Franchise Strategies

Dec 19, 2025

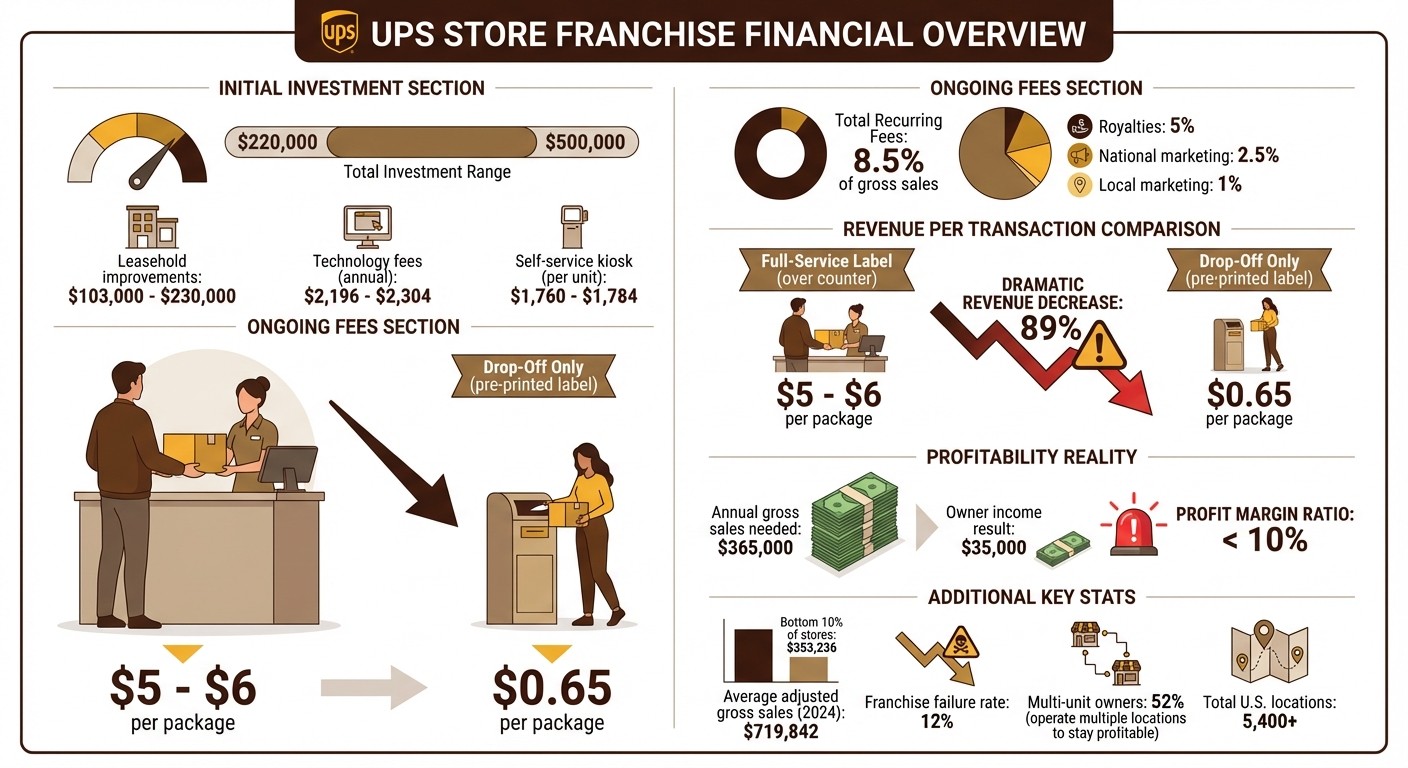

Deep dive into UPS Store franchise economics: falling per-package revenue, rising fees, and digital competitors eroding profits for traditional shipping stores.

The UPS Store franchise faces mounting challenges, making profitability harder for owners. Here's why:

Declining Revenue Per Transaction: Many customers now print shipping labels at home and use stores as drop-off points, earning franchisees just $0.65 per package compared to $5–$6 for in-store label purchases.

High Operating Costs: Initial investments range from $220,000–$500,000, with ongoing fees like 5% royalties, 3.5% marketing fees, and tech fees ($2,196–$2,304 annually).

Corporate Competition: UPS Access Points in places like Walgreens and Dollar General offer similar services at lower costs, impacting store traffic.

Shifting Consumer Habits: Digital solutions like self-service kiosks and label-free returns reduce franchise income while increasing operational complexity.

Market Pressures: UPS's decision to cut Amazon shipping volume by 50% by mid-2026 and rising USPS delivery costs further strain franchisees.

Franchisees need $365,000 in annual gross sales to earn just $35,000, with 52% owning multiple stores to stay afloat. Despite its strong brand reputation, the model is increasingly unsustainable in a world moving toward digital and self-service options.

UPS Store Franchise Costs vs Revenue Breakdown 2025

1. The UPS Store Franchise

Revenue Model

Between 2018 and 2020, average adjusted gross sales for The UPS Store grew from $494,418 to $607,750. The franchise generates revenue through a variety of services, including shipping, packing, mailbox rentals, printing, copying, notary services, and office supplies. A key contributor to this income is the Corporate Retail Solutions (CRS) program, which requires stores to handle transactions for corporate clients, such as returns and discount programs. In 2020, this program alone brought in an average of $47,334 per location.

That said, profitability can be a challenge for franchise owners. For example, annual gross sales of $365,000 typically result in just $35,000 in owner income. With over 5,400 independently owned locations across the U.S. as of May 2025, many franchisees - 52% to be exact - operate multiple stores to ensure financial stability.

To adapt to changing demands, The UPS Store has introduced self-service kiosks and expanded its presence in non-traditional locations. More than 1,500 stores now feature kiosks, which have collectively handled over 11.5 million transactions. Additionally, following UPS's acquisition of Happy Returns, the franchise has embraced contactless returns to capture the growing e-commerce market. The brand is also venturing into hotels, grocery stores, and storage facilities to attract new customers.

Cost Structure

Despite its diversified revenue streams, high operating costs remain a hurdle for franchisees. The initial investment to open a UPS Store ranges from $220,000 to $500,000, with leasehold improvements alone costing between $103,000 and $230,000. Once operational, franchisees face ongoing expenses, including a 5% royalty on gross sales and 3.5% in marketing fees (split between local and national advertising). Technology fees add another $2,196 to $2,304 annually, depending on the location.

The financial strain is evident in the performance of some locations. In 2020, the bottom 10% of centers averaged just $299,467 in adjusted gross sales. Adding to the uncertainty, UPS has reduced its Amazon shipping volume by 50%, which could impact store traffic. At the same time, USPS last-mile delivery costs have surged, increasing from $2.79 to $5.10 for a 12-ounce package between 2024 and 2025.

Market Trends

Broader industry trends are adding to the challenges faced by franchisees. UPS reported nearly a 3% drop in revenue during Q2 2025, marking its second consecutive quarterly decline. The China-to-U.S. trade route, UPS’s most profitable shipping lane, experienced a sharp 34.8% decrease in volume during May and June 2025. Trade policy changes, such as higher tariffs and the removal of the de minimis exception for low-value imports, have further squeezed international shipping margins.

In response, UPS is undergoing a "network reconfiguration", which includes closing 74 facilities in 2025 and aims to save $3.5 billion through automation. Currently, 64% of UPS volume is processed through automated facilities, a 4% increase from the previous year. However, these corporate-level efficiencies don’t necessarily ease the day-to-day operations for individual franchise owners.

"Trade follows policy, and generally tariffs are not good for trade." - Carol Tomé, CEO, UPS

Consumer Behavior

Shifts in consumer behavior are also reshaping the landscape. Many customers now purchase and print shipping labels at home, using stores primarily as drop-off points. This results in high foot traffic but lower revenue per transaction. On top of that, discretionary spending has been declining every month since March 2025, raising concerns about the traditional holiday shipping surge.

"The magic of The UPS Store happens over the counter. If you can't meet someone's needs or solve their problems over the counter, it is terrifying and it'll ruin your day." - Sarah Casalan, President of The UPS Store, Inc.

To address these changes, the franchise has modernized its training methods, replacing outdated paper binders with mobile-friendly digital systems. However, the core issue remains: customers rely less on physical shipping stores than they once did. These evolving habits highlight the growing challenges for traditional shipping franchises in maintaining their relevance.

2. Digital and Self-Service Shipping Options

Revenue Model

The shift toward digital shipping is reshaping how UPS Store franchisees earn revenue - and not in their favor. When customers print shipping labels at home and use the store as a drop-off point, franchisees earn just $0.65 per package through the UPS Drop-Off Program. Compare that to the $5 to $6 per package earned when selling a full-service shipping label over the counter. This stark difference means franchisees are now handling significantly more transactions for far less income per customer.

The financial picture becomes even clearer when looking at the numbers. In 2024, the average adjusted gross sales for all UPS Store locations reached $719,842. However, the bottom 10% of stores averaged only $353,236. High transaction volumes don’t make up for slim margins, and with a 12% failure rate for UPS franchises, the room for error is dangerously small as revenue per transaction continues to shrink.

To make matters worse, digital operations come with rising costs that further squeeze these already tight margins.

Cost Structure

Franchisees are feeling the financial pinch of going digital. The UPS Store has rolled out self-service kiosks in over 1,500 of its 5,570 locations. While these kiosks aim to streamline operations, each one costs between $1,760 and $1,784, and franchisees also face annual technology fees ranging from $2,196 to $2,304.

These kiosks have handled approximately 11.5 million transactions, but high transaction numbers don’t necessarily translate into high profits. Michelle Van Slyke, Senior Vice President of Marketing and Sales at The UPS Store, commented:

"We're finding it to be very successful. We've had about 11.5 million transactions, so we think it's an area where we can satisfy the customer and be convenient".

While customers may appreciate the convenience, franchisees are left with thinner margins. On top of these costs, they still owe 5% in royalties and 2.5% in national advertising fees on all gross sales.

Adding to the financial strain, changing consumer habits are creating new challenges for franchise owners.

Consumer Behavior

Modern customers want fast, hassle-free service. Many are now accustomed to self-checkout at grocery stores and expect the same level of ease when dropping off packages. They prefer digital solutions like QR code drop-offs and label-free returns - services that shift operational complexity and costs onto franchisees. This trend has gained momentum with UPS’s acquisition of Happy Returns, which introduced "box-free and label-free" return technology.

For franchisees, this shift means more foot traffic but less revenue per visit. Services like printing and copying, once reliable income streams, are declining as people share documents electronically. Mailbox rentals remain steady but require ongoing effort to manage. Meanwhile, drop-off services generate high volume but offer razor-thin profits, leaving franchise owners grappling with how to cover fixed costs while staying in the black.

UPS Store Franchise: What They Don’t Want You To Know.

Advantages and Disadvantages

The UPS Store franchise model and its digital shipping alternatives come with a mix of benefits and challenges, especially when considering operational hurdles and evolving consumer preferences.

Traditional UPS Store franchises offer a more personalized experience, along with additional revenue streams like notary services, professional printing, and mailbox rentals. The brand’s reputation is strong - The UPS Store ranked #4 overall in Entrepreneur's Franchise 500 in both 2024 and 2025 and has held the #1 spot in Postal & Business Services for 34 straight years. However, franchisees face steep costs. These include recurring fees totaling 8.5% (5% royalties, 1% local marketing, and 2.5% national advertising), annual technology fees ranging from $2,196 to $2,304, and periodic redesign costs that can exceed $40,000. Additionally, franchise agreements don’t guarantee exclusive territory, meaning UPS can open competing locations or Access Points nearby. While personalized services can bring in higher-margin revenue, many franchisees struggle with slim profits from routine drop-off services.

Digital and self-service options, on the other hand, offer a more cost-effective, 24/7 solution that aligns with the preferences of today’s consumers. For example, self-service kiosks in UPS Stores have handled about 11.5 million transactions across more than 1,500 locations. Similarly, box-free returns through services like Happy Returns cater to e-commerce shoppers who value speed and convenience. While these innovations reduce overhead and streamline operations, they also tend to generate lower revenue per transaction for franchisees.

Here’s a side-by-side comparison of the two models:

Feature | UPS Store Franchise Model | Digital & Self-Service Options |

|---|---|---|

Revenue Model | Retail markup on shipping, service fees (e.g., notary, printing), and mailbox subscriptions | Corporate-level contracts with e-commerce companies; minimal per-unit handling fees |

Cost Structure | High: Rent, labor, 8.5% royalties, and required 10-year upgrades | Low: Automated kiosks, third-party host locations (Access Points), and drop boxes |

Market Trends | Declining use of traditional mail; increasing focus on small business support services | Growth in e-commerce returns and label-free logistics |

Consumer Behavior | Prefers in-person assistance and specialized services | Values speed, convenience, and 24/7 accessibility |

These differences highlight the tough decisions franchisees must make in an evolving market. For instance, a typical UPS Store needs about $365,000 in annual gross sales to generate a modest $35,000 in income for the owner. With a 12% failure rate and over half of franchisees (52%) owning multiple locations just to maintain sustainable income, the traditional model is becoming harder to sustain. Many franchisees are turning to higher-margin services, like 3D printing and graphic design, to remain competitive.

The trade-offs between traditional and digital models underscore the challenges of adapting to changing consumer habits and market demands, making it clear why the viability of traditional shipping franchises is under pressure.

Conclusion

The analysis highlights the significant structural hurdles facing The UPS Store franchise. While it boasts impressive accolades - ranking #4 on Entrepreneur's Franchise 500 and maintaining a 34-year leadership in Postal & Business Services - the financial realities paint a less optimistic picture. Franchisees need to generate approximately $365,000 in annual gross sales just to earn $35,000 in income, and even then, the model carries a 12% failure rate. To make matters more viable, 52% of successful franchisees now operate multiple locations to achieve sustainable earnings.

The challenges don’t stop at razor-thin profit margins. Franchisees face mandatory redesigns and technology upgrades every ten years, alongside the absence of territorial exclusivity, which allows UPS to establish competing Access Points nearby. On top of that, annual technology fees ranging from $2,196 to $2,304 and the minimal revenue generated from prepaid labels further strain profitability.

Adding to the complexity, the industry is shifting toward business centers that emphasize services like copying and printing, making it increasingly difficult for traditional shipping revenue alone to sustain operations. With digital platforms and self-service kiosks handling millions of transactions, the core appeal of a physical shipping store is steadily diminishing.

For potential investors, these challenges underscore the need for a cautious approach. Prioritize high-demand locations, explore multi-unit ownership for better financial stability, and seek advice from experienced franchisees with 3–5 years of operational history. Considering the substantial upfront investment of $220,000–$500,000 and limited financial upside, it may be wise to explore opportunities in industries with stronger growth trajectories.

FAQs

How can UPS Store franchisees stay profitable as shipping revenues decline?

To maintain profitability as shipping revenues decline, UPS Store franchisees can broaden their offerings to include printing services, mailbox rentals, and office solutions. These additional services not only attract a wider range of customers but also create new revenue streams. Mailbox rentals, in particular, stand out as a reliable source of consistent income.

Franchisees can also focus on cutting operational expenses, delivering exceptional customer experiences to build loyalty, and implementing smart marketing strategies to encourage repeat visits. Expanding to multiple locations is another way to boost revenue, as it spreads financial risk and opens up opportunities in untapped markets. By staying in tune with evolving customer needs and refining their business approach, franchisees can effectively counter the challenges posed by shrinking shipping margins.

How are digital and self-service shipping options affecting the profitability of UPS Store franchises?

Digital and self-service shipping options are changing the way UPS Store franchises operate, and not always for the better. As more customers turn to online tools and automated kiosks for their shipping needs, the demand for in-store transactions decreases. This shift often leads to a drop in service fees, leaving franchise owners grappling with how to keep customers engaged.

On top of that, implementing and maintaining these systems comes with its own set of challenges. Advanced technology requires regular updates and upkeep, pushing operational costs higher. While these options offer undeniable convenience for consumers, they also put pressure on the traditional revenue models that many shipping stores depend on.

How does UPS reducing Amazon shipping volume impact franchise owners in the long run?

The move by UPS to scale back Amazon shipping volume could have a noticeable impact on franchise owners. For many, Amazon shipments make up a large chunk of their shipping revenue, so this cutback might mean less income from this key service. On top of that, the reduction could open the door to increased competition from other shipping and drop-off services, making it even harder for franchise owners to stay profitable.

In the long run, these shifts could pose financial hurdles, potentially shaking the stability of day-to-day operations or, in some cases, even leading to store closures. With consumer preferences shifting and alternative shipping options becoming more popular, franchise owners will need to pivot and adjust quickly to keep their businesses running smoothly.