Business Strategies

Dec 31, 2025

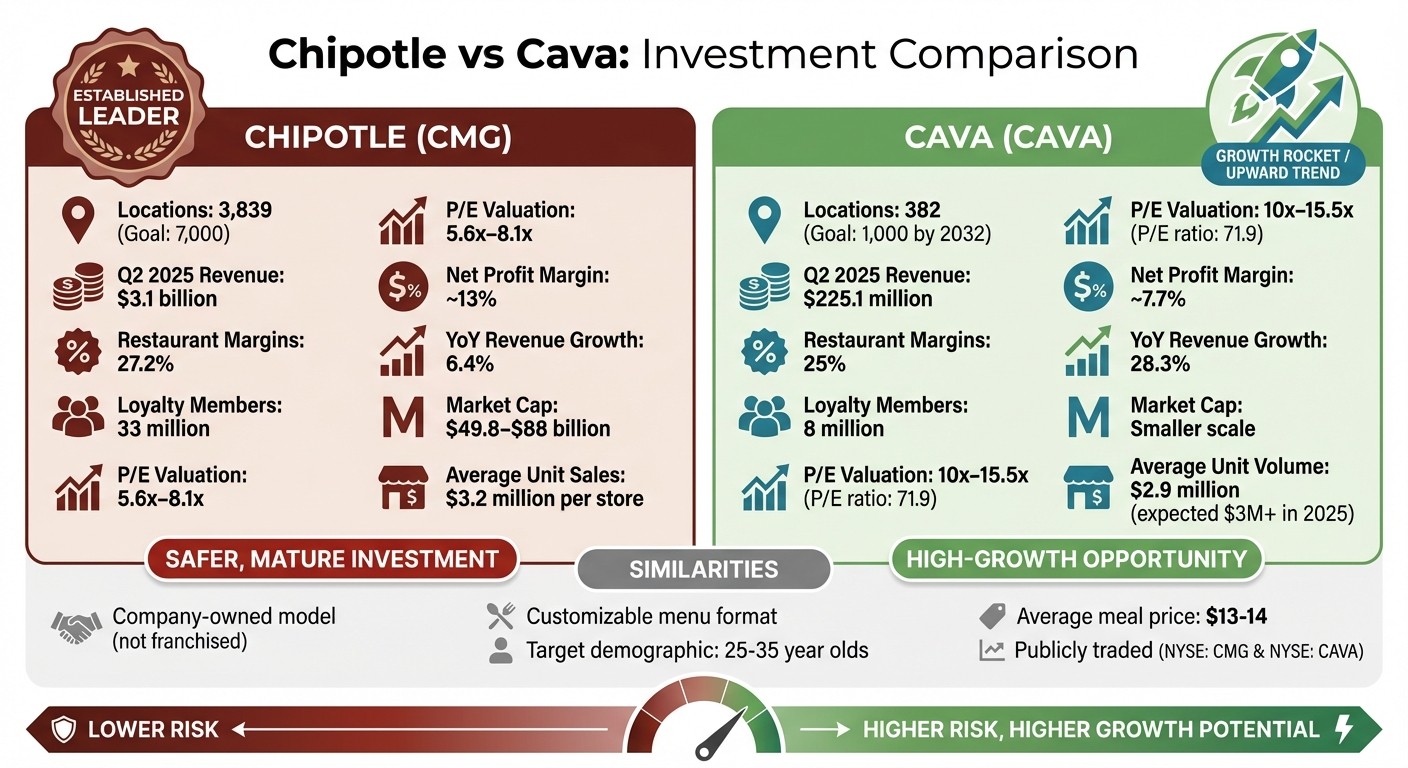

Compare Cava and Chipotle: locations, margins, growth plans and valuations to weigh stable value versus higher-growth risk.

Chipotle dominates the fast-casual dining market with nearly 4,000 locations and impressive financial performance. Cava, a Mediterranean-inspired chain with 382 restaurants, is emerging as a promising competitor. While Chipotle offers stability and scale, Cava shows growth potential but faces higher risks. Here's a quick breakdown:

Chipotle: Established leader, $3.1 billion in quarterly revenue, 27.2% margins, expanding to 7,000 locations.

Cava: Rapid growth, 28.3% YoY revenue increase, plans for 1,000 locations by 2032, but smaller scale and higher valuation risks.

Key takeaway: Chipotle is a safer, mature investment, while Cava appeals to those seeking growth opportunities with higher risk. Both brands are adapting to challenges like reduced consumer spending among younger diners.

Quick Comparison

Factor | Chipotle (CMG) | Cava (CAVA) |

|---|---|---|

Locations | 3,839 (goal: 7,000) | 382 (goal: 1,000 by 2032) |

Revenue (Q2 2025) | $3.1 billion | $225.1 million |

Margins | 27.2% | 25% |

Loyalty Members | 33 million | 8 million |

Valuation (P/E) | 5.6x–8.1x | 10x–15.5x |

Both brands share a company-owned model and customizable menus, but Chipotle's scale offers efficiency, while Cava's growth trajectory comes with valuation challenges. Choose based on your risk tolerance and investment goals.

Chipotle vs Cava Investment Comparison: Key Metrics and Financial Performance

1. Chipotle

Market Positioning

Chipotle’s extensive network of 3,839 locations - with a goal to reach 7,000 - gives it a significant edge in the fast-casual dining space. This scale allows the company to negotiate better prices for ingredients, thanks to bulk purchasing, and to spread marketing costs across thousands of restaurants. As stock analyst Neil Patel puts it:

"Chipotle has a more visible brand, and its huge sales base allows it to better leverage marketing, product, and technological investments".

Chipotle positions itself as a value-driven option, offering generous portions for around $13 to $14 per meal. This pricing often makes it more affordable than competitors without sacrificing quality. The company’s loyalty program, with an impressive 33 million members, further solidifies its market dominance. These advantages are the foundation for an efficient and scalable operational model.

Operational Strategies

Chipotle’s operational success lies in its simplicity. The brand’s efficient assembly-line setup reduces waste and speeds up service. By owning and operating all its restaurants, Chipotle ensures consistent quality across locations. This approach has led to strong results, with average unit sales reaching $3.2 million per store in early 2025 and restaurant-level margins of 26.7%.

Technology plays a pivotal role in Chipotle’s strategy. Its Chipotlanes - digital-order drive-thrus - are now in over 500 locations, and the company plans to include this feature in 80% of its new openings. Chief Development Officer Tabassum Zalotrawala highlights their importance:

"Chipotlanes are the digital drive thru of the future and a key piece of our growth strategy as we plan to more than double our restaurant count over the long term to achieve 7,000 restaurants or more in North America".

Chipotle is also introducing advanced tools like AI-powered kitchen systems, automated produce slicers, and dual-sided planchas to improve consistency and reduce labor challenges. Its scale not only enhances operational efficiency but also strengthens its supply chain, leading to better profit margins over time.

Financial Performance

Chipotle’s financial performance continues to impress. In Q3 2024, revenue hit $2.79 billion, reflecting a 13% year-over-year growth, with restaurant-level operating margins at 27.2%. By the end of 2024, the company’s market capitalization reached approximately $88 billion. In Q1 2025, Chipotle opened 57 new restaurants, showcasing its disciplined and scalable growth approach. These numbers cement Chipotle’s position as a leader in the fast-casual dining industry.

Customer Appeal

Chipotle’s ability to connect with younger consumers is a key factor in its success. CEO Scott Boatwright notes:

"We tend to skew younger and slightly over-indexed to this group relative to the broader restaurant industry... the group has become more cautious about discretionary spending".

To address slowing traffic among Gen Z diners in 2025, Chipotle launched targeted promotions like TikTok challenges and a Halloween special offering $6 entrees for costumed guests after 3:00 p.m.. President and Chief Brand Officer Chris Brandt emphasizes:

"Our results show that when we create engaging experiences for our rewards members, they come more often and their spend increases".

The enduring appeal of Chipotle’s customizable "build-your-own-bowl" concept also plays a big role in customer satisfaction. This approach allows diners to tailor their meals while keeping operations streamlined and efficient.

2. Cava

Market Positioning

Cava is carving out a strong niche in the fast-casual dining world by spotlighting Mediterranean cuisine as the next big trend in the industry. With 367 restaurants as of late 2024 - about 10% of Chipotle's footprint - Cava is still in its expansion phase but gaining impressive traction. The company has ambitious plans to scale up to 1,000 locations by 2032, focusing on both well-established areas and untapped regions in the Midwest and South.

One of Cava's standout strategies is its vertical integration, which allows the company to produce its own dips and spreads, ensuring consistent quality across all its locations. Harendra Ray, an analyst at Zacks Investment Research, highlights this approach:

"The company is successfully positioning Mediterranean cuisine as the next major cultural category, attracting strong traffic across regions and demographics."

Cava’s "walk-the-line" assembly style, which lets customers customize bowls, pitas, and salads, mirrors the model that has worked so well for Chipotle. Most of its locations are strategically situated in high-traffic areas to capture the fast-casual crowd. On top of that, Cava’s loyalty program has grown to nearly 8 million members by mid-2025, further solidifying its connection with customers. Together, these strategies are driving Cava’s rapid growth and operational success.

Operational Strategies

Cava is making waves with an average unit volume (AUV) of $2.9 million in late 2024, expected to surpass $3 million in 2025. Its restaurant margins, hovering around 25%, are nearly on par with Chipotle’s.

The acquisition of Zoes Kitchen in 2018 gave Cava a significant boost, providing 145 locations for conversion and a strong foothold in the South. The company is also experimenting with innovations like digital-only kitchens and "Cava Pick-up" lanes for online orders, following the lead of Chipotle’s Chipotlanes. Rather than pouring resources into robotics, Cava is leveraging AI video technology to enhance digital order accuracy and optimize labor schedules.

New restaurants, which cost about $1.4 million to build, typically recoup their investment within two years - a rapid turnaround in the restaurant world. CFO Tricia Tolivar underscores the company’s focus on sustainable growth:

"Our restaurant level profits are strong and growing... we've made robust investments in technology, people from a real estate, design and construction standpoint... to make sure that we could sustain the growth."

Financial Performance

Cava’s financial metrics reflect strong growth, though not without some volatility. In Q4 2024, the company reported a 21.2% spike in same-store sales. Quarterly revenue reached $225.1 million, marking a 28.3% year-over-year increase. The mid-2024 introduction of grilled steak proved to be a pivotal move, driving both customer traffic and higher sales.

Analyst Geoffrey Seiler from The Motley Fool compares Cava to an early-stage Chipotle:

"Cava looks a lot like early-stage Chipotle with rapid same-store sales growth and top-notch RLMs."

However, by late 2025, the fast-casual bowl trend hit a bump as younger consumers began cutting back on discretionary spending. This shift contributed to a 60% drop in Cava’s stock value. To adapt, the company implemented a modest 1.7% menu price increase in January 2025, which it plans to keep as the only hike for the year. Cava’s forward price-to-sales ratio of 10x–15.5x, though higher than Chipotle’s 5.6x–8.1x, reflects investor confidence in its growth potential.

Customer Appeal

Cava’s core audience is 25- to 35-year-olds, a demographic that also forms the backbone of Chipotle’s customer base. CEO Brett Schulman explains:

"We tend to skew younger and slightly over-indexed to this group relative to the broader restaurant industry."

However, inflation and job insecurity in 2025 have made this younger group more cautious about spending. In response, Cava launched a revamped tiered loyalty program in October 2025 to win back inactive members and boost visit frequency. The brand is also branching out into lifestyle marketing, with initiatives like a streetwear line featuring items such as "Hot Harissa" hats to foster a sense of community.

Cava’s Mediterranean-inspired menu, with an average check of $13 to $14, appeals to health-conscious diners seeking a fresh alternative to traditional Mexican fast-casual options. While about 40% of consumers now view fast-casual dining as increasingly pricey, Cava’s customizable offerings and youth-oriented marketing help it stay competitive in a challenging market.

Better Stock to Buy for 2025: Cava vs. Chipotle

Pros and Cons

Before diving into an investment decision, it’s important to evaluate what each brand brings to the table. Both Chipotle and Cava are publicly traded companies (NYSE: CMG for Chipotle, NYSE: CAVA for Cava), meaning investments are made through their publicly traded stock.

Here’s a quick breakdown of key factors to consider for each brand:

Factor | Chipotle (CMG) - Pros | Chipotle (CMG) - Cons | Cava (CAVA) - Pros | Cava (CAVA) - Cons |

|---|---|---|---|---|

Market Position | Established leader with 3,839 locations and a 30-year history | Growth opportunities are limited due to market saturation | Rapidly expanding, with 382 locations and plans for 1,000 by 2032 | Currently only 10% of Chipotle’s size, with unproven scalability |

Financial Stability | Strong net profit margin (~13%) and $386.6 million net income in Q1 2025 | Slower revenue growth at 6.4% YoY | Revenue growth of 28.2% YoY and restaurant-level margins of 25.1%, nearing Chipotle’s 26.2% | Net profit margin is lower (~7.7%), with net income of $25.7 million in Q1 2025 |

Valuation | Lower P/E ratio and a market cap between $49.8–$88 billion | Limited potential for multi-bagger returns | High valuation reflects aggressive growth expectations | P/E ratio of 71.9 in mid-2025, making it 78% pricier than Chipotle |

Operational Efficiency | 33 million loyalty members and advancing automation efforts | Nearly 8 million loyalty members and self-funded growth with no debt | ||

Expansion Strategy | Over 80% of new locations include Chipotlanes, with a goal of 7,000 North American stores | 79% of locations are within one mile of a Chipotle, with CPG products in 650+ retail stores |

This comparison highlights the trade-off between stability and growth potential in the fast-casual dining sector.

Chipotle stands out as a reliable performer, making it a solid choice for investors looking for steady returns with lower risk. Meanwhile, Cava offers a high-growth opportunity for those willing to take on more risk. As one analysis from Nasdaq puts it:

"Based on financial metrics, Chipotle has the better value, while Cava has more upside".

It’s worth noting that both brands are facing challenges due to reduced discretionary spending among younger consumers, particularly Gen Z. This trend underscores the importance of balancing growth expectations with broader market realities.

Conclusion

Can Cava stack up against Chipotle's well-established model? That depends entirely on what you're looking for as an investor.

Chipotle stands out for its stability and consistent profitability, with around 3,839 locations and an impressive 33-million-member loyalty program. On the other hand, Cava offers a high-growth trajectory, boasting a 28.2% year-over-year revenue increase and restaurant-level margins of 25%, which are close to Chipotle's 26.7%.

Both brands share a similar operational approach, running almost entirely company-owned locations rather than offering traditional franchise opportunities. For those interested, you can invest in them through publicly traded stock - Chipotle trades under NYSE: CMG, while Cava trades under NYSE: CAVA.

Valuation is a critical factor to consider. As of mid-2025, Cava's price-to-earnings (P/E) ratio sits at 71.9 - making it about 78% pricier than Chipotle. This premium reflects the market's expectations for Cava's growth. However, as Jon Quast from The Motley Fool points out:

"In investing, the business and the stock are different things... I don't believe [Cava stock] will be the strong investment opportunity that Chipotle was until its valuation becomes far more reasonable".

Before making any decisions, dive deep into the numbers. Track Cava’s progress toward its ambitious goal of 1,000 stores by 2032 and pay attention to how it handles corporate overhead, which currently accounts for 24% of revenue, compared to Chipotle’s 18% at a similar stage. These details are essential in determining whether Cava aligns with your risk tolerance and financial objectives.

For those exploring franchised fast-casual opportunities, you might also consider consulting with Franchise Ki, which offers free guidance on franchise investments.

FAQs

What are the key risks of investing in Cava compared to Chipotle?

Investing in Cava comes with its share of risks, especially when stacked against the more established Chipotle.

Cava is still in its early stages of growth, meaning its brand recognition and market presence are not as solidified. Unlike Chipotle, which boasts a long history of success, Cava is less tested as an investment. While its financial performance has been promising, much of its profitability hinges on raising prices and maintaining steady customer traffic. If demand slows or costs rise faster than expected, its earnings could take a hit.

Another challenge lies in Cava's ambitious goal of expanding to 1,000 locations by 2032. Scaling at such a rapid pace requires substantial capital and precise execution to ensure quality and consistency across locations. Any mismanagement during this expansion could hurt the company's overall performance. These factors position Cava as a riskier investment compared to Chipotle, which benefits from a more established and stable business model.

How does Cava’s expansion strategy compare to Chipotle’s approach?

Cava is making bold moves to grow its footprint, aiming to jump from about 260 locations today to an ambitious 1,000 by 2032. The company is using funds raised through its IPO to roll out new restaurant formats, launch catering services, and introduce loyalty programs. Recent numbers back up this strategy: same-store sales have surged by 21.2%, and guest traffic is up 15.6%. Impressively, newer locations are pulling in over $3 million annually on average, outperforming the chain-wide average of $2.9 million. This rapid-growth approach also comes with a financial upside, as build-out costs are typically recouped within two years.

Chipotle, in contrast, takes a more measured approach to growth. The company focuses on steady same-store sales increases and operational efficiency rather than rushing to open new locations. Known for its streamlined menu and deliberate expansion strategy, Chipotle is often considered the gold standard in the fast-casual space, with analysts regularly pointing to it as a model for success.

In essence, Cava is all about fast growth and diversification, while Chipotle sticks to steady, performance-focused expansion based on its proven playbook.

Why is Cava valued higher than Chipotle despite being a smaller company?

Cava's valuation is bolstered by its noteworthy growth momentum, highlighted by faster same-store sales growth, rising customer visits, and solid price-mix improvements. On top of that, the brand's swift rollout of new locations points to promising opportunities for capturing a larger market share, making it an appealing choice for investors - even with its relatively smaller footprint.

What attracts investors even more is Cava's knack for maintaining steady growth while tapping into the growing popularity of Mediterranean-inspired fast-casual dining. This positions the company as a standout growth opportunity within the industry.