Franchise Strategies

Dec 16, 2025

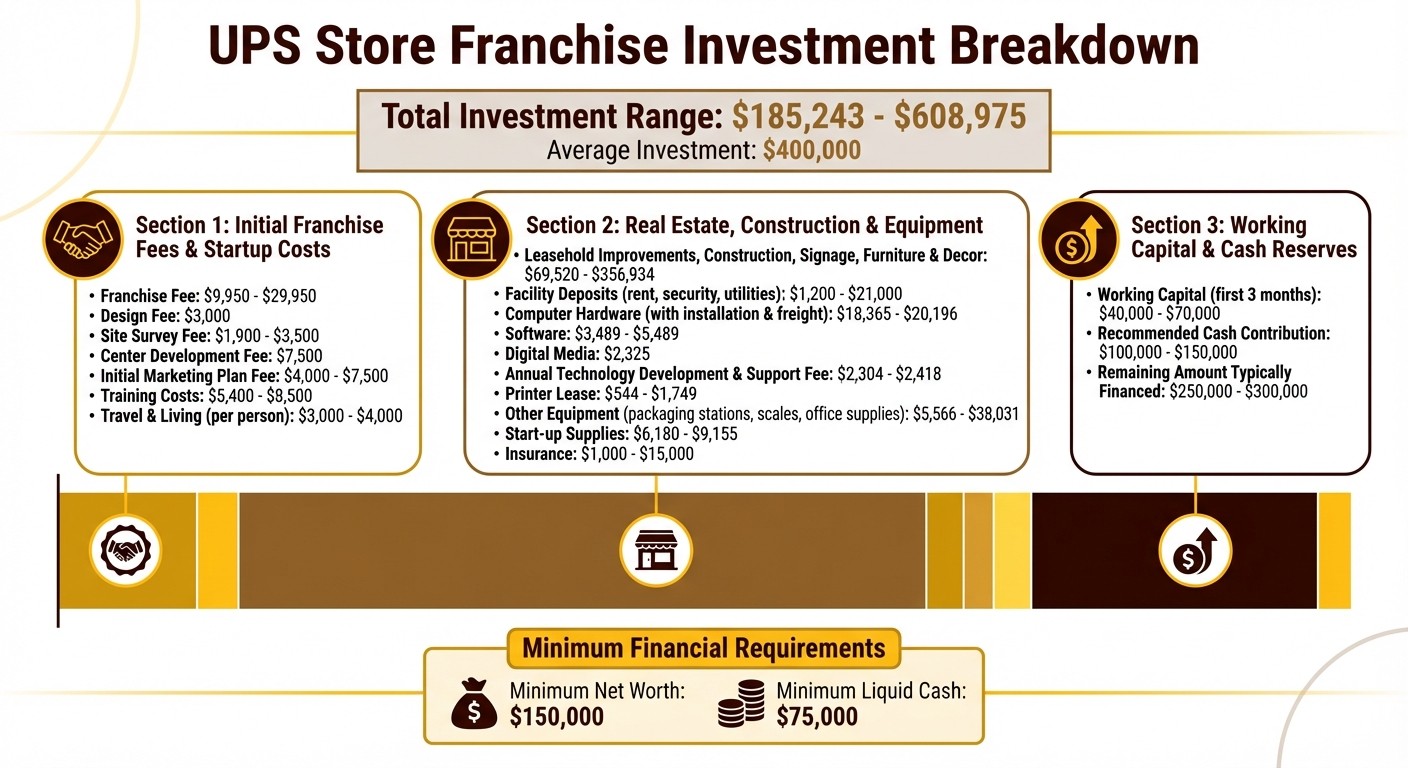

Overview of the $400K investment, franchise fees, royalties, revenue streams, financing options, and how UPS Stores compete with Amazon Lockers.

The UPS Store franchise requires an estimated $400,000 investment to launch, offering services beyond shipping, such as printing, mailbox rentals, and notary services. Unlike Amazon Lockers, which are self-service, UPS Stores provide hands-on assistance, making them ideal for small businesses and freelancers needing comprehensive solutions. With over 5,500 locations globally, franchisees benefit from the trusted UPS brand and multiple revenue streams like shipping, packaging, and recurring mailbox rentals.

Key Points:

Investment Range: $185,243–$608,975, depending on location and size.

Franchise Fees: $9,950–$29,950.

Equipment/Setup Costs: Includes technology, printers, signage, and supplies.

Recurring Costs: 8.5% of gross sales for royalties and marketing.

Revenue Streams: Shipping, printing, mailbox rentals, and business services.

Average Sales: $719,842 (2024 data); top 10% average $1.2M annually.

Competition: Amazon Lockers focus on automation, while UPS Stores cater to personalized, full-service needs.

Franchisees should plan for upfront cash contributions (typically $100,000–$150,000) and explore financing options like SBA loans or traditional bank loans. Success depends on location, customer base, and operational efficiency. UPS Stores are ideal for those seeking a hands-on, service-driven business model.

How Much Can you Make with a UPS Store in 2025? (costs, sales, & fees)

What the $400,000 Investment Covers

UPS Store Franchise Investment Breakdown and Cost Analysis

The $400,000 estimate falls right in the middle of the range outlined in the 2025 Franchise Disclosure Document. Based on this document, the total initial investment for opening a traditional UPS Store can vary widely, from $185,243 to $608,975, covering the first three months of operation. The variation depends on factors like store size, location, lease agreements, and the extent of renovations needed. For instance, urban locations with higher rents and significant buildout requirements will push costs toward the upper end, while smaller stores in less expensive areas may stay closer to the lower range.

The investment is divided into three main categories: franchise fees, real estate and equipment costs, and working capital.

Franchise Fees and Initial Startup Costs

The initial costs include a franchise fee that ranges from $9,950 to $29,950, depending on the type and location of the store. Other upfront expenses include:

Design fee: $3,000

Site survey fee: $1,900–$3,500

Center development fee: $7,500

Initial marketing plan fee: $4,000–$7,500

Training costs: $5,400–$8,500, plus travel and living expenses of $3,000–$4,000 per person for training sessions held at corporate headquarters or regional centers

These fees cover the essentials for getting the store off the ground, from training to marketing preparation.

Real Estate, Construction, and Equipment Costs

This category represents the largest chunk of the startup expense. Costs include:

Leasehold improvements, construction, signage, furniture, and decor: $69,520–$356,934, depending on whether the location is turnkey or requires significant renovations

Facility deposits (rent, security, utilities): $1,200–$21,000

Equipment and technology:

Computer hardware, including installation and freight: $18,365–$20,196

Software: $3,489–$5,489

Digital media: $2,325

Annual technology development and support fee: $2,304–$2,418

Printer lease: $544–$1,749

Other equipment like packaging stations, scales, and office supplies: $5,566–$38,031

Start-up supplies: $6,180–$9,155

Insurance: $1,000–$15,000, depending on coverage needs and local regulations

These expenses ensure that the store is fully equipped, functional, and ready to serve customers.

Working Capital and Cash Reserves

The final piece of the puzzle is working capital, which is the cash needed to cover early operating expenses. The Franchise Disclosure Document suggests setting aside an additional $40,000–$70,000 to cover the first three months. This reserve allows you to focus on growing the business, building customer relationships, and fine-tuning operations without the immediate stress of breaking even. It’s especially useful if you need funds to cover personal living expenses while the business gains traction.

This well-structured investment plan provides a solid foundation for managing initial costs and steering the business toward profitability.

Monthly Expenses and Income Potential

Monthly Fees and Operating Costs

Once your UPS Store is up and running, recurring expenses will play a key role in shaping your profits. One of the largest ongoing costs is the combined royalty and marketing fee, which equals 8.5% of your adjusted gross monthly sales. This fee is split into 5% for royalties and 3.5% for marketing, which funds both local and national advertising. According to the Franchise Disclosure Document, The UPS Store, Inc. collects this 8.5% fee to support franchisees through brand promotion and operational backing.

Beyond this, you’ll need to account for rent, payroll, and utilities. There are also monthly technology and equipment-related expenses, including fees for technology development, support, and potential printer lease payments.

This fee structure is designed to support the franchise's growth while maintaining profitability.

How UPS Stores Generate Revenue

Despite these expenses, UPS Store franchisees have access to multiple revenue streams that can help diversify earnings. These include shipping and packaging services, mailbox rentals, printing, and other in-center business support services. Among these, mailbox rentals stand out as a reliable source of steady, recurring income.

To give you an idea of the earning potential, 2024 performance data shows that traditional UPS Store Centers achieved an average Adjusted Gross Sales (AGS) of $719,842, while the median AGS was $686,743. The top-performing 10% of stores averaged an impressive $1,225,942, with the highest-earning store bringing in $2,453,930.

Timeline to Profitability

The journey to profitability depends on several factors, including operational efficiency and the dynamics of your local market. Specific timelines for reaching profitability are outlined in the Franchise Disclosure Document. Critical elements like building brand awareness in the community, hiring skilled staff, and streamlining daily operations can significantly influence how quickly you break even.

If you’re looking for a faster route to profitability, acquiring an existing, profitable UPS Store can be a smart move. Starting fresh often requires more time to build a loyal customer base.

Ultimately, key factors such as location visibility, foot traffic, local demographics, and the quality of management will determine your success. While ongoing fees do impact net profits, the established UPS brand and franchise support can help accelerate growth in the early stages.

How UPS Stores Compete with Amazon Lockers

Service Advantages Over Self-Service Lockers

UPS Stores stand out by offering hands-on, expert service and a variety of business solutions that go far beyond the basic package drop-off and pickup provided by Amazon Lockers. From printing and notary services to passport photos, shredding, and office supplies, UPS Stores cater to a wide range of customer needs, creating a more comprehensive experience.

One key feature is their Certified Packing Experts®, who specialize in handling fragile and oversized items with care. This personalized service minimizes the risk of damage during shipping. For example, in Redding, California, UPS Store owners Ben and Heide Bradshaw provide tailored packing and shipping services for unique, one-of-a-kind items, ensuring they arrive safely [UPS Store Franchise Blog, October 10, 2025].

As Authorized Shipping Outlets for UPS, these stores also offer the full spectrum of UPS shipping services - Ground, Air, and International - backed by advanced tracking and UPS's global logistics network. This extensive service offering not only ensures secure and efficient parcel handling but also appeals to small businesses looking for reliable shipping solutions.

Attracting Small Business Customers

These enhanced services make UPS Stores a go-to resource for small business owners, freelancers, and online sellers who often lack in-house support for their shipping and business needs. UPS Stores function as more than just shipping hubs - they're one-stop shops for essential services.

Mailbox rentals are a prime example of how they build customer loyalty. By providing professional street addresses, mail receiving, and forwarding services, these rentals create a steady income stream while offering convenience for small businesses and online sellers who may not have access to such infrastructure.

Additionally, corporate partnerships with major UPS clients and national brands drive more business to franchise locations, ensuring a consistent flow of shipping and printing opportunities.

Improving Customer Experience and Access

With over 5,300 locations across the United States, UPS Stores combine accessibility with a service-oriented approach. Their strategic locations, extended hours, and personalized support ensure customers receive more than just transactional services - they get solutions tailored to their needs.

Face-to-face interactions allow customers to navigate complex shipping requirements with expert guidance. Whether it's advice on packaging, shipping options, or other business services, this personalized approach fosters trust and loyalty. Unlike automated lockers, UPS Stores position themselves as community hubs, offering a level of care and expertise that keeps customers coming back.

How to Finance a UPS Store Franchise

Financing Options for Franchise Buyers

The UPS Store doesn’t provide direct in-house financing. Instead, it connects franchise buyers with a network of third-party preferred lenders familiar with its business model. Here are some common financing options:

SBA Loans: These loans, backed by the Small Business Administration, often come with lower interest rates and longer repayment terms. For instance, the SBA 7(a) loan program can offer up to $5 million in funding.

Traditional Bank Loans: If you have strong credit and a solid business plan, traditional bank loans can provide competitive rates.

Alternative Online Lenders: These lenders may approve loans more quickly but often charge higher interest rates.

Rollover for Business Startups (ROBS): This allows you to use your retirement savings to fund your franchise without facing early withdrawal penalties.

Additionally, military veterans may qualify for a discount of about 50% on initial franchise fees in 2025, which can help lower upfront costs.

Next, it’s crucial to understand the capital requirements and how your cash contribution fits into the overall investment.

Planning Your Capital Structure

For an investment of $400,000, you’ll typically need to provide $100,000 to $150,000 in cash upfront. The remaining $250,000 to $300,000 can usually be financed, as lenders often require a cash contribution of 10% to 30% of the total investment.

According to The UPS Store:

"Lenders typically review your credit history, management experience and business plan when considering financing requests".

To qualify, you’ll need a minimum net worth of $150,000 and at least $75,000 in liquid cash. Additionally, an approval letter from a lender is required before you can move forward with booking your new center.

When planning your financing, consider how monthly loan payments will affect your cash flow during the first year. While longer repayment terms can reduce monthly payments, they may result in higher total interest costs over time.

Getting Help from Franchise Ki

Once your financing plan is in place, expert guidance can make the process smoother.

Franchise Ki offers free consulting services to help navigate financing. Founded by Bennett Maxwell, who built and sold over 300 franchise units with Dirty Dough Cookies, and co-founded by Liam Chase, who expanded client portfolios from 13 to nearly 70 units in one quarter, their team specializes in connecting clients with vetted franchise opportunities. They also assist with due diligence and help break down the Franchise Disclosure Document.

With Franchise Ki’s support, you can compare financing options, craft a strong business plan for lender presentations, and negotiate better terms. This allows you to focus your resources on the franchise investment itself while feeling confident in your financial strategy.

Is a UPS Store Franchise Right for You?

Main Points to Consider

Owning a UPS Store franchise involves a significant financial commitment and requires active participation in daily operations. The estimated investment hovers around $400,000, and achieving success often depends on being directly involved. With over 5,232 locations across the U.S. and about 52% of franchisees owning multiple stores, the franchise model has proven to be reliable, boasting a relatively low failure rate of 12%.

However, there are challenges to keep in mind. The franchise operates under strict guidelines, including set pricing structures, which can sometimes limit flexibility. Additionally, competition from digital services and other shipping companies remains a factor. On the flip side, the growing demand for shipping services - driven by freelancers and small businesses - provides new opportunities for growth. Ultimately, your success will depend on developing and executing a solid business plan.

Given these complexities, seeking expert advice can make a significant difference.

Getting Started with Franchise Ki

Once you’ve weighed these considerations, the next step is determining whether this franchise aligns with your financial goals and lifestyle. If you’re unsure, Franchise Ki offers free consulting services to help you evaluate your readiness. Their team specializes in assessing whether the hands-on nature of managing a UPS Store franchise fits your schedule and long-term aspirations. This is especially important if you’re juggling other responsibilities, as managing a franchise alongside a full-time job is typically not feasible.

Franchise Ki’s tailored approach helps you break down the initial investment, compare it with other franchise opportunities in the same price range, and determine if the UPS Store’s competitive edge aligns with your goals. Their consultants will guide you through the due diligence process and help you craft a financing plan, setting you up for success from the very beginning.

FAQs

What are the key benefits of owning a UPS Store franchise compared to using Amazon Lockers?

Owning a UPS Store franchise comes with several standout perks that go beyond what Amazon Lockers can offer. As a franchise owner, you’re backed by the strong reputation of a nationally recognized brand that customers already trust. Plus, The UPS Store equips you with thorough training and ongoing support, so you’re set up with the skills and resources you need to thrive.

What sets a UPS Store franchise apart is the ability to tap into multiple revenue streams. Beyond handling package deliveries, you can offer services like printing, mailbox rentals, and shipping solutions. With a tried-and-true business model and a vast network of locations, you’re positioned to provide exceptional convenience for customers while exploring a variety of profitable opportunities.

What are the financing options for covering the $400,000 investment required to open a UPS Store franchise?

When it comes to financing the $400,000 investment required for a UPS Store franchise, potential franchisees have several paths to consider. Popular options include tapping into personal savings, securing traditional bank loans, applying for Small Business Administration (SBA) loans, exploring franchisor-specific financing programs, or utilizing a 401(k) rollover as business startup (ROBS).

Keep in mind that you'll generally need $100,000 to $150,000 in liquid assets to meet the qualification criteria. Partnering with third-party lenders who specialize in franchise funding can also make the process smoother, offering solutions tailored to your needs. Taking the time to carefully plan and understand your financial options is essential for successfully funding your franchise venture.

What factors affect how quickly a UPS Store franchise becomes profitable?

The timeline for turning a profit with a UPS Store franchise can vary widely and depends on several important factors. One of the biggest influences is the location. Stores situated in areas with high foot traffic, easy accessibility, and a strong mix of nearby businesses and residential communities tend to perform better.

Another key element is efficient operations paired with solid management skills. Keeping costs under control while maximizing revenue is crucial for success. The initial investment also plays a role, as does the local demand for services like shipping and printing. Offering additional services, such as mailbox rentals or professional printing, can help create diverse revenue streams that boost profitability.

Lastly, staying ahead of the local competition is essential. Understanding the competitive landscape and finding ways to stand out can make a big difference in attracting and keeping customers.