts a restaurant-level profit margin of 24.6% and an average unit volume of $2.9 million. Owning all their locations means they keep full control over profits, rather than sharing revenue with franchisees. CFO Tricia Tolivar emphasized this point, stating, "Our restaurant level profits are strong and growing, so as we continue to open more and more restaurants, that will continue to expand".

While this approach ensures consistency and profitability, it also means no opportunities for franchise partnerships.

What This Means for Potential Franchisees

Cava's commitment to corporate ownership means it's not an option for franchise investors. For those interested in the brand, the only financial involvement available is through purchasing its stock on the NYSE under the ticker symbol CAVA.

If you're drawn to Mediterranean cuisine and are seeking franchise opportunities, there are other options to consider. For instance:

Taziki's Mediterranean Cafe: Operates over 100 locations with an average unit volume of $1.9 million for franchised stores.

Nick the Greek: Boasts more than 90 locations.

The Halal Guys: Runs over 80 units.

Taim Mediterranean Kitchen: Launched its franchise program in July 2025 and is actively selling territories.

For those more interested in Cava's customizable bowl concept rather than the Mediterranean focus, brands like Teriyaki Madness offer a similar health-focused, build-your-own meal model. Startup costs for this franchise range from $350,500 to $976,860.

Ultimately, the key is identifying what aspect of Cava’s appeal resonates with you - whether it’s the Mediterranean menu, the bowl format, or the focus on healthy eating - and finding franchised brands that align with those interests. Exploring these alternatives can help entrepreneurs find investment opportunities that welcome franchise partners, saving time and effort otherwise spent on a brand like Cava, which remains firmly corporate-owned.

Fast-Casual Market Saturation: Main Challenges

Competition in the Healthy Fast-Casual Category

The fast-casual industry, particularly the Mediterranean and health-focused niche, is feeling the strain of market saturation. With so many players vying for the same health-conscious audience, standing out has become increasingly difficult, and building customer loyalty is an uphill battle.

Mark Wasilefsky, Head of TD Bank's Restaurant Franchise Finance Group, summed up the challenge:

"Mediterranean food is going to continue to grow... But if you're going to open up and a Cava is going to open down the street, it's going to be a real concern."

The numbers tell the story. Over the past decade, the fast-casual sector has nearly doubled, growing from 27,925 locations in 2015 to a projected 44,098 by 2025. But this rapid expansion has come at a cost. Traffic growth has slowed significantly, dropping from 3.3% in December 2024 to just 1.7% by October 2025. For example, Cava reported flat traffic in October 2025 and adjusted its full-year same-store sales expectations from 4–6% to 3–4% [9, 13]. The overcrowded market has not only diluted customer loyalty but has also pushed brands into fierce pricing battles and promotional tactics to stay competitive.

Financial Costs in Saturated Markets

Breaking into the healthy fast-casual space requires a hefty financial commitment, and saturated markets only amplify cost pressures. Aggressive promotions have become the norm, squeezing profit margins. Brett Schulman, CEO of Cava, described the current climate bluntly:

"Today's landscape is the most intense discount environment since the Great Recession."

Promotions now influence the dining choices of two-thirds of consumers, and loyalty programs have become a critical strategy, with 59% of fast-casual chains adopting them. However, these efforts come at a price. Cava, for instance, saw its net income drop to $14.7 million in Q3 2025, down from $17.9 million the previous year, and the company had to lower its profit margin projections to a range of 24.4% to 24.8% [2, 9, 13].

Operating Difficulties in Crowded Markets

The challenges don’t stop at finances - operational hurdles are also mounting. With so many similar options available, keeping customers loyal is a tough task. Younger consumers, particularly those aged 25 to 34, are visiting less often due to financial pressures like high unemployment, student loan repayments, and inflation [3, 9, 2]. Gen Z unemployment is reportedly double the national average.

Tricia Tolivar, CFO of Cava, pointed out:

"The 25- to 34-year-old consumer seems to be impacted a bit more than others, and fast casual tends to have a higher concentration of those consumers within their guest portfolio."

Adding to the strain, nearly 40% of consumers now feel fast-casual dining is too expensive. This perception forces brands to walk a fine line between maintaining competitive prices and protecting their margins. While Quick Service Restaurants (QSRs) have improved their value scores by 4% between 2021 and 2025, fast-casual restaurants have only seen a modest 1% increase.

Quality control is another pressing issue. For instance, in 2024, The Halal Guys had to close 8 out of their 88 franchised locations due to subpar food quality, a decision necessary to preserve the brand's reputation. This highlights the ongoing operational challenges brands face in maintaining standards while navigating a crowded and competitive market.

How to Assess Market Viability Before Investing

Metrics to Measure Market Potential

When evaluating the potential of fast-casual investments, certain metrics are crucial. For example, Average Unit Volume (AUV) reflects the revenue generated by each location. Take Cava, for instance: its AUV rose from $2.6 million in late 2023 to $2.9 million by late 2025, with newer locations reporting over $3 million.

Another key metric is same-store sales growth, which shows how well existing locations are performing. In 2023, Cava saw a 17.9% increase in same-store sales, though this growth is expected to moderate to 3%–4% by fiscal 2025. It’s important to understand whether growth is driven by increased customer traffic or merely higher prices - stagnant traffic could indicate market saturation.

You’ll also want to examine the restaurant-level profit margin (RLM), which measures profitability before accounting for corporate expenses. A strong RLM in the fast-casual sector typically hovers around 25%, and Cava hit this mark, coming close to Chipotle’s 26.7%. Other critical factors include the digital revenue mix and free cash flow. Brands that can fund expansion without relying heavily on debt are generally better equipped for long-term success[7, 13].

By focusing on these metrics, you can better gauge whether your investment strategy can thrive in a competitive or saturated market.

Ways to Stand Out in a Saturated Market

In markets teeming with competitors, carving out a niche is essential. Brett Schulman, CEO of Cava, describes their approach:

"CAVA is creating and defining the next major cultural cuisine category with substantial white space opportunity."

Rather than blending in as just another healthy dining option, brands can define themselves through unique offerings. For example, Taim specializes in Israeli street food, while Sweetgreen emphasizes a protein-focused menu with detailed macronutrient tracking. Menu innovation is another way to attract attention. Many brands are introducing high-protein, premium items like grilled steak or salmon to appeal to health-conscious diners willing to spend more[2, 3].

The in-store experience also plays a pivotal role. While digital ordering is growing, about 64% of Cava’s customers still prefer dining in. Initiatives like Cava’s "Project Soul" enhance the ambiance with warmer lighting, softer seating, and greenery to create a welcoming atmosphere[2, 8]. Investing in technology, such as Kitchen Display Systems and high-speed ovens, can improve order accuracy and speed[2, 13]. Additionally, tiered loyalty programs encourage repeat visits without relying on discounts that could harm the brand’s perceived value[2, 3].

Finding Alternative Opportunities with Franchise Ki

In today’s crowded fast-casual market, identifying the right franchise opportunities has become more important than ever.

How Franchise Ki Helps You Find Franchises

Since Cava operates exclusively with company-owned locations, investors looking for franchised Mediterranean fast-casual options need to explore alternatives. That’s where Franchise Ki steps in. This platform offers free consulting and personalized matching services, connecting you with vetted franchise opportunities like Taziki's, Taim, Nick the Greek, and The Hal. Additionally, they provide funding guidance to help you meet the financial requirements for your investment.

The team behind Franchise Ki brings a wealth of franchising expertise. For instance, Bennett Maxwell’s success with Dirty Dough Cookies and Liam Chase’s track record of rapid unit expansion demonstrate their deep understanding of the industry.

But Franchise Ki doesn’t stop at just finding opportunities - it also helps reduce the risks involved in franchise investments.

Advantages of Using Franchise Ki

One key benefit of working with Franchise Ki is reducing investment risks. With the fast-casual bowl market experiencing a slowdown - evidenced by softer traffic reported by major players like Cava and Chipotle in late 2025 - having expert guidance can help you avoid oversaturated segments. Franchise Ki’s database is carefully curated to exclude unproven or unstable business models, giving you a better chance of success.

Another advantage is the ongoing support they provide throughout the entire process. From performing due diligence to assisting with negotiations, Franchise Ki ensures you have the insights you need to evaluate critical metrics like Average Unit Volume, same-store sales growth, and profit margins. This hands-on support empowers you to make informed, confident decisions about your franchise investments.

Conclusion: Making Smart Franchise Choices

The fast-casual dining sector is facing a slowdown. For instance, Cava's Q3 same-store sales growth came in at just 1.9%, with flat traffic numbers. This reflects broader industry challenges, including reduced dining activity among 25- to 35-year-olds, partly driven by high Gen Z unemployment rates. The "bowl boom" that fueled rapid growth in 2024 has lost its momentum, impacting the entire sector - not just Cava. For potential investors, this underscores the importance of thoroughly evaluating the market before committing capital.

If you're eyeing Cava specifically, it's important to note that franchising isn't an option. The company remains entirely corporate-owned. So, if you're interested in the Mediterranean fast-casual space, you'll need to explore other franchise-friendly brands.

Market research is more critical than ever. Before diving into any franchise investment, take a close look at local demographics, nearby competitors within a three-mile radius, and the brand's ability to sustain traffic without heavy reliance on discounts. As Mark Wasilefsky of TD Bank pointed out:

"Mediterranean food is going to continue to grow... But if you're going to open up and a Cava is going to open down the street, it's going to be a real concern."

These factors not only guide your decision-making but also highlight the value of exploring franchises with a proven track record. Alternatives like Taziki's (boasting $1.9 million in average unit volumes for franchised locations), Nick the Greek, and Taim are actively expanding and offer genuine franchise opportunities. With resources available for due diligence, funding support, and market analysis, you can identify promising opportunities in less crowded segments and avoid the risks of entering oversaturated markets.

Given the trends and competitive pressures outlined, making informed decisions starts with digging deeper into the numbers and evaluating the support and returns each opportunity offers. In today’s market, success lies in looking beyond surface-level metrics and focusing on the factors that truly drive growth.

FAQs

Why doesn’t Cava offer franchise opportunities?

Cava has opted to expand exclusively through company-owned locations, steering clear of franchising. This decision allows the brand to retain complete control over its menu, pricing strategies, technology, and the overall customer experience - key elements that distinguish it in the Mediterranean fast-casual dining space.

The company’s leadership has also pointed to challenges in the fast-casual sector, such as slower market growth and stagnant customer traffic, as reasons for avoiding the franchising route. By focusing on internal growth, Cava ensures consistency across its locations and avoids the potential pitfalls of brand dilution that often come with franchising.

In essence, Cava’s approach prioritizes deliberate, quality-driven expansion while safeguarding its brand identity.

What challenges does the fast-casual dining market face today?

The fast-casual dining industry is navigating some tough hurdles that are making it increasingly difficult for brands to thrive. One major challenge is market saturation. With more fast-casual restaurants popping up, competition for the same pool of customers has intensified. To grab attention, brands need to offer something distinct, whether that's a standout menu item, exceptional service, or a memorable dining experience.

On top of that, the industry's growth has hit a plateau. Many restaurants are seeing little to no increase in sales or foot traffic. Economic factors are also squeezing the market, as tighter consumer budgets mean people are dining out less often. Together, these issues - crowded competition, slower growth, and reduced spending - are creating a tough landscape for fast-casual businesses like Cava to navigate.

How can I find a profitable franchise opportunity in a crowded fast-casual market?

To pinpoint a promising franchise opportunity in a crowded market, start by diving into the brand’s performance metrics. Pay attention to trends like steady or increasing same-store sales and customer traffic - these are clear signs of sustained demand. On the flip side, flat or declining numbers might hint at market saturation or other challenges. Don’t forget to assess the brand’s unique selling points - whether it’s standout menu offerings, cutting-edge technology, or streamlined operations. These can give the franchise an edge in a competitive landscape.

It’s equally important to examine the financial health and investment requirements of the franchise. Go through the Franchise Disclosure Document carefully to understand fees, royalties, and the initial investment needed. Take the time to talk with existing franchisees to get insights into profitability, the franchisor's support system, and the reliability of the supply chain. Lastly, compare the franchise’s target audience with your local market demographics. Make sure there’s enough demand in your area and that competition isn’t too stiff. By weighing these factors, you’ll be better equipped to choose a franchise with great potential for success.