Franchise Strategies

Dec 13, 2025

A fast-growing coffee chain chose full corporate ownership to protect culture, ensure consistent service, and control its growth.

Dutch Bros is not a franchise opportunity. The company stopped franchising in 2017 and transitioned to a fully corporate-owned model. This decision ensures consistent quality, protects brand identity, and allows the company to maintain control over its operations. Today, all Dutch Bros locations are owned and operated by the company, with no external franchisees.

Here’s why Dutch Bros chose this path:

Control Over Brand and Operations: Corporate ownership helps maintain their "Dutch Luv" culture and ensures a consistent customer experience across all locations.

Financial Benefits: Each store generates an average of $2 million in annual sales, with corporate control centralizing profits and supporting steady growth.

Focused Expansion: Dutch Bros plans to open 160 new locations in 2025, prioritizing deliberate growth in new markets.

For those interested in investing, the only option is buying Dutch Bros stock (NYSE: BROS), which was trading at $61.16 as of December 12, 2025. If you're looking for franchise opportunities, consider exploring other coffee chains like Dunkin' or Starbucks' licensed models.

Key Takeaway: Dutch Bros prioritizes quality, consistency, and internal growth over franchising, making it a corporate-owned success story in the coffee industry.

How Dutch Bros Moved from Franchising to Corporate Ownership

The Beginning and Early Franchise Model

Dutch Bros started in 1992 when brothers Dane and Travis Boersma set up shop in Grants Pass, Oregon, with nothing more than a pushcart and a dual-head espresso machine. By 2000, the company took its first steps into franchising, opening its initial franchise location in Oregon and quickly expanding throughout the Northwest. Franchising became the backbone of their growth strategy, and by 2017, more than 85% of Dutch Bros locations were franchise-owned. This rapid growth, however, laid the foundation for a major shift in how the company operated.

Buying Back Franchises and Going Corporate

In 2008, Dutch Bros made a pivotal decision to move away from selling franchises to outside operators. Co-founder Travis Boersma explained the rationale behind this shift:

"The biggest change came in 2008 when the chain decided to stop selling franchises to operators who didn't grow up in the company... but they just didn't understand the culture."

This led to a new approach: only employees who had worked at Dutch Bros for at least three years could qualify to become franchisees. By 2017, the company stopped offering new franchises altogether and began buying back underperforming locations. This allowed Dutch Bros to maintain tighter control over its brand and preserve the company culture.

The 2021 IPO and Investor Influence

The operational changes eventually paved the way for a significant financial milestone: Dutch Bros' initial public offering (IPO) on September 15, 2021. The IPO raised $484 million, with the company selling roughly 21 million shares at $23 each. Out of these funds, $100 million was allocated to reduce $192 million in long-term debt.

Why Dutch Bros Chooses Corporate Ownership

Protecting Brand Standards and Company Culture

Dutch Bros learned early on that franchising wasn’t the best fit for maintaining their signature "Broista" culture. This culture thrives on employees delivering genuine enthusiasm and building personal connections with customers - something that proved difficult to replicate consistently through franchised locations.

To address this, the company pivoted to a corporate ownership model, which now includes over 400 internal operators. These operators average seven years of experience with Dutch Bros, creating a deep well of expertise within the organization. Through comprehensive training programs rooted in what they call the "Mafia Manifesto", the company ensures uniform service quality across all locations. Whether you're grabbing a drink in Oregon or visiting a new market, the experience feels the same. This consistency has built a loyal customer base, with 67% of transactions coming from loyalty members. By prioritizing internal expertise, Dutch Bros has created a strong foundation for both its culture and its financial success.

Financial Advantages of Owning All Stores

The decision to maintain corporate ownership isn’t just about culture - it also makes financial sense. Dutch Bros’ IPO highlighted the strength of their model, with stock performance reflecting the benefits of unified revenue streams from all locations. Each store averages over $2 million in revenue, contributing to the company’s overall financial health.

Institutional investors have taken notice, with 82% of Dutch Bros now institutionally owned as of June 22, 2025. Insiders also hold $345 million in shares, underscoring confidence in the company’s predictable and consolidated financial performance. By keeping all locations under corporate control, Dutch Bros ensures that every store directly strengthens the bottom line.

Control Over Operations and Growth Strategy

One of the biggest perks of corporate ownership is the ability to make decisions quickly and strategically, without needing to navigate franchisee agreements. Dutch Bros has optimized its operations with a small-footprint, double-sided drive-thru model designed for speed and efficiency.

This centralized approach also shapes the company’s expansion plans. In 2025, Dutch Bros aims to open at least 160 new shops, with a focus on expanding eastward. By maintaining direct control over site selection, the company ensures new locations meet strict investment criteria. When entering new markets, experienced internal operators are sent in to establish the brand, ensuring new shops deliver the same energy and standards that customers have come to expect.

Even with the financial boost from the IPO, Dutch Bros President and CEO Joth Ricci has emphasized the importance of steady, deliberate growth. The company plans to continue expanding across the United States while staying true to its roots. This hands-on control over operations and growth allows Dutch Bros to preserve its unique brand identity and deliver the consistent customer experience that sets it apart from competitors.

Dutch Bros’ Secrets to Being One of the Coolest and Fastest-Growing Restaurant Chains in America

What This Means If You Want to Invest

Corporate-Owned vs Franchise Coffee Shop Business Models Comparison

Dutch Bros Doesn't Offer Franchises

Dutch Bros runs entirely as a corporate-owned brand, meaning they don't accept franchise applications. Every location is company-owned, and regional operator roles are exclusively available to current employees.

For those interested in investing, the options are limited to purchasing Dutch Bros stock (NYSE: BROS) or working as an employee with the goal of moving into an operator role. However, climbing the ranks requires a proven track record and alignment with the company's values and culture.

How to Evaluate Other Franchise Options

Since Dutch Bros isn't an option for franchising, you'll need to look into other coffee brands if you want to own and operate a location. Start by requesting the Franchise Disclosure Document (FDD) from potential franchises. This document outlines essential details like fees, investment ranges, and performance metrics.

Focus on Items 5, 6, and 7 in the FDD, which cover the franchise fee, ongoing royalties, contributions to the brand fund, and the total initial investment. For example, Dunkin' Donuts requires an investment ranging from $121,000 to $1.3 million, while Starbucks' licensed model demands around $315,000 in licensing fees, with at least $700,000 in liquid assets often required.

It's critical to conduct thorough research. Talk to current franchisees to understand real-world challenges like staffing issues, local wage trends, drive-thru efficiency, utility expenses, and permitting timelines in your area. Additionally, consider how seasonal demand impacts revenue. With the global coffee market projected to grow from $269.27 billion in 2024 to $369.46 billion by 2030, the industry shows strong potential.

This approach provides a solid foundation for comparing franchising opportunities to corporate-owned models.

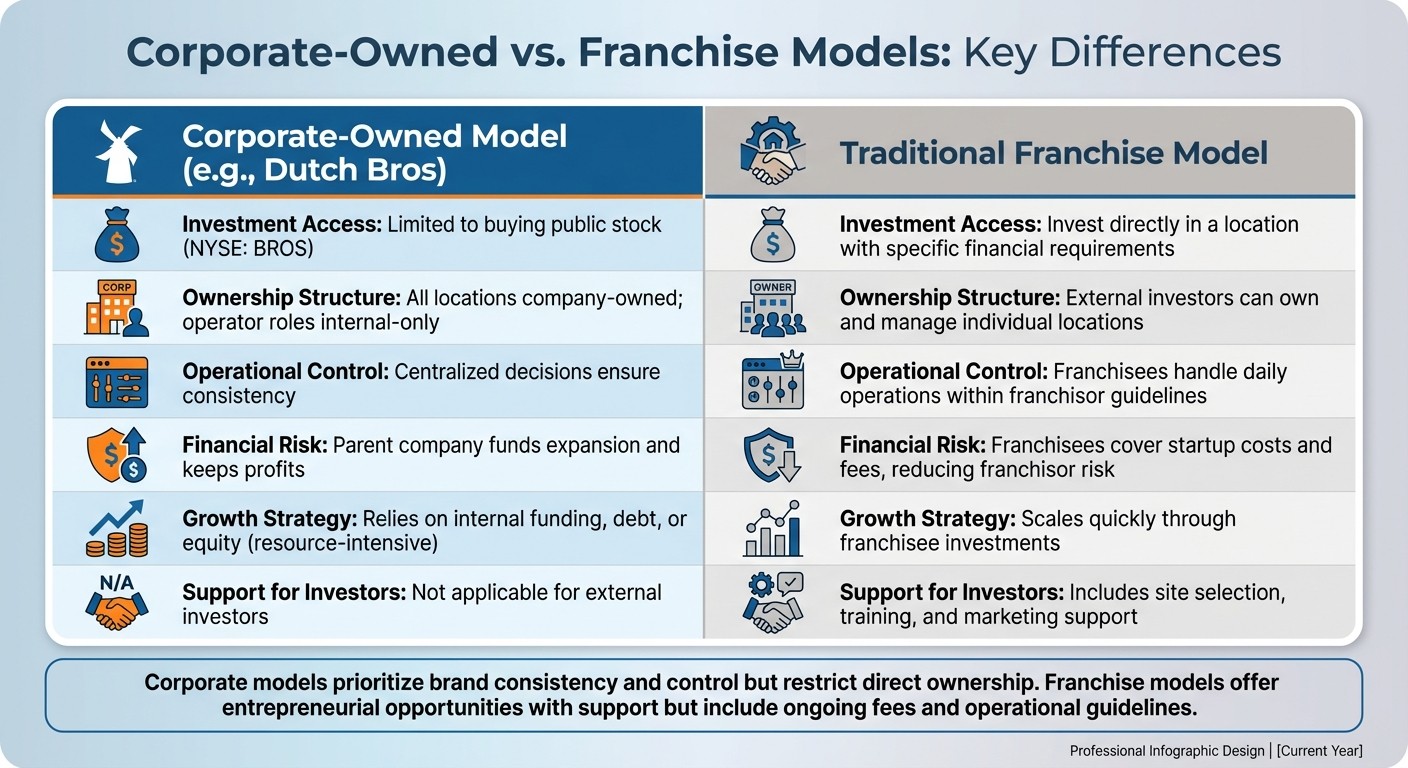

Corporate-Owned vs. Franchise Models: A Comparison

Here's a side-by-side look at how corporate-owned models, like Dutch Bros, differ from traditional franchise setups:

Feature | Corporate-Owned Model (e.g., Dutch Bros) | Traditional Franchise Model |

|---|---|---|

Investment Access | Limited to buying public stock (NYSE: BROS) | Invest directly in a location with specific financial requirements |

Ownership Structure | All locations are company-owned; operator roles are internal-only | External investors can own and manage individual locations |

Operational Control | Centralized decisions ensure consistency | Franchisees handle daily operations within franchisor guidelines |

Financial Risk | Parent company funds expansion and keeps profits | Franchisees cover startup costs and fees, reducing franchisor risk |

Growth Strategy | Relies on internal funding, debt, or equity, which is resource-intensive | Scales quickly through franchisee investments |

Franchisor Support | Not applicable for external investors | Includes site selection, training, and marketing support |

Corporate-owned models, like Dutch Bros, prioritize brand consistency and centralized control but restrict direct ownership opportunities. On the other hand, franchise models offer entrepreneurial opportunities and franchisor support but come with ongoing fees and strict operational guidelines. Deciding between the two depends on whether you prefer to be a hands-on operator or a passive investor in a publicly traded company.

How to Find a Franchise That Fits Your Goals

What Makes Dutch Bros Successful

Dutch Bros has built its success on two key pillars: an efficient drive-thru system and a strong focus on people. Their drive-thru model is designed to handle high volumes of traffic smoothly, which contributed to an impressive systemwide average unit volume of about $1.7 million in 2020. With an average check of $7.50, their operations highlight the importance of efficiency in franchise performance.

The company's "Dutch Luv" culture is another standout factor. Employees, known as "broistas", make an effort to connect personally with customers, remembering their names and even their usual orders. This focus on genuine customer interactions has helped Dutch Bros achieve fourteen straight years of same-shop sales growth through 2020.

Their menu strategy also plays a significant role. Offering customizable drinks, including their proprietary energy beverages, Dutch Bros appeals to a wide range of customers. Notably, 82% of their drinks were served cold in 2020, reflecting consumer preferences. Additionally, their shops achieved a contribution margin of 29% that year, showcasing the financial strength of their model. These elements provide a roadmap for what to prioritize when evaluating a franchise opportunity.

How Franchise Ki Helps You Find the Right Franchise

Franchise Ki offers free consulting services to help you identify franchise opportunities that align with your goals and preferences. Founded by industry veterans Bennett Maxwell and Liam Chase, the platform connects potential franchisees with pre-vetted options tailored to their skills, budget, and values.

The platform simplifies the franchise search process by offering personalized matches, funding strategy advice, and expert assistance in due diligence. While Dutch Bros remains a corporate-owned operation and doesn’t offer franchising, Franchise Ki can guide you toward coffee or beverage franchises with similar operational models and growth potential. Their resources and expertise provide a solid foundation for making informed decisions.

A Framework for Evaluating Franchises

When evaluating a franchise, start by considering its culture and operational efficiency. Dutch Bros' decision to buy back franchises that didn’t meet their standards highlights the importance of consistent quality. To ensure alignment, review the Franchise Disclosure Document (FDD) and speak with existing franchisees about how quality control is maintained. Look for systems that support high throughput, such as drive-thru setups with runners using tablets to take orders. Dutch Bros' success in this area demonstrates the value of operational excellence.

Financial performance is another critical factor. Compare metrics like contribution margins and sales growth. For example, as of December 31, 2020, 99% of Dutch Bros' mature company-operated shops reported positive shop-level contributions, and 91% of locations open for over 15 months had contribution margins above 20%. These benchmarks can serve as a guide when assessing the financial viability of other franchises.

Lastly, evaluate the franchise's community involvement. In 2020, Dutch Bros donated around $5.2 million to various causes, with $2.0 million specifically supporting COVID-19 first responders. Franchises that actively engage with their communities often cultivate stronger customer loyalty and attract employees who share their values. This aspect can be a meaningful differentiator when choosing the right franchise.

Conclusion

Why Dutch Bros Stays Corporate-Owned

In 2017, Dutch Bros made the decision to stop selling franchises. Their focus shifted toward maintaining their distinct company culture and ensuring a consistent experience for their customers. By operating under a corporate-owned model, Dutch Bros retains full control over daily operations, allowing them to uphold quality standards and foster internal growth.

As of Q2 2025, Dutch Bros managed 725 company-owned locations out of a total of 1,043 stores, with these company-operated shops contributing 92.7% of the company's total revenue by Q3 2025. This approach has proven financially rewarding, delivering 31% shop-level contribution margins and targeting a 45% cash-on-cash return for new stores. Reaching free-cash-flow-positive status in 2024 enabled Dutch Bros to fund most of its new store openings through internal profits. Additionally, their 2021 IPO, which raised approximately $484 million, provided the resources needed to accelerate the transition to a fully corporate-owned model.

This strategic model underscores the value of maintaining cultural alignment and operational control in building a successful brand. The financial and operational benefits of this approach have also paved the way for a focused and effective investment strategy.

Next Steps for Franchise Investors

Since Dutch Bros operates as a corporate-owned business, investors interested in this brand can explore opportunities by purchasing BROS stock, which was trading at $61.16 per share as of December 12, 2025. Beyond Dutch Bros, the U.S. coffee market continues to offer strong investment potential, with industry revenue projected to hit $95.58 billion by the end of 2025.

For personalized advice on identifying investment opportunities that align with your goals, reach out to Franchise Ki for expert guidance.

FAQs

Why did Dutch Bros stop franchising and switch to a corporate-owned model?

Dutch Bros decided to halt franchising in 2008, shifting to a corporate-owned model to retain full control over their brand, culture, and operations. This move allowed them to prioritize consistent quality, ensure a seamless customer experience, and stay aligned with their long-term goals.

By managing all locations directly, the company can oversee growth more effectively, safeguard its unique culture, and provide a cohesive experience across every store - something that can be harder to guarantee with franchise arrangements. For those interested in investing or exploring franchise opportunities, this underscores the importance of understanding how a company's operational strategy shapes its future.

Why does Dutch Bros choose to stay corporate-owned instead of offering franchises?

Dutch Bros stays corporate-owned to keep a firm grip on its brand standards, operational consistency, and growth strategy. By steering clear of franchising, the company avoids the added costs and challenges of managing franchisees and paying franchise fees.

This strategy lets Dutch Bros channel its profits straight into growing the business and nurturing a unified company culture, guaranteeing a reliable and consistent experience for both customers and employees.

How does Dutch Bros maintain a consistent customer experience across all its locations?

Dutch Bros delivers a reliable and enjoyable customer experience by building a vibrant company culture and emphasizing top-notch service. Their employees, affectionately called Broistas, undergo thorough training to ensure they bring a friendly, upbeat energy to every interaction, staying true to the brand's core values.

The company also excels in operational efficiency. With a simplified menu, dual drive-thru lanes, and pre-ordering options, Dutch Bros keeps things running smoothly and reduces wait times, making every visit as quick and hassle-free as possible.